In 2025, Citizens Bank made a big move by launching a new lineup of Citizens Bank credit cards designed for everyday users, travelers, and even first-time credit card holders.

Known mostly for its banking services in the Northeast and Midwest, Citizens is now competing in the credit card space with a full suite of options. In this guide, we’ll break down each credit card in their portfolio, explain who they’re best for, and help you choose the right one.

Overview of Citizens Bank’s Credit Card Strategy

Citizens Bank is shaking things up in 2025. Its older credit cards are being phased out, and a new lineup is stepping in, aimed at offering better options, cleaner rewards, and more transparency.

Citizens Bank now offers a well-rounded set of four main credit cards, each designed for a different type of customer. Whether you’re just starting to build credit, looking for everyday cash back, or want premium travel perks, there’s something here for you.

What sets these Citizens Bank credit cards apart?

- Clear reward structures

- No penalty APRs

- Competitive intro APRs on balance transfers

- Designed with specific financial goals in mind

- Pre-qualification with no impact on your credit score

This strategic refresh positions Citizens as a solid option, especially for its existing banking customers.

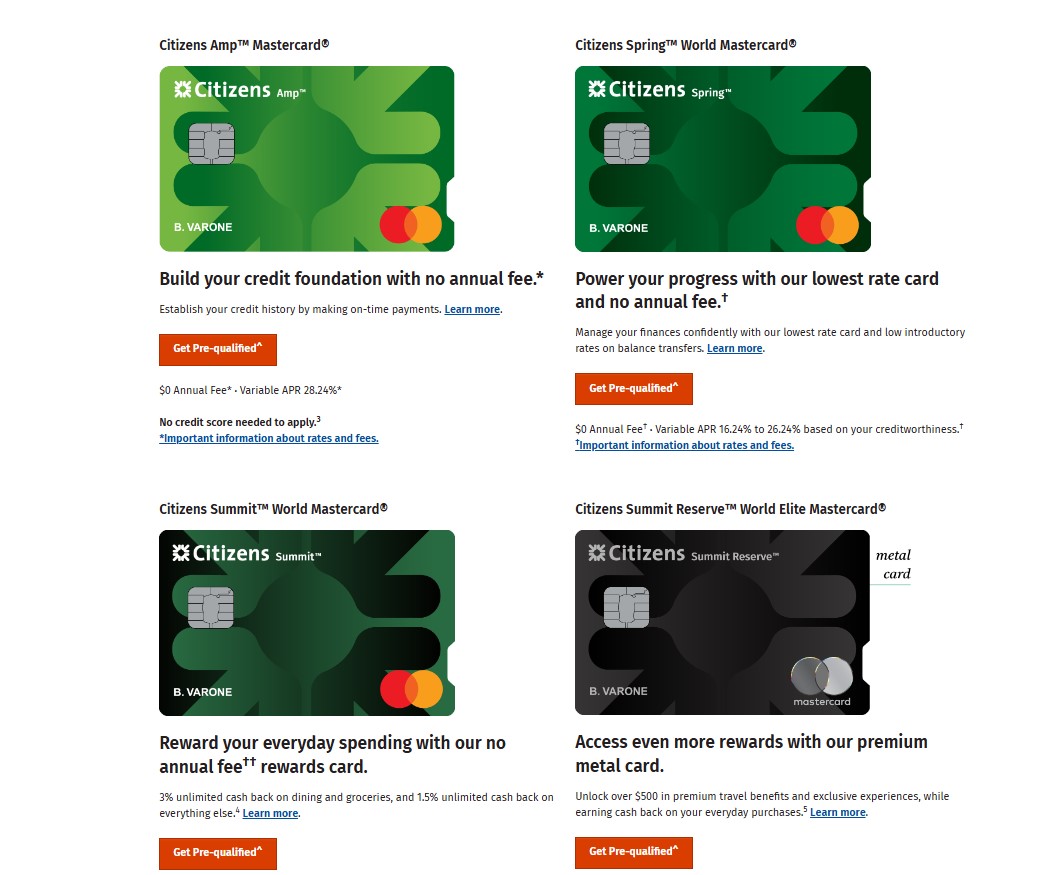

Types of Citizens Bank Credit Cards

Citizens Bank offers a variety of credit cards designed to match different financial goals from building credit to earning rewards and enjoying premium travel benefits:

Citizens Amp Mastercard

The Citizens Amp Mastercard is a great starting point if you’re just getting into credit or have a limited credit history. Unlike most cards, you don’t need a credit score to apply. There’s no annual fee, and responsible use helps you build your credit over time.

Key Features:

- $0 annual fee

- No minimum credit score needed for the Citizens Amp credit card

- No penalty APR

- No security deposit

- Opportunity for credit line increases after 6 months

- No rewards program, but full access to Mastercard tools

If you’re new to credit or trying to rebuild your score, this Citizens Bank credit card offers a gentle way to start. No security deposit means it’s not a secured card. Even better, it reports to all three major credit bureaus, which helps you build a history fast, if you make payments on time.

Best for:

- Young adults or students starting credit

- Those rebuilding credit with a reliable bank

It’s a straightforward, no-frills card. If you’re focused on getting approved and building a strong financial base, this is a smart pick.

What to Watch Out For: The regular APR is quite high at 28.24% variable, so avoid carrying a balance if possible.

Citizens Spring World Mastercard

Need time to pay off a big purchase or move a balance from another card? The Citizens Spring World Mastercard is built for low interest and debt management.

Key Features:

- 0% intro APR on balance transfers for 18 billing cycles

- Competitive variable APR: 16.24%–26.24% after intro period

- No annual fee

- No penalty APR

Spring World Citizens Bank Credit Card Balance Transfer Details:

- 5% transfer fee (or $10 minimum)

- Must complete transfers within the first 90 days

If you’re carrying high-interest balances on other cards, this one gives you time, a full 18 months, to pay off those balances interest-free.

Best for:

- People who carry a balance

- Those looking to consolidate high-interest debt

While this Citizens Bank credit card doesn’t offer rewards, it shines with its long intro APR period, one of the longest on the market. That can mean serious savings if you need time to pay off debt.

What to Watch Out For: No rewards program is included. This card is purely for financial recovery, not everyday spending.

Citizens Summit World Mastercard

The Summit card is Citizens’ most versatile and widely appealing credit card. It combines no annual fee with strong cash-back rewards across everyday categories.

Key Features & Rewards Breakdown:

- $0 annual fee

- 3% cash back on dining and groceries

- 1.5% back on all other purchases

- 0% intro APR on balance transfers for 12 billing cycles

- Variable APR: 18.24%–28.24%

- Credits for services like Lyft, Peacock, and shopping apps

- Cash back doesn’t expire (with one eligible purchase every 12 months)

Additional Features:

- Cell phone protection

- Extended warranties

- Mastercard ID Theft Protection

Unlike rotating category cards or rewards with complicated redemption options, this card is simple. Use it for groceries, restaurants, or daily purchases and get cash back with no caps or expiration (as long as your account stays active).

Redemption Options:

- Statement credits

- No minimum redemption requirement listed

Best for:

- Families, commuters, and frequent diners

- Anyone wanting reliable rewards without an annual fee

This card is especially useful for users who want to earn rewards on routine expenses like groceries and takeout without having to memorize rotating categories.

What to Watch Out For: Cash back only applies if the merchant is coded correctly. For example, groceries at superstores like Walmart don’t count.

Citizens Summit Reserve World Elite Mastercard

If you want top-tier perks and don’t mind a fee, check out the Summit Reserve card. This metal card is packed with travel benefits and lifestyle credits that go well beyond what most cash-back cards offer.

For Citizens Bank credit cards that offer more perks, such as the Summit World Mastercard or the Reserve World Elite Mastercard, the credit score needed for Citizens Bank credit card is around 680 or higher.

Rewards:

- 3% cash back on dining, groceries, and entertainment (including streaming services, concerts, sports events)

- 1.5% back on everything else

Annual Fee:

- $295/year

- $95 or $0 annual fee with qualifying Citizens accounts

- No foreign transaction fees

Premium Perks:

- Priority Pass membership for airport lounges

- Global Entry or TSA PreCheck credit

- $100+ in ride-share, streaming, and delivery credits

- Mastercard Concierge & Elite travel tools

It rivals premium cards from Chase or Amex with a big bonus for Citizens Bank customers. If you hold a Quest Checking account, your annual fee drops to $95. If you’re a Private Client Checking customer, it’s waived entirely.

Best for:

- Frequent travelers who want luxury perks

- Citizens Bank loyalists with large account balances

While $295 sounds high, if you take advantage of the credits and lounge access, the value can outweigh the fee quickly.

What to Watch Out For: To unlock the $0 fee, you need serious assets, $200,000+ for Quest, or $5M+ in liquid assets for Private Bank membership.

Exclusive: Summit Reserve for Citizens Private Bank

This special version of the Summit Reserve card is only for Citizens Private Bank members.

Requirements:

- Must have $5 million+ in liquid assets or a $10 million+ net worth

- The card includes all Summit Reserve benefits

- May include exclusive experiences or concierge services

This Citizens Bank credit card is more about prestige and convenience than raw value, but it aligns with high-net-worth banking relationships.

Fees & APRs of Citizens Bank Credit Cards

Before choosing a credit card, it’s important to understand the fees and interest rates involved. With Citizens Bank credit cards, the costs are fairly standard compared to most major credit card issuers, but a few things stand out.

Here’s what to expect:

- APR (Interest Rate): Most Citizens cards have a variable APR between 19.99% and 29.99%, depending on your credit score and approval.

- Balance Transfer Fee: If you move a balance from another card, you’ll pay 3% of the transfer amount, with a minimum fee of $10.

- Cash Advance Fee: Taking out cash using your card will cost you 5% of the amount, also with a $10 minimum.

- Foreign Transaction Fees: The Summit, Summit Reserve, and Cash Back Plus cards do not charge fees on purchases made outside the U.S. This is great for travelers or online international shoppers.

On the plus side, most Citizens Bank credit cards have no annual fee (except Summit Reserve) and come with helpful extras like:

- Zero liability protection in case of fraud

- Real-time fraud alerts

- Mastercard travel benefits, like car rental insurance and extended warranties

These advantages give you peace of mind, especially if you use your card frequently or while traveling.

Common Citizens Bank Credit Card Benefits

No matter which card you choose, you’ll enjoy a range of modern banking conveniences:

- Contactless Tap & Go payments

- 24/7 online account access

- Digital wallet compatibility (Apple Pay, Google Pay, Samsung Pay)

- Distinctive notch card design for easier use

- Acceptance at 36+ million Mastercard locations worldwide

Pros and Cons of Citizens Credit Cards

Pros of Citizens Bank credit cards:

- No penalty APRs on any card

- Simple, flat-rate cash back rewards

- Multiple no-annual-fee options

- Pre-qualification won’t hurt your credit score

- Attractive balance transfer offers

- Fee waivers for existing Citizens banking customers

Cons of Citizens Bank credit cards:

- Limited branch availability (only 14 states + D.C.)

- High regular APRs (especially on Amp and Summit)

- Reward category exclusions (e.g., Walmart)

- No major signup bonuses (as of this writing)

- Best perks reserved for wealthier clients

After all, here’s a quick way to match your goals with the best card:

| Your Goal | Best Card | Why? |

|---|---|---|

| Build credit from scratch | Citizens Amp™ | No credit score needed, no annual fee |

| Pay off old credit card debt | Citizens Spring™ | 18 months 0% intro APR on balance transfers |

| Maximize cash back on daily spending | Citizens Summit™ | 3% on food, 1.5% on everything else |

| Travel often and want perks | Citizens Summit Reserve™ | Premium benefits + no foreign transaction fees |

| You’re a Private Bank client | Private Summit Reserve | Elite experiences and concierge-style rewards |

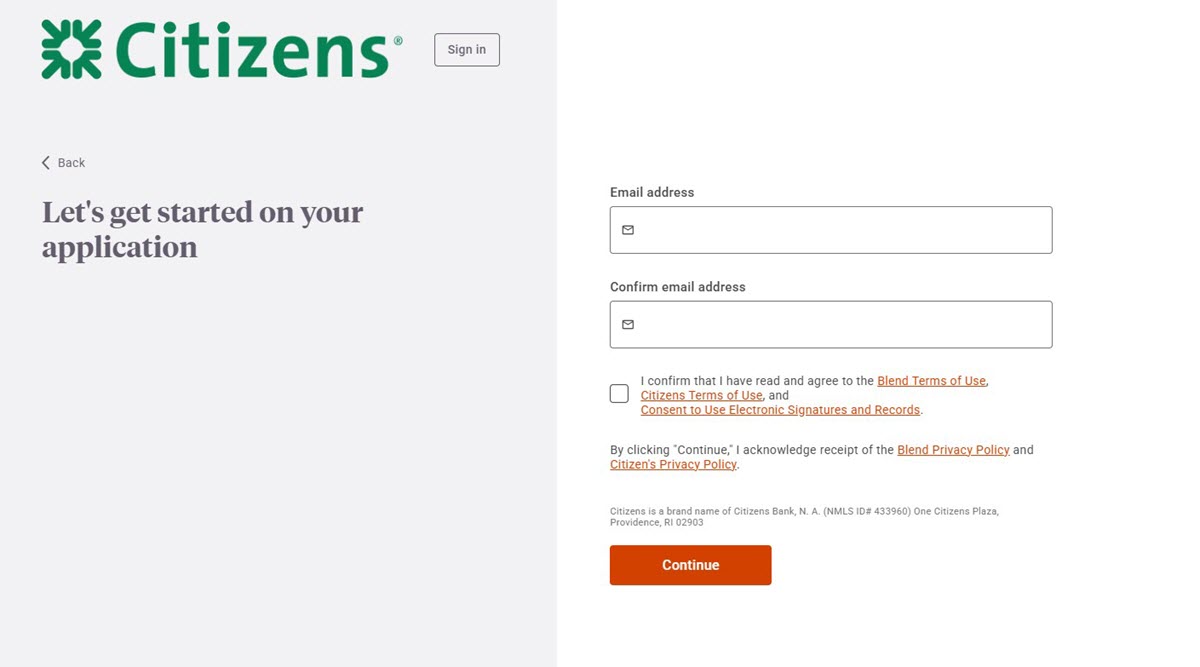

Citizens Bank Credit Card Application Process

Applying for a Citizens credit card is simple and can be done online or in person. Here’s how to do it:

- Pick the Right Card: Start by choosing a card that fits your needs. If you’re new to credit, the Amp Mastercard is a good option. If you want rewards or low interest, look at Summit, Spring, or Reserve.

- Check for Pre‑Qualification: Citizens lets you see if you pre-qualify using a soft credit check, which won’t affect your score. It’s a great way to know your chances before applying.

- Apply Online or at a Branch: You’ll need to provide basic details like your name, income, Social Security number, and contact info. The application is free and takes just a few minutes.

- Wait for Approval: Some applicants get approved instantly, while others may need to wait a few days. In rare cases, it can take up to 30 days.

- Receive and Activate Your Card: If approved, your card will arrive by mail in about 7–10 business days. Once it arrives, activate it online or by phone, and you’re ready to go.

Pro tip: Use your Citizens checking account (if you have one) to unlock extra perks or even fee discounts on some Citizens Bank credit cards.

Applying is quick, secure, and a great way to start building credit or earning rewards.

Simple Tips to Get the Most from Citizens Credit Cards

Want to make your credit card work harder for you? Here are five easy ways to squeeze more value out of your Citizens Bank card:

- Bundle with a Citizens Checking Account: If you already bank with Citizens, linking your credit card can make life easier. In some cases, it may even help qualify you for loyalty perks or waive certain fees.

- Avoid Interest: The best way to save money is to pay your bill in full every month. That way, you avoid paying interest once your 0% intro APR period ends.

- Use Rewards Wisely: Most Citizens Bank credit cards let you redeem cash back as a statement credit. This is the simplest and fastest way to lower your bill using the rewards you’ve earned.

- Know Where You Spend the Most: If you spend a lot on groceries or dining, use a card like Summit or Summit Reserve to earn higher cash back in those categories.

- Don’t Forget the Extras: Citizens Bank credit cards like Summit and Reserve come with added perks like Lyft ride credits, streaming discounts, and even airport lounge access. These extras can add up quickly, so be sure to activate and use them.

By following these tips, you can get more value from your card, whether that’s saving on interest, earning better rewards, or enjoying exclusive lifestyle benefits.

FAQs About Citizens Bank Credit Cards

Does getting pre-qualified hurt my credit score?

- No. Citizens allows you to check your eligibility with no impact on your score.

Can I apply without a credit score?

- Yes. The Citizens Amp card does not require a credit score for application, though other factors still apply.

Do rewards expire?

- Not if you make one eligible purchase every 12 months and your account is in good standing.

Is there a Citizens Bank credit card with no annual fee?

- Yes, most Citizens Bank credit cards including Amp, Spring, and Summit have no annual fee. Only the Summit Reserve card has an annual fee of $295, which may be reduced or waived if you have a qualifying Citizens relationship.

How do I apply for a Citizens Bank credit card?

- You can apply online through the official website at citizensbank.com or visit a local Citizens branch. The application takes just a few minutes and requires basic personal and financial information.

What if I want to upgrade later?

- Citizens may allow product upgrades after six months of responsible card usage, especially on the Amp card.

Citizens Bank may be new to the credit card scene, but it’s come out strong. Their latest card lineup offers something for almost everyone. You’ll find solid cash-back rates, helpful intro APR offers, and valuable travel perks if you choose the right card. If you already bank with Citizens, it’s an easy match. But even if you don’t, cards like Summit and Summit Reserve hold their own against other bigger names. Simple, rewarding, and flexible, Citizens credit cards are definitely worth a look.