Regions Bank checking account options offer a range of choices for everyday banking, from simple online plans to accounts made for students and seniors. With thousands of ATMs and branches across the South and Midwest, Regions is a name many people trust.

But are Regions Bank checking accounts truly worth it? In this guide, we’ll explore the fees, features, and who each account is best for, so you can decide with confidence.

Understanding Regions Bank Checking Account Lineup

Before diving into the checking accounts themselves, it helps to know who’s behind them.

About Regions Bank

Regions Bank is the banking arm of Regions Financial Corporation, one of the largest full-service providers of consumer and commercial banking in the Southeastern U.S. Headquartered in Birmingham, Alabama, the bank serves customers across 15 states, with over 1,300 branches and 1,900+ ATMs. Regions is a member of the S&P 500 and is known for its focus on customer service, community involvement, and a strong regional presence.

Regions provides a wide variety of financial services for both individuals and businesses. These include savings accounts, certificates of Deposit (CDs), credit cards, auto loans, investment and retirement planning tools, and more.

About Regions Bank Checking Accounts

When it comes to personal banking, Regions Bank offers a variety of checking account options to fit different needs and lifestyles. Whether you’re a student opening your first account, a retiree managing fixed income, or someone who prefers online banking, Regions has an option tailored for you.

Currently, there are six main Regions Bank checking account options available:

- LifeGreen Checking – for everyday use

- LifeGreen Preferred Checking – for those who maintain higher balances and want interest

- LifeGreen eAccess Checking – ideal for digital users who don’t write checks

- LifeGreen Student Checking – for young adults and college students (ages 18–25)

- LifeGreen Senior Checking – for customers aged 62 and older

- Now Checking – a no-overdraft account for simplified money management

All of these accounts come with mobile banking access, online statements, and Visa debit cards. You can send and receive money through Zelle, deposit checks via mobile, and track spending through Regions’ built-in financial tools.

However, each Regions Bank checking account has its own set of rules, including different monthly maintenance fees, minimum balance requirements, interest options, and fee waiver conditions. Some accounts are more flexible, while others are built for specific age groups or spending habits.

Regions Bank Checking Account Options

Now, in this section, we’ll break down each one in detail to help you choose the best Regions Bank checking account for your lifestyle.

LifeGreen Checking

The LifeGreen Checking account is Regions Bank’s most popular option. It’s made for everyday banking. Whether you’re paying bills, transferring money, or shopping with your debit card, this account gives you the tools you need without being overly complicated.

Key Features

- You’ll need at least $50 to open the account.

- Unlimited check writing.

- Comes with a free savings account.

- There’s a $8 monthly fee, but if you choose paperless statements, it drops to $5.

- Want to avoid the fee completely? Just meet one of these:

- Keep a $1,500 average monthly balance, or

- Maintain a monthly direct deposit of at least $500.

With this account, you’ll also get access to mobile and online banking, Regions’ budgeting tools, Zelle for sending money, and a Visa debit card.

Overdraft Protection

Overdrawing your account comes at a cost:

- $36 per overdraft transaction

- You’ll only be charged up to 3 times per day, which can still add up quickly.

To avoid these charges, you can link your LifeGreen account to another Regions account (like savings or credit) for overdraft protection. Regions also offers Overdraft Grace, giving you until the end of the same business day to fix the negative balance and avoid the fee.

ATM Access

- Free withdrawals at Regions-owned ATMs

- $3 fee at out-of-network ATMs (plus any ATM operator’s fee)

- 3% fee on international debit card purchases

To sum up, this Regions Bank checking account works well if you can stay above the fee thresholds or set up direct deposit. But if not, the monthly charges and overdraft fees can quickly become a burden.

LifeGreen Preferred Checking

If you usually keep a high balance in your account and want a little more in return, the LifeGreen Preferred Checking might be for you. While the perks are modest, they’re tailored for those with more financial activity.

Key Features

- Minimum deposit to open: $50

- $18 monthly fee, but you can waive it by:

- Keeping an average daily balance of $5,000, or

- Holding at least $25,000 in combined Regions accounts (checking, savings, money markets, CDs, or investments)

Interest Earnings

- Offers a very low Regions Bank checking account interest rate of 0.01%

- You’ll earn interest, but it’s unlikely to make a real impact unless your balance is quite large

Bonus

- 2 ATM rebates per month for out-of-network usage

- Free cashier’s checks

- Discounts on safe deposit boxes and certain services

This account is really only a good deal if you can easily meet the balance requirements or take advantage of the extra services. If not, that $18 monthly fee could outweigh the minimal interest you earn.

LifeGreen eAccess

If you’re someone who never writes checks, doesn’t visit branches, and prefers doing everything on your phone or laptop, LifeGreen eAccess was made for you. It’s a digital-first account built for convenience.

Key Features

- Requires a $50 opening deposit

- The monthly fee is $8, but you can avoid it by making 10 or more debit card purchases per month

- Comes with online-only features and no paper checks

- Includes mobile check deposit, online bill pay, and access to the Regions mobile banking app

- After the first three, paper statements cost $0.50 each, encouraging customers to go fully digital.

It’s an excellent choice for tech-savvy users who manage everything online. Just be sure you’re using your debit card regularly. Otherwise, that $8 fee sticks around even if you don’t touch the account much.

LifeGreen Student Checking

Starting with a checking account can feel overwhelming, which is why Regions created the Regions Bank checking account just for students. It keeps things simple, and the best part is, no monthly fee.

Key Features

- For young adults aged 18 to 25

- No monthly maintenance fee

- Only $50 needed to open the account

- Offers one overdraft fee refund per year, a great safety net for beginners

- Includes free online and mobile banking, bill pay, and mobile check deposit

But you need to remember that while the fee forgiveness is helpful, all other overdraft transactions still cost $36 each.

This Regions Bank checking account is great for students who want a no-fee checking experience. But new users should watch their balances closely, as overdrafts are still expensive and may catch first-time bankers off guard.

LifeGreen Senior Checking

Regions knows that older adults often want simple, reliable banking. The Senior Checking account is designed with this in mind, offering reasonable fee waivers and full access to Regions’ banking services.

Key Features

- Available for anyone aged 62 or older

- Monthly fee: $11, or $8 if you choose electronic statements

- Waive the fee by:

- Maintaining an average monthly balance of $1,500, or

- Setting up $1,000 or more in monthly direct deposits

- Comes with a Visa debit card, online and mobile banking, and Regions’ budgeting tools.

However, unlike some senior-focused accounts at other banks, this one does not offer interest or special benefits like estate planning tools or medical assistance tie-ins.

It’s a solid option for retirees with steady income from Social Security or pensions. You’ll want to take advantage of direct deposit or keep your balance high enough to avoid the monthly fee.

Now Checking

Some people just don’t want to worry about overdrafts. If you’ve been burned by unexpected fees or are trying to keep tighter control over spending, Now Checking may be the answer.

Key Features

- Certified “Bank On” low‑fee account

- No overdraft transactions allowed. If you don’t have enough money in the account, the transaction is simply declined

- Opening deposit: $50

- A monthly fee applies, which can be waived by maintaining certain balances or setting up direct deposits (varies by region)

Because overdrafts aren’t allowed, you never have to worry about that dreaded $36 fee again.

Who It’s For

- People who want tighter control over spending

- Those trying to rebuild credit or avoid past financial pitfalls

- A smart secondary account for things like daily spending, allowances, or even teen banking

This Regions Bank checking account offers peace of mind. If you know you’re prone to overspending, or just want to play it safe, it’s worth considering despite the basic feature set.

Comparing the Regions Bank Checking Accounts

Here’s a quick comparison of the key features:

| Account Type | Monthly Fee | Overdraft Protection | Checks Allowed | Interest | Ideal For |

|---|---|---|---|---|---|

| Now Checking | Low flat fee | No overdraft fees | Standard use | No | Budget‑conscious or “on‑track” users |

| eAccess Checking | $8 or $0 with conditions | Standard overdraft | N/A | No | Tech‑savvy online users |

| LifeGreen Checking | $8 – $11, waived with conditions | Standard overdraft | Unlimited | No | Those using checks frequently |

| LifeGreen Preferred | $11, waived with balance | Standard overdraft | Unlimited | Yes, 0.01% | Balance holders, want interest |

| Student Checking | $0 | Standard overdraft | Standard | No | College students |

| Senior Checking | $8 – $11, waived with conditions | Standard overdraft | Standard | No | Seniors (62+) |

Regions Bank Checking Account Fees & Limits

Understanding the fees that come with your checking account is key, especially with Regions Bank, where some charges can sneak up if you’re not paying attention.

Regions Bank Monthly Fees

Regions Bank has different monthly fees depending on the type of checking account you choose. Here’s a breakdown:

| Monthly Maintenance Fee | Amount | Details |

|---|---|---|

| LifeGreen Checking | $11/month ($8 with eStatements) | Waived with ≥$1,500 average daily balance OR ≥$500 in direct deposits/month |

| LifeGreen Preferred Checking | $18/month | Waived with ≥$5,000 average balance OR $25,000+ combined Regions accounts |

| eAccess Checking | $8/month | Waived with 10+ debit card purchases/month |

| Student Checking | $0 | For ages 18–25, no monthly fee |

| Senior Checking | $11/month ($8 with eStatements) | Waived with ≥$1,500 balance OR ≥$1,000 in direct deposits/month |

| Now Checking | Low flat monthly fee | Cannot be waived; includes no-overdraft design |

Regions also updates its fee schedules occasionally, so it’s always smart to check the latest terms on their website before applying.

Overdraft Fees

Regions follows a standard overdraft policy, but the type of account you choose can impact how much you pay or whether you pay at all.

- Now Checking stands out because it doesn’t allow overdrafts, so you’ll never be charged an overdraft fee. If you don’t have enough money in your account, the transaction will simply be declined.

- For other checking accounts, overdraft fees typically cost around $36 per item. Depending on your account type, you could be charged for up to 3 or even 5 overdrafts per day, which adds up fast.

Overdraft protection options are available. You can link a Regions savings account or credit line to your checking account. This way, if you overspend, money will be pulled from your linked account, but there’s a $15 fee per transfer.

ATM Fees and Withdrawal Limits

Regions Bank allows a daily ATM withdrawal limit of about $808, though the exact amount may vary depending on the type of debit card you have or your account standing.

- In-branch withdrawals and online transfers usually have higher or no limits. This makes it easy to move large amounts when needed. With over 1,400 branch locations, Regions offers personal support across the Southern and Midwestern U.S.

- You can use over 2,000 Regions ATMs nationwide. Some accounts also include fee rebates when you use out-of-network ATMs, depending on the account tier.

- If you use an out-of-network ATM, there’s a $3 fee from Regions, plus any extra fee charged by the ATM owner.

Other Fees of Regions Bank Checking Account

- Foreign transaction fee: 3%

- Paper statements: $0.50 after three (for eAccess)

- Stop payment: $36 per item

Regions Bank Checking Account Requirements

Opening a checking account at Regions Bank is straightforward, but you’ll need to meet a few basic requirements:

- Minimum opening deposit: Most accounts require $50 to open. Some like Now Checking may accept as little as $10.

- Valid identification: You’ll need a U.S. government-issued photo ID such as a driver’s license, passport, or state ID.

- Social Security Number (SSN) or Taxpayer Identification Number (TIN) for identity verification.

- Personal information: Including your full name, date of birth, current address, phone number, and email.

- Age requirement: You must be at least 18 years old to open most accounts. The Student Checking account is available for those between 18 and 25.

In some cases, Regions may perform a soft credit check or use ChexSystems to review your banking history. If you’re applying for a Regions Bank checking account bonus, you may also need to live within a certain distance of a branch and register online before opening your Regions Bank checking account.

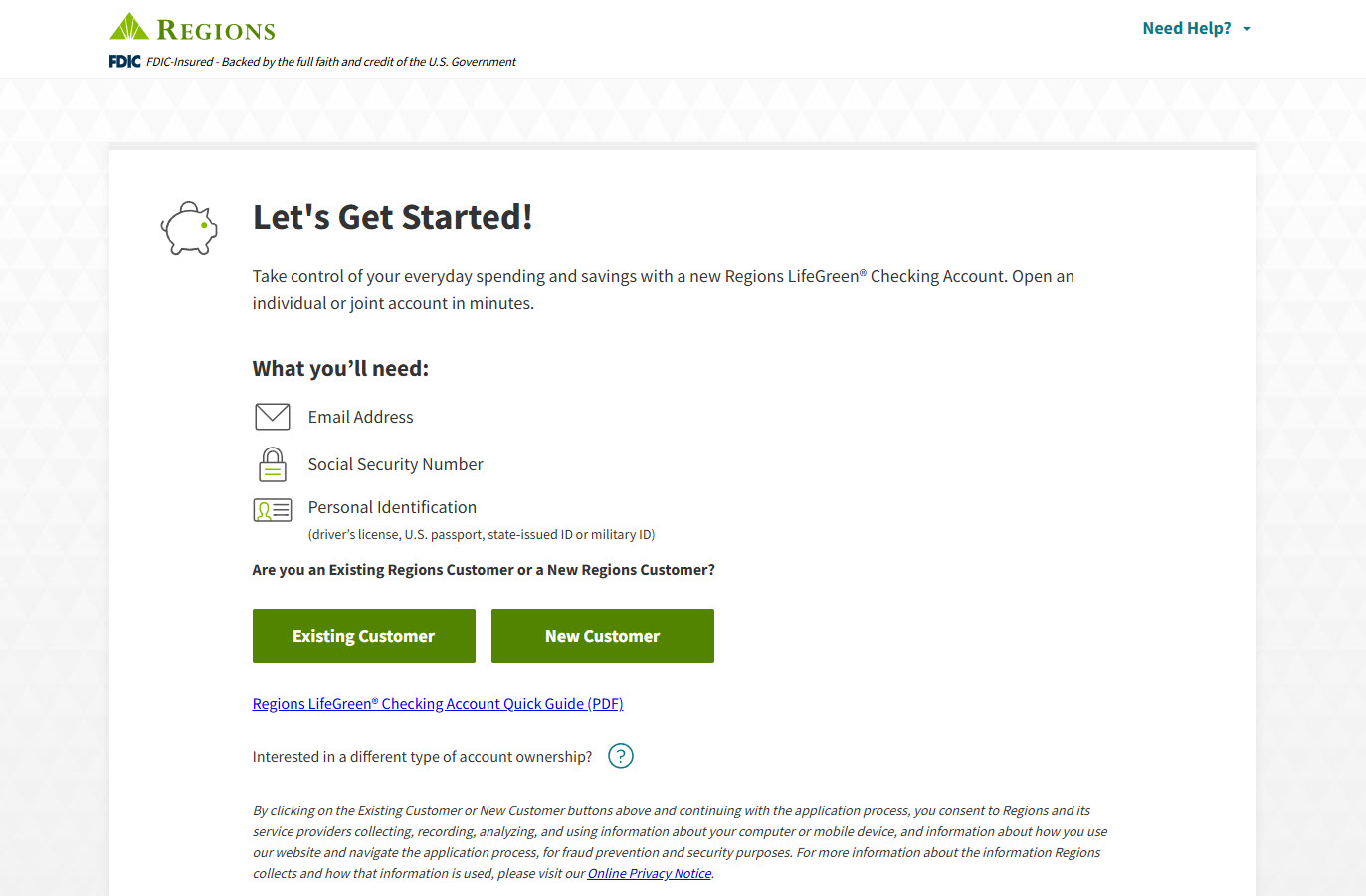

How to Open a Regions Bank Checking Account

Ready to open a Regions Bank checking account? Here’s how to get started:

- List your banking needs. Think about your spending habits, how often you use checks, whether you want interest, and if you’ll maintain a balance.

- Compare account types. Look at the features of LifeGreen, Now Checking, eAccess, and others to see which fits your lifestyle.

- Check the fee schedule. Visit Regions.com and review the current terms for each Regions Bank checking account. This helps you avoid unexpected charges.

- Apply online or in person. Regions lets you open an account online in as little as 5 minutes, or you can stop by a local branch.

In-Person Application

Visit your nearest Regions Bank branch.

- Bring a valid ID and your Social Security Number.

- A banker will help you choose the best account, complete the paperwork, and accept your initial deposit.

- You can also ask about the current Regions Bank checking bonus offers and promotions available in your area.

After opening, you’ll receive your Visa debit card, gain access to mobile and online banking, and can begin using your account immediately.

Online Application

- Visit Regions.com and browse the checking accounts section.

- Click “Open Now” under the Regions Bank checking account you want.

- Complete the secure application form with your personal information.

- Upload a photo ID or follow the steps to verify your identity.

- Make your opening deposit (usually $50) using a debit card, bank transfer, or ACH.

- If you’re applying for a sign-up bonus, be sure to:

-

- Register for the promotion

- Enter any promo codes if needed

- Set up online banking

- Initiate qualifying direct deposits (e.g., $1,000 within 60 days)

Regions Bank Checking Account Routing Numbers

A routing number is a 9-digit code that helps identify your bank during electronic transactions, like direct deposits, wire transfers, or bill payments. For Regions Bank, this number depends on the state where your account was opened.

- You can find your Regions Bank checking routing number printed on the bottom left corner of your paper checks, right before your account number.

- If you use online banking or the Regions mobile app, simply go to your account details, and you’ll see both the routing number and account number listed clearly.

Here are some common Regions Bank routing numbers by state:

| State | Routing Number |

|---|---|

| Alabama | 062000019 |

| Arkansas | 082000109 |

| Florida | 063104668 |

| Georgia | 061101375 |

| Illinois | 071122661 |

| Indiana | 074014213 |

Since routing numbers can vary by region, it’s important to double-check yours before setting up any payments or transfers. Using the wrong number could delay your transaction or cause it to fail.

Regions Bank Checking Customer Service

If you ever need help with your Regions Bank checking account, you have plenty of options to get support:

Phone Support

- General Customer Service:

Call 1‑800‑734‑4667 for questions about accounts, balances, or general inquiries. - Online Banking Assistance:

Call 1‑800‑472‑2265 if you’re having trouble logging in, resetting your password, or using the mobile app. - Visa Debit Card Issues:

For lost or stolen cards or transactions you don’t recognize, call 1‑800‑295‑8472. - Financial Hardship Support:

Regions offers a Customer Assistance Program for those facing difficulties. Call 1‑800‑289‑6730 for help. - Fraud and Emergency Services:

Call 1‑800‑734‑4667 immediately to report fraud, lost cards, or suspicious activity.

Online Help

- Use Reggie, the virtual assistant on the Regions website or app, to get 24/7 support for common questions.

- You can also schedule an appointment at your local branch through the online portal for more personalized help.

Regions’ customer service hours are typically Monday to Friday, 8 a.m. to 5 p.m. ET, but some services may be available after hours or on weekends, depending on the department.

Pros and Cons of Regions Bank Checking Accounts

Every checking account has strengths and weaknesses. Here’s what stands out with Regions Bank:

Pros of Regions Bank checking accounts:

- Multiple account options: Whether you’re a student, senior, digital user, or someone who wants overdraft protection, Regions has a plan designed for your lifestyle.

- Fee waivers are achievable: If you set up direct deposit or maintain a modest balance, you can avoid monthly maintenance fees on most accounts.

- Modern tools included: Enjoy features like mobile banking, online budgeting tools, and mobile check deposit.

- Zelle integration: Sending and receiving money to others is now a lot simpler.

- In-person support: Prefer talking to someone face-to-face? With over 1,400 branches, help is usually just around the corner in Regions’ service areas.

Cons of Regions Bank checking accounts:

- Overdraft fees are steep: At $36 per transaction, even students aren’t spared from these charges.

- Interest is nearly non-existent: Even the Preferred Checking account only pays about 0.01% APY, barely anything.

- Fewer ATMs nationwide: Compared to large national banks like Chase or Bank of America, Regions’ ATM network is more limited.

5 Tips to Get the Most from Your Regions Account

To avoid unnecessary fees and make your checking experience smoother, try these simple strategies:

- Set up direct deposit: This is the quickest and easiest way to avoid monthly service fees on most Regions checking accounts.

- Go paperless: Choosing eStatements can save you up to $3/month on some accounts like LifeGreen.

- Monitor your balance closely: Sign up for account alerts to avoid overdrawing your account. You’ll get notified when your balance is low, so you can act before it’s too late.

- Use your debit card wisely: If you have an eAccess account, remember to make at least 10 debit purchases each month to waive the monthly fee.

- Link accounts for overdraft protection: Connecting your Regions Bank checking account to a savings or credit account can save you from those costly $36 overdraft fees. Yes, there’s still a fee, but it’s $15, which is a lot better than $108 if you overdraft three times in one day.

FAQs About Regions Bank Checking Accounts

How much does it cost to open a Regions Bank checking account?

- To open a Regions Bank checking account, you’ll need a minimum deposit of $50. This applies to most accounts, including LifeGreen, Preferred, eAccess, Student, and Now Checking. While opening is affordable, make sure to review monthly fees and waiver conditions to avoid ongoing charges.

Does Regions Bank offer a checking account bonus?

- Yes! Regions periodically offers cash bonuses when you open a new qualifying checking account. For example, through mid-2025, you could earn $300–$400 for opening a LifeGreen Checking or Preferred Checking account in select states. Bonus offers vary by location and time, so always check Regions’ website or ask at your local branch to confirm availability and eligibility.

How do I avoid the $8 monthly fee on the LifeGreen Checking account?

- You can avoid the fee by keeping at least $1,500 in your account daily or by setting up monthly direct deposits totaling $500 or more.

Does Regions Bank charge overdraft fees?

- Yes. Regions charges $36 per overdraft item, with a limit of 3–5 charges per day, depending on your account type. You can avoid these fees by enrolling in Overdraft Grace, linking another Regions account for overdraft protection ($15/transfer), or using the Now Checking account, which doesn’t allow overdrafts at all.

How to close my Regions Bank checking account?

- You can close your Regions checking account by visiting a local branch, calling customer service at 1‑800‑734‑4667, or sending a secure message through online banking. Make sure your balance is $0 and all pending transactions are cleared.

In conclusion, Regions Bank offers a solid range of checking options for everyday users, seniors, and students. But a Regions Bank checking account is not the most competitive when it comes to fees, interest, or overdraft policies. If you’re already banking with Regions or value local support, it’s a decent choice, as long as you play by the rules to avoid fees. But if you’re fee-sensitive or want a modern, interest-earning checking account, you might want to compare online banks before signing up.