Regions Bank credit card options are designed to fit real-life needs, whether you’re earning cash back, managing balances, or building credit from scratch. Unlike flashy travel cards with high annual fees, Regions focuses on straightforward benefits, low costs, and tools that help you stay in control.

In this guide, we’ll break down each card’s features so you can easily figure out which one works best for your wallet and lifestyle.

Overview of Regions Bank Credit Cards

Regions Bank offers a flexible lineup of Visa credit cards, built for everyday spending, budgeting, and building credit. Whether you want to earn rewards, enjoy a long 0% intro APR, or improve your credit, there’s likely a Regions Bank credit card that works for you.

Regions Bank offers four primary credit card options:

- Cash Rewards Credit Card with simple, flat-rate cash back offers.

- Prestige Visa Signature Credit Card with bonus points and flexible rewards.

- Life Visa Credit Card: A low-rate card for balance transfers.

- Explore Visa Credit Card: A tool for credit building.

Each card serves a unique purpose. Some cards reward spending, while others help you manage or rebuild credit. The good news? All come with Visa benefits and are accepted worldwide.

Types of Regions Bank Credit Cards

Regions Bank offers a variety of credit cards designed to meet different personal financial needs, whether you’re looking to earn rewards, save on interest, or build your credit from the ground up.

Cash Rewards Visa Signature Credit Card

This is the go-to card for people who want simple, unlimited cash back on everything they buy.

Key Features:

- Unlimited 1.5% cash back on all purchases

- Spending $1,000 within the first ninety days will earn you a $200 bonus.

- No annual fee

- 0% intro APR for 12 months on purchases and balance transfers

- Variable APR after intro period: 19.24% – 29.24%

- No foreign transaction fees

For those who like a simple rewards plan without any categories to monitor, this Regions Bank credit card is ideal.

Prestige Visa Signature Credit Card

The Prestige card is a step up for those who spend more on dining, entertainment, gas, and groceries.

Key Features:

- 3% back on dining and entertainment

- 2% back on gas and groceries

- 1% back on all other purchases

- Earn up to 4% with the Regions Rewards Multiplier

- Spend $1,000 during the first ninety days and receive a $200 bonus.

- No annual fee

- 0% intro APR for 12 months

- Variable APR: 19.24% – 29.24%

- No foreign transaction fees

Rewards Multiplier Explained: Link your Prestige card to your Regions checking or savings account and earn an extra 0.25% to 1% on purchases. The higher your deposit balances, the more you earn.

If you dine out often or spend heavily on entertainment and travel, this Regions Bank credit card offers excellent value with higher category rewards.

Life Visa Credit Card

The Life card is designed for people who want more time to pay off purchases—perfect for large expenses or emergencies.

Key Features:

- 18 months of 0% introductory APR on purchases and balance transfers

- After 18 months, variable APR: 17.24% – 27.24%

- No annual fee

- No foreign transaction fee

- Access to Regions Offers for cash back deals

This is ideal if you need a long runway to pay down debt or want to finance a big purchase with no interest.

Explore Visa Credit Card (Secured)

If you’re working on building or rebuilding your credit, this secured card could be a smart starting point.

Key Features:

- $250 minimum security deposit

- $29 annual fee

- 27.24% variable APR for purchases and balance transfers

- Refundable deposit if you manage the account responsibly

- Earn cash back with Regions Offers

- No foreign transaction fee

It’s best for new credit users, students, or anyone looking to build a credit history safely.

Rewards Program Comparison

Both the Regions Cash Rewards and Prestige Credit Card offer valuable promotions and incentives, but they reward you in different ways. Let’s break it down so you can decide which Regions Bank credit card bonus program fits your spending habits better.

| Card | Base Rewards | Bonus Categories | Welcome Bonus | Max Rewards Rate |

|---|---|---|---|---|

| Cash Rewards Visa® | 1.5% on all purchases | None | $200 for $1,000 spend | 1.5% |

| Prestige Visa® | 0.25% to 1% on every purchase | 3% dining & entertainment, 2% gas & grocery, 1% on all other purchases | $200 for $1,000 spend | 4% with multiplier |

| Life Visa® | None | None | None | None |

| Explore Visa® (Secured) | None | None (Regions Offers available) | None | Varies by offer |

If you want to see which is more rewarding for your lifestyle? Regions offers a handy Cash Back vs. Points Calculator that lets you estimate real-world value.

Regions Bank Credit Card Fees and Interest Rates

While many Regions cards have no annual fee, it’s important to know what other fees might apply. Here’s a quick look at the common fees across all Regions credit cards:

| Fee Type | Amount |

|---|---|

| Annual Fee | $0 (most cards) / $29 (Explore card) |

| Balance Transfer Fee | $10 or 4% (whichever is greater) |

| Cash Advance Fee | $10 or 4% (whichever is greater) |

| Late Payment Fee | Up to $39 |

| Foreign Transaction | $0 |

| Overdraft Protection | Optional; fees may apply |

Knowing these fees can help you avoid surprises and keep your card costs low.

Next, here’s a quick breakdown of important Regions Bank credit card APR details:

| Card | Intro APR | Regular APR |

|---|---|---|

| Cash Rewards | 0% for 12 months | 19.24% – 29.24% variable |

| Prestige | 0% for 12 months | Prime + 9.74%–17.74% |

| Life | 0% for 18 months | 17.24% – 27.24% 29.24% variable APR for cash advances |

| Explore | N/A | 27.24% variable APR for purchases and balance transfers. 29.24% variable APR for cash advances. |

Security Features and Technology

Every Regions Bank credit card has solid built-in security and customization tools, including:

- Regions LockIt: You can instantly block your card from being used for:

- Online or in-store purchases

- ATM withdrawals

- International transactions

- Fraud Alerts: Receive real-time texts or calls if there’s suspicious activity on your account.

- Visa Zero Liability: You’re not responsible for unauthorized purchases made with your card.

- Tap to Pay & Digital Wallets: Make fast, secure contactless payments or pay via Apple Pay, Google Pay, or Samsung Pay.

- Visa Concierge & Travel Protections: Get access to 24/7 concierge services, travel accident insurance, roadside assistance, and other benefits with Visa Signature cards.

How to Apply for a Regions Bank Credit Card

Ready to apply for a Regions credit card? You can do it in three ways: Online, over the phone, or at a local branch. But first, let’s get started with the documents you need:

What You’ll Need

- Full name and contact info

- Income and job details

- Social Security number

- Optional: Your existing Regions account info (helps if you want to link to Rewards Multiplier)

Get Regions Bank Credit Card Pre-approval

Before you apply, Regions lets you check if you’re pre-approved for a credit card. This soft inquiry won’t affect your credit score. You can visit the Regions website or app to see eligible offers. It’s quick, easy, and helps you understand your chances before officially applying. If you see a “pre-qualified” offer, that means Regions is more likely to approve you, without the risk of a score dip.

Steps to Check:

- Go to the Regions website

- Click on “Check for preapproved offers”

- Fill in some basic information

- View your results in just a few moments

Already a customer? You can log in to see your personalized credit card offers even faster.

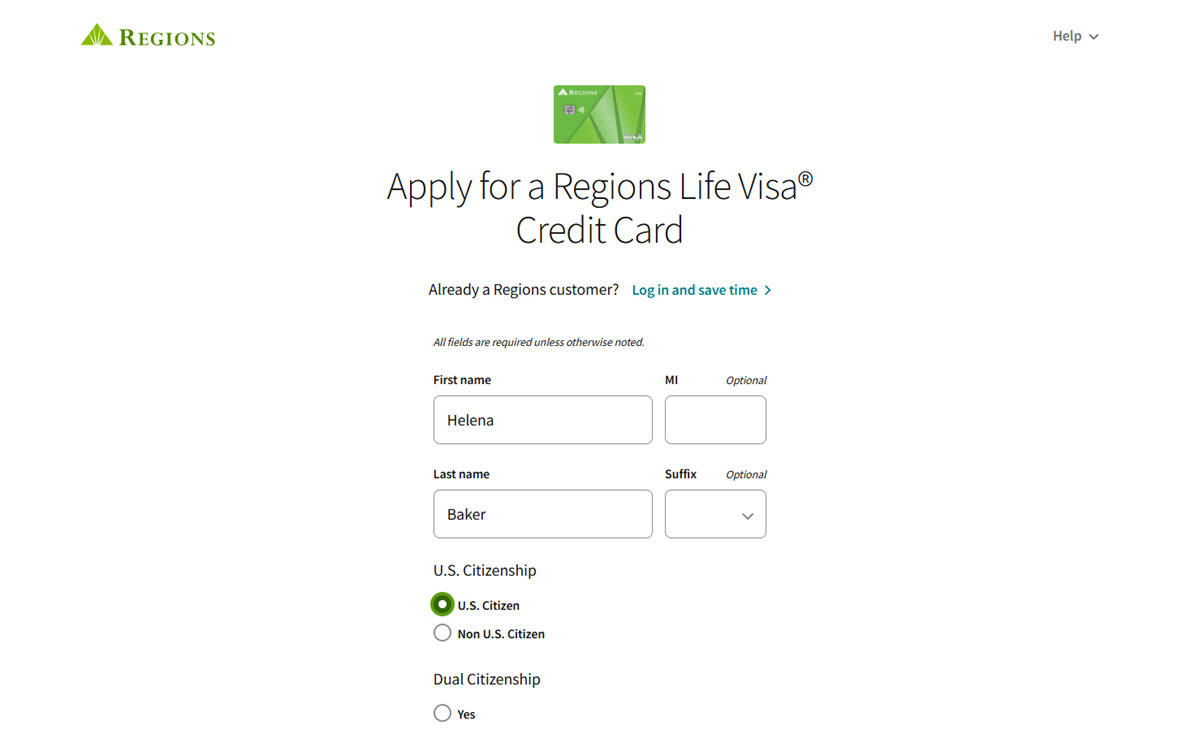

Application Process

Applying is quick, and if approved, you’ll receive your card in the mail shortly after. Whether you prefer doing it online, over the phone, or in person, the steps are pretty much the same:

- Choose Your Card

Pick one of four options: Cash Rewards, Prestige, Life, or Explorem, depending on your needs and spending style. - Check for Pre-Qualification (Optional)

Visit Regions.com to see if you’re eligible for a card using a soft inquiry. - Apply Online, by Phone, or In-Branch

- Online: Go to apply.regions.com

- Phone: Call Regions Bank credit card phone number 1‑800‑253‑2265

- In Person: Visit any Regions branch

- Provide Your Information

You’ll need to supply your personal information and documents as mentioned above. - Get a Quick Decision

Many applicants receive an answer within 60 seconds if applying online or by phone. - Receive Your Card by Mail

If approved, your new card will arrive within 7 to 10 business days, ready to activate.

Regions Bank Credit Card Activation

Now, assume that you’ve successfully created a credit card. Before you can start using your new credit card, you’ll need to activate it. Regions gives you multiple ways to do this. Choose the one that works best for you:

Online or Mobile App

- Log in to Regions Online Banking or the Regions mobile app

- Go to the “Cards” section

- Select “Activate Card”

- Enter your card number, expiration date, and CVV

By Phone

- Call 1‑800‑253‑2265, the number listed on the sticker attached to your card.

- To finish the activation process, adhere to the automatic instructions.

At a Regions ATM

Some customers report that inserting their new card into a Regions ATM can also trigger activation, especially if you already have an account with Regions.

Once your card is activated, you can begin using it for purchases, bill payments, and more.

Regions Bank Credit Card Pros and Cons

Before choosing a card, it helps to see both the strengths and potential drawbacks.

Pros of Regions Bank Credit Cards:

- Most cards have no annual fee

- Built-in fraud protection and control tools

- Introductory 0% APR offers available

- Solid rewards options for everyday spending

- Easy to manage through online and mobile banking

- No foreign transaction fees, great for travel

Cons of Regions Bank Credit Cards:

- Rewards may be lower without the Rewards Multiplier

- High APRs if you carry a balance

- Explore card has a $29 annual fee

- Some cards limit bonus rewards to specific spending categories.

Regions Bank Credit Card Customer Service

If you have questions or run into an issue with your Regions Bank credit card, there are several support options available:

- Phone Support:

-

- Credit Card Support: Call 1‑800‑253‑2265 for help with your card, payments, or account details.

- General Banking Support: Call 1‑800‑734‑4667 for broader questions about your Regions account.

- Visit a Branch: Prefer face-to-face help? You can walk into any Regions Bank branch to speak with a representative.

- Online Help: Visit the Help & Support section on the Regions website. Or browse FAQs related to credit cards, payments, balance transfers, and more.

However, phone support may be slower during peak times. If you’re not getting through right away, try the app or website for faster Regions Bank credit card customer service.

Regions Bank Credit Card Payment Options

Besides excellent customer service, the bank makes it easy to pay your credit card bill on time with several convenient options:

- Pay Online or via Mobile App

- Log into Regions Online Banking or the mobile app.

- Choose your credit card account and click “Make a Payment”.

- Pay using a linked Regions checking/savings account or external bank account.

- Pay by Phone: Call 1‑800‑253‑2265 and follow the voice prompts to make a one-time payment using your bank details.

- Pay by Mail: Send a check or money order (no cash) to the Regions Bank credit card address:

Regions Credit Card Consumer

PO BOX 70912

Charlotte, NC 28272‑0912 - Pay In-Branch: Walk into any Regions location near you to pay with cash, check, or debit.

- Set Up AutoPay: Want to avoid missing a due date? Enable AutoPay through online banking to have your bill paid automatically each month. You can also check your payment history, update linked accounts, or change your payment amount directly in the app or website.

FAQs About Regions Bank Credit Cards

Does checking for preapproval affect my credit score?

- No, checking for preapproval with Regions does not impact your credit score.

How do I redeem my Regions credit card rewards?

- You can redeem Regions Bank rewards for a statement credit, check, gift cards, or a direct deposit into your account.

Can I get a Regions credit card without a Regions checking account?

- Yes, but linking a Regions deposit account allows you to boost rewards through the Rewards Multiplier program.

Does Regions Bank offer cards for people with no credit history?

- Yes, the Explore Visa Secured Credit Card is designed to help users build or rebuild credit.

Are there any foreign transaction fees?

- No, all Regions credit cards come with no foreign transaction fees, which makes them great for international use.

Regions Bank credit cards offer something for everyone, whether you’re earning cash back, managing debt, or building credit. With no annual fees on most cards and flexible features, it’s easy to find one that fits your financial goals. Take a few minutes to check for pre-approval, compare your options, and choose the card that works best for your lifestyle today.