If you’re a small or mid-sized business owner based in the Midwest, chances are you’ve heard of Huntington Bank. A Huntington business account offers flexible options designed for startups, growing companies, and established firms alike.

In this review, we’ll explore its checking and savings features, highlight the pros and cons, and help you decide if Huntington is the right fit for your business.

Huntington Business Account Overview

For over 150 years, Huntington Bank has helped small businesses handle their finances with confidence. Based in Columbus, Ohio, Huntington is known for its strong roots across the Midwest and for delivering friendly, personal service, not something you always get at big national banks.

But Huntington stands out for more than just its customer care. What really makes it different is how well it adapts to the needs of growing businesses. Whether you’re just getting started or running a busy operation, Huntington has a variety of accounts to match your stage. Their business checking options are set up in tiers, so you can upgrade as your company grows. On top of that, they offer handy tools like online budgeting, fraud protection, and their 24-Hour Grace program, which gives you extra time to cover overdrafts before getting hit with a fee.

Business owners benefit from:

- Easy account access with online and mobile banking

- Tools for managing cash flow and detecting fraud

- Options to avoid monthly fees

- Seamless integration of personal and business accounts

- Customizable bonus services

With a reputation for strong customer support and flexible account management, Huntington provides convenience and cost-efficiency for business banking.

Huntington Business Checking Accounts

Huntington offers three business checking accounts, each tailored to fit different stages of business growth, from side hustles to high-volume operations.

Business Checking 100

Business Checking 100 is Huntington’s entry-level business checking account. It’s perfect for sole proprietors, freelancers, and start-ups with modest monthly activity.

Key Features:

- $0 monthly maintenance fee

- Up to 100 free monthly transactions

- Up to $2,500 in cash deposits per month at no charge

- 120-day free trial of fraud prevention tool (Reverse Positive Pay)

The no-fee structure makes this account appealing to freelancers, small online sellers, and part-time business owners. It gives you what you need to manage money without the worry of ongoing charges. And here’s a bonus, Huntington includes a 120-day free trial of Reverse Positive Pay, a fraud detection tool that helps prevent unauthorized checks from clearing your account. This kind of protection often costs extra at other banks.

However, if your business begins to grow and you start making more than 100 transactions per month or deal with a lot of cash, the added fees could outweigh the benefits. That’s when upgrading makes sense.

Unlimited Business Checking

Unlimited Business Checking is a step up, designed for businesses with higher cash flow and transaction needs.

Key Features:

- $20 monthly fee (waived with $10,000 in total deposit relationship or with a qualifying personal account)

- Unlimited transactions

- Up to $10,000 in cash deposits/month at no charge

- One bonus service of your choice

Bonus Services Include:

- Reverse Positive Pay (fraud mitigation tool)

- Payroll services discount (via Paychex)

- Two free incoming domestic wire transfers/month

- $25 monthly credit toward Remote Deposit Capture

- Waiver of returned deposited item fees (up to 25/month)

This Huntington business account is built for businesses that are actively growing, think brick-and-mortar shops, service providers with regular clients, or contractors managing multiple projects. The unlimited transactions help you avoid those pesky per-item charges. And the $20 monthly fee is manageable, especially since it can be waived with a $10,000 average balance.

One standout benefit is the option to pick a bonus service that suits your business. For example, if you frequently send wires, you can use the free wire perk. If you manage a team, a payroll discount might save you more. The key is choosing the benefit that fits how you run your business.

Unlimited Plus Business Checking

Unlimited Plus Business Checking is a premium Huntington Bank business account. It’s best for businesses with large cash flows, frequent transactions, and advanced treasury needs.

Key Features:

- $40 monthly fee, waived with $50,000 in total deposit relationship or with a qualifying personal account

- Unlimited transactions

- Interest-bearing account

- Up to $25,000 in cash deposits/month at no charge

- Two bonus services of your choice

Bonus Services:

Same as above, except you get to choose two bonus features instead of one.

Additional Benefits:

- Higher interest rates on linked Business Premier Plus Money Market Accounts

- Premium digital tools for treasury management

- Integrated view with Huntington personal accounts for business owners (if you own at least 25%)

This is Huntington’s most robust business checking account. It not only gives you unlimited transactions and the highest cash deposit limit, but it also pays interest on your balance, something most checking accounts don’t offer. The actual interest rate isn’t very high, but it’s still a plus if you’re holding large balances.

You also get two bonus services instead of just one. This means you can stack benefits like wire fee waivers and fraud protection, or payroll discounts and cash flow tools, whatever mix gives your business the most value.

The sign-up bonus of up to $1,000 is another strong reason to consider this Huntington business account. Eligibility details vary by location and time, so check current offers directly on Huntington’s site or with a banker.

Business Savings Options at Huntington

In addition to business checking, Huntington also offers a range of business savings options to help you grow your money while keeping it safe. Whether you want to build an emergency fund, earn higher interest on excess cash, or lock in a guaranteed return, there’s a savings product to match your business goals. All Huntington business savings accounts come with competitive interest rates, FDIC insurance up to applicable limits, and full access through online and mobile banking.

Business Premier Savings

If you need to keep your money liquid while still earning some interest, this Huntington business account offers flexibility and ease of access.

- No monthly fee if you maintain a daily balance of $500 (otherwise, $5/month)

- Interest is compounded quarterly

- No minimum deposit required to get started

- Easy online transfers between your business accounts

- Great for setting aside funds for taxes, payroll, or emergency expenses

This account is great for smaller businesses that want to start saving. The $500 balance to waive the fee is manageable, and while the interest rate is low, it beats earning nothing.

However, be mindful of transaction limits. After 20 deposits or $1,000 in monthly cash deposits, fees kick in.

Business Premier Plus Money Market Account

This account is a smart choice for businesses that want to earn more interest on extra cash while keeping funds accessible.

- Interest is compounded monthly to help grow your balance faster

- No minimum deposit required to open

- No monthly fee if you keep an average daily balance of $10,000 (otherwise, it’s $10/month)

- Move money between your business checking and savings online at no extra cost

- Pairs well with Unlimited Plus Business Checking for better interest rates

This is the premium savings option for businesses with higher balances. If you consistently hold more than $10K, you’ll earn a better return compared to the basic savings account.

The integration with business checking for overdraft protection is also a helpful safeguard. And when linked to certain checking accounts, you may qualify for boosted interest rates through Huntington’s Relationship Pricing program.

Business CDs (Certificates of Deposit)

For businesses looking for a guaranteed return, Huntington’s Business CDs offer fixed interest rates for a set term.

- Choose from a wide range of terms, from 1 to 60 months

- Interest is compounded daily and can be paid monthly, quarterly, semi-annually, or annually

- Helps you lock in a stable return on surplus funds

- CDs must be opened at a Huntington branch location

No matter what stage your business is in, Huntington’s savings products give you control over your cash flow, offering the flexibility, security, and interest earnings your business needs to thrive.

Additional Features Included with All Business Accounts

No matter which Huntington business account you choose, you’ll enjoy a full set of convenient features designed to make managing your business easier and more secure:

- 24-Hour Grace for Business: If your Huntington business account is overdrawn, you get an extra business day to fix it before any overdraft fees are charged. This can help you avoid penalties and keep your cash flow running smoothly.

- Online and Mobile Banking: Access your business accounts anytime, anywhere using Huntington’s secure online platform or mobile app. You can check balances, pay bills, transfer funds between accounts, and even deposit checks remotely.

- The Hub: Huntington’s digital banking suite, The Hub, offers tools to help you plan ahead and manage your cash flow. It includes features like budgeting, cash flow forecasting, and detailed insights into your business spending trends.

- Overdraft Protection Options: You can link your business checking account to another Huntington business credit card, business line of credit, or business savings account. This way, if your checking balance drops too low, funds are automatically transferred to cover the gap, helping you avoid declined payments or overdraft fees.

- Single Sign-On Access: If you also bank with Huntington personally, you can seamlessly switch between your personal and business accounts from one login. It saves time and keeps everything accessible from one dashboard.

Huntington Business Account Fee Overview

While many Huntington features are business-friendly, some costs can creep up, especially with wire transfers and international activity.

Huntington Business Checking Fees

Understanding Huntington business account fees is important when selecting the right business checking solution. Huntington offers three main business checking accounts, each with its own fee structure designed for different business sizes and needs. Below is an overview of the most common charges:

| Fee Type | Business Checking 100 | Unlimited Business Checking | Unlimited Plus Business Checking |

|---|---|---|---|

| Monthly Service Fee | $0 | $20 (waived with $10K balance or qualifying personal account) | $40 (waived with $50K balance or qualifying personal account) |

| Interest Bearing | ❌ No | ❌ No | ✅ Yes |

| Included Transactions | 100 free/month | ✅ Unlimited | ✅ Unlimited |

| Cash Deposit Limit | $2,500/month | $10,000/month | $25,000/month |

| Excess Cash Deposit Fee | $0.30 per $100 | $0.30 per $100 | $0.30 per $100 |

| Overdraft Fee | $36 (max 3/day) | $36 (max 3/day) | $36 (max 3/day) |

| Returned Item Fee | $36 (max 1/day) | $36 (max 1/day) | $36 (max 1/day) |

| Incoming Wire (Domestic) | $18 | $18 | $18 |

| Outgoing Wire (Domestic) | $50 | $50 | $50 |

| Non-Huntington ATM Fee | $3.50 + owner fee | $3.50 + owner fee | $3.50 + owner fee |

| Paper Statement Fee | $5.00/month (can waive) | $5.00/month (can waive) | $5.00/month (can waive) |

Huntington Business Savings Fees

In addition to business checking, Huntington provides business savings solutions designed to help you grow your money while keeping costs low. The Business Premier Savings and Business Premier Plus Money Market Account (PPMMA) are both interest-bearing and include access to essential digital tools and features like overdraft protection, The Hub, and mobile banking.

| Fee Type | Business Premier Savings | Business Premier Plus MMA |

|---|---|---|

| Monthly Maintenance Fee | $5 (waived with $500 average balance) | $10 (waived with $10,000 average balance) |

| Interest Bearing | ✅ Yes (compounded quarterly) | ✅ Yes (compounded monthly) |

| Free Cash Deposits | Up to $1,000/month | Up to $1,000/month |

| Excess Cash Deposit Fee | $0.30 per $100 | $0.30 per $100 |

| Returned Deposited Item Fee | $15 per item | $15 per item |

| Wire Transfers (Outgoing – Domestic) | $50 | $50 |

| Wire Transfers (Outgoing – International) | $80 | $80 |

| Overdraft Fee | $36 (up to 3/day) | $36 (up to 3/day) |

| Return Item Fee | $36 (max 1/day) | $36 (max 1/day) |

| Stop Payment (Online / In Branch) | $27 / $35 | $27 / $35 |

| Mailed Statement Fee | Free | $5/month (waived with paperless) |

| Online & Mobile Banking | ✅ Free | ✅ Free |

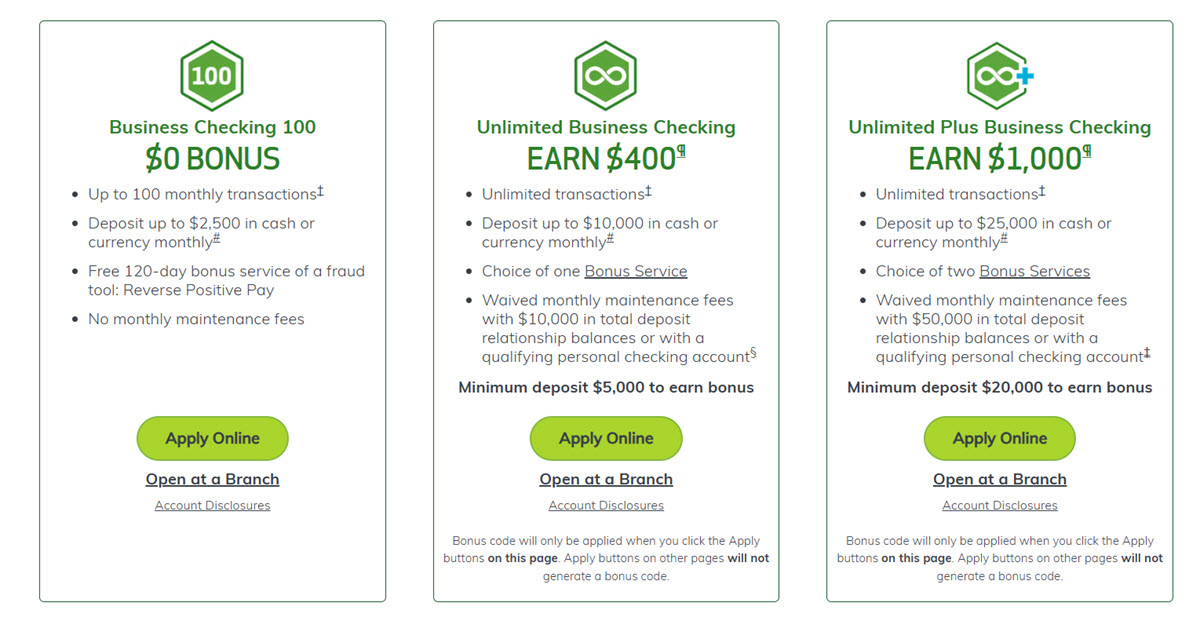

Huntington Business Account Promotions

Huntington Bank frequently offers promotions for new business customers. These Huntington business account promos typically come in the form of a cash bonus after meeting certain requirements within a set period of time.

Here are two current offers available in many eligible states:

- $400 Bonus with Unlimited Business Checking: To earn this bonus, open a new account, deposit at least $5,000 in new money within the first 60 days, and keep the account open for at least 90 days.

- $1,000 Bonus with Unlimited Plus Business Checking: For this larger bonus, deposit at least $20,000 in new funds within the first 30 days, maintain that balance for 60 days, and keep the account open for at least 90 days.

These offers are typically for new customers only. You’ll also need to apply through Huntington’s promotional link and meet all terms and deadlines to receive the bonus. Once all conditions are met, the bonus is usually credited to your account within two weeks.

Huntington Business Account Requirements

Before you open a Huntington business account, you’ll need to provide a few important documents. These are required to confirm your identity and verify that your business is legally formed.

Here’s what you typically need:

- A legitimate photo ID from the government, like a passport or driver’s license

- An Employer Identification Number (EIN) for your business. If you’re a sole proprietor, you may use your Social Security Number (SSN)

- Legal documents that show how your business is structured. This could include Articles of Incorporation, LLC operating agreements, partnership agreements, or nonprofit certificates

- Names and identification of authorized signers for the business account

- At least one authorized person who has permission to open and manage the account on behalf of the business

Some business types, such as nonprofits or multi-owner companies, may need to provide extra documents. It’s best to gather everything ahead of time to avoid delays.

How to Open a Huntington Business Account Online

Opening a business account at Huntington Bank is easy and can be done entirely online. You don’t have to visit a branch unless you prefer to.

You can open your Huntington business account online if you meet the following conditions:

- You’re a U.S. citizen or legal resident

- You’re at least 18 years old

- You’re authorized to act on behalf of the business

All three checking account types and two savings account types are available for online applications. You only need to apply for Huntington Business CD in person.

Here’s how the process works:

- Go to Huntington’s website and select the business account that best fits your needs (Business Checking 100, Unlimited, or Unlimited Plus)

- Click the “Apply Online” button

- Create a user profile or sign in if you already have one

- Fill out the application with your business and personal information

- Upload required documents, such as your ID and business formation paperwork

- Fund your account if needed (some promotional offers require an initial deposit)

- Submit your application and wait for approval

The entire process usually takes only a few minutes, and you’ll receive updates by email once your Huntington business account is ready to use.

Pros & Cons of Huntington Business Accounts

Before choosing a Huntington business account, it’s important to weigh the benefits and limitations. Huntington offers a lot of value, but no bank is perfect, so to help you see the larger picture, here is a breakdown:

Pros:

- Flexible Account Options: Whether you’re a freelancer or CFO, there’s a tier for you.

- Unlimited Transactions: Both mid-tier and top-tier checking offer unlimited transactions.

- Overdraft Protection: 24-Hour Grace is rare and helpful.

- Cash Deposit Allowance: Generous limits for growing businesses.

- Bonus Offers: Bonus Offers: Up to $1,000 in sign-up bonuses are available.

Cons:

- High Balance Requirements: Waiving monthly Huntington Bank business account fees may require $10K to $50K.

- Low Interest Rates: Even premium accounts offer modest yields.

- Transaction Limits on Savings: Fees apply if you exceed monthly caps.

And here’s a quick guide to help match your business type with the most suitable Huntington business account:

| Business Type | Best Fit Account |

|---|---|

| Freelancer or Side Hustle | Business Checking 100 |

| Small-Medium Business (SMB) | Unlimited Business Checking |

| High-Volume or Retailer | Unlimited Plus + Premier Money Market |

| Cash-Handling Business | Unlimited Plus (for $25K cash deposit) |

Huntington Business Account Customer Service

If you have questions or need help managing your Huntington business bank account, the bank offers several support options to make sure you get the help you need.

You can reach their Business Direct customer service team by phone at Huntington Business Account phone number 1-800-480-2001. They’re available Monday through Friday from 7:30 a.m. to 6:30 p.m. ET, and Saturday from 8 a.m. to 5 p.m. ET.

Other support features include:

- A helpful online banking system where you can send secure messages

- In-person support at over 1,300 branch locations

- Access to “The Hub,” Huntington’s digital tool that helps manage business finances, track spending, and forecast cash flow

- Text and email alerts to help monitor account activity

- Business Online access for managing payments, transfers, and reporting, with advanced tools for larger teams

Whether you’re opening a new account or need help with transactions, Huntington’s business banking support is easy to access and focused on helping small and mid-size businesses succeed.

FAQs about Huntington Business Accounts

How do I open a Huntington business account online?

- Visit Huntington’s website, select the business checking product you want, and follow the online application steps. You’ll need your business documents and ID.

Can I waive the monthly maintenance fee?

- Yes. Each business checking account has waivable fees based on total deposit balances or by maintaining a qualifying personal Huntington account.

What is the Huntington business account minimum balance?

There is no minimum balance to open a business account. However, to waive monthly fees, you may need to maintain balances of $10,000 (Unlimited) or $50,000 (Unlimited Plus), depending on the account type.

Which Huntington business account earns interest?

- Only the Unlimited Plus Business Checking earns interest on your balance.

How do I close my Huntington business account?

- To close your Huntington Bank business account, visit a local branch or call Business Direct at 1-800-480-2001. Make sure your account has a $0 balance and all pending transactions have cleared before requesting closure.

Huntington business account options are built with growth in mind. You can start with a no-fee, low-limit checking account and graduate to interest-bearing options with bonus perks. The 24-Hour Grace feature, access to relationship pricing, and digital tools add real value, especially for business owners juggling multiple responsibilities.