Choosing the right checking account can make everyday banking easier and less stressful. If you’re considering an M&T Bank checking account, it’s important to know what you’re getting, like fees, features, and digital tools.

This quick guide will help you understand your options and see if M&T is a good fit for your financial needs.

M&T Bank Checking Account Overview

Before choosing a checking account, it’s helpful to understand what M&T Bank offers and how its checking options can fit your financial needs.

About M&T Bank

M&T Bank, officially known as Manufacturers and Traders Trust Company, has been serving customers for over 160 years. Today, M&T is a well-established regional bank with a strong presence in the Northeast and Mid-Atlantic, operating more than 1,000 branch locations and around 2,000 ATMs.

What sets M&T apart is its focus on community banking. Unlike some big national banks that feel distant, M&T aims to stay connected to local neighborhoods. It offers a wide range of services, including personal and business banking, home and personal loans, investment products, and digital banking tools like mobile apps and online services. Whether you prefer walking into a branch or banking from your phone, M&T offers flexibility to fit your style.

About M&T Bank Checking Accounts

When it comes to everyday banking, M&T Bank checking accounts offer a wide range of choices. Whether you want a simple, no-fee account or a premium option with interest and perks, M&T has an account tailored to your lifestyle and financial goals.

M&T Bank offers four main checking account options, each designed to meet different needs:

- EZChoice Checking: A straightforward account with no monthly fee

- MyWay Banking: A checkless, beginner-friendly option with overdraft protection

- MyChoice Plus Checking: A more advanced account that earns interest and offers ATM rebates

- MyChoice Premium Checking: A premium account for those who keep higher balances and want exclusive benefits

Each account comes with digital tools like online and mobile banking, debit card access, and fraud protection.

M&T Bank Checking Account Options

Now, let’s take a closer look at what each checking account offers.

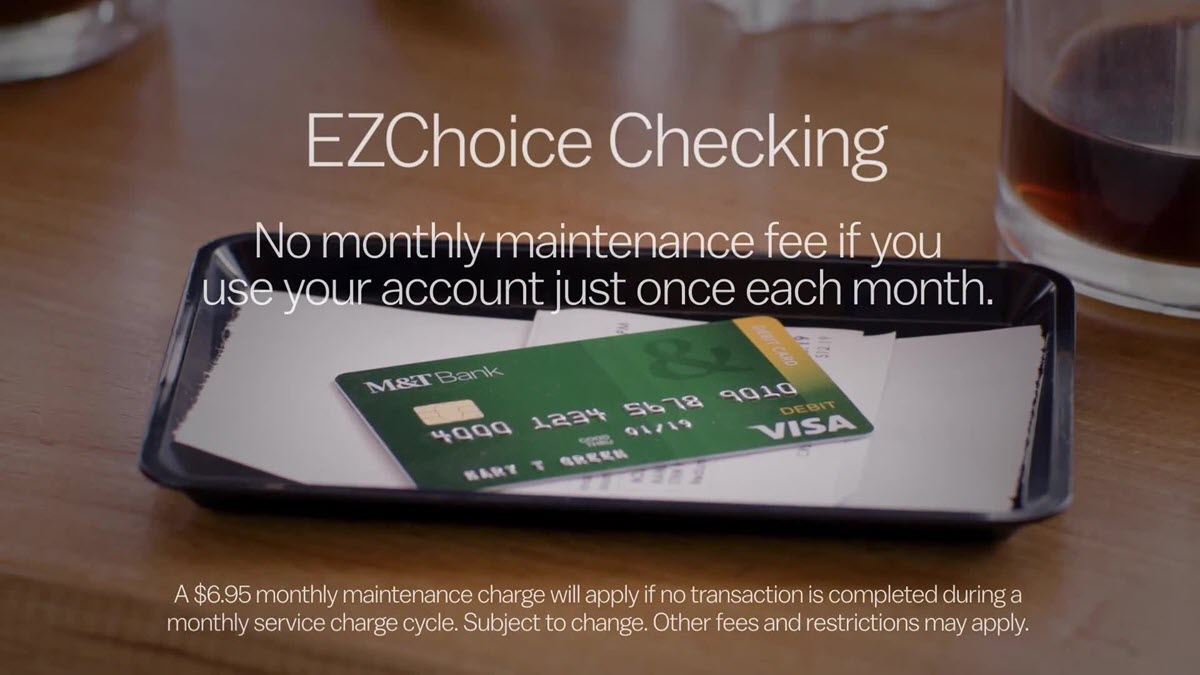

EZChoice Checking

The EZChoice Checking account is perfect for people who want a basic account without having to worry about monthly fees or minimum balances.

Key Features:

- No monthly maintenance fee

- No minimum balance requirement

- No required number of monthly transactions

- Free access to online and mobile banking

- Custom debit card designs at no cost

- Real-time M&T Alerts for account activity or low balances

This M&T Bank checking account is ideal for students, young adults, retirees, or anyone who just needs a simple place to deposit money, pay bills, and use a debit card. If you’re looking for a checking account that won’t charge unnecessary fees or require hoops to jump through, this one delivers.

The biggest advantage of EZChoice Checking is the $0 monthly fee, with no balance or deposit requirements. It’s truly fee-free and beginner-friendly, yet still gives you full access to all of M&T’s digital tools and banking services.

MyWay Banking

MyWay Banking is designed for people who are new to banking or want a safer way to manage their money without worrying about overdrafts or checks.

Key Features:

- No paper checks allowed, for easier tracking and safer spending

- No overdraft fees. Transactions that exceed your balance are simply declined

- $4.95 monthly fee, but it can be waived with one deposit or debit purchase per month

- Free mobile and online banking

- Custom debit card and M&T Alerts for peace of mind

This M&T Bank checking account is great for teens, students, or adults who want more control over their spending. It’s also useful for people who want to rebuild trust with banking after past overdraft issues.

With no risk of overdraft charges, MyWay Banking gives users the confidence to manage money responsibly. And since the monthly fee can be waived so easily, it’s a low-cost way to bank safely.

MyChoice Plus Checking

If you regularly maintain a higher balance or travel often and use various ATMs, MyChoice Plus Checking offers extra value with interest earnings and ATM fee reimbursements.

Key Features:

- Earn interest on your checking balance

- No M&T fees at any ATM

- Rebates up to $2 per ATM transaction for out-of-network charges

- Discounted personal loan interest rates

- $14.95 monthly maintenance fee, waived if you maintain:

- $2,500 average daily balance, or

- $1,500 in qualifying direct deposits each month

This account works well for professionals and families who keep a steady balance in checking and want some return on that money, plus savings on loan rates and ATM fees.

Few checking accounts give you interest earnings and ATM rebates in the same package. With MyChoice Plus, you get more benefits for being a loyal customer without needing to open extra accounts.

MyChoice Premium Checking

MyChoice Premium Checking is the best choice among the checking accounts offered by M&T Bank. It’s designed for customers who maintain larger balances and want access to premium features, savings, and VIP service.

Key Features:

- Earn a competitive M&T Bank checking account interest rate on your balance

- Premium deposit interest rates on CDs or savings accounts

- Reduced rates on M&T loans

- Unlimited access to M&T and non-M&T ATMs

- ATM surcharge reimbursements

- Free overdraft protection transfers

- Waived or discounted safe deposit box rental

- $24.95 monthly maintenance fee, waived with:

- $7,500 in daily checking balance, or

- $25,000 in combined M&T accounts (checking, savings, investments)

This account is ideal for financially active individuals, business professionals, or retirees who keep larger balances and want enhanced banking privileges and flexibility.

MyChoice Premium combines high-end benefits with convenience. If you qualify for the fee waiver, this account gives you one of the best overall banking experiences at M&T.

No matter which M&T Bank checking account you choose, you’ll enjoy a wide range of convenient and modern features designed to make everyday banking easier and more secure:

- Mobile & Online Banking: You can manage your account anytime, anywhere. View your balance, transfer money between accounts, pay your bills, or send money with Zelle, all from your phone or computer.

- Mobile Check Deposit: No need to visit a branch to deposit a check. Just take a photo of the check using the M&T Mobile Banking app, and the money goes straight into your M&T Bank checking account.

- M&T Alerts: Get real-time notifications about your account activity. These alerts can help you track low balances, spot suspicious transactions, and stay in control of your money.

- Contactless Payments: Shopping is faster and safer with digital wallets. M&T debit cards work with Apple Pay, Google Pay, Samsung Pay, and Garmin, so you can tap and go without pulling out your card.

- Custom Debit Card Designs: Make your debit card your own. M&T lets you choose from a variety of free card designs to match your personality or style.

- Over 900 Branches & 2,000 ATMs: You’re never far from support. M&T Bank’s strong regional presence, especially in the Northeast and Mid-Atlantic, means you can visit a branch or withdraw cash whenever you need to.

M&T Bank Checking Account Digital Tools & Security

M&T Bank makes everyday banking easier, faster, and more secure with a full set of digital tools designed to protect your money and simplify how you manage it:

- M&T Assurance: This advanced fraud protection service works 24/7 to monitor your account for suspicious activity. If something looks unusual, you’ll be notified right away, helping you stop fraud before it causes serious damage. Whether it’s a strange purchase or an unknown login attempt, M&T has your back.

- Zelle Integration: Need to split a bill or send money to a friend? With Zelle, you can send and receive money quickly and safely from your M&T checking account. It’s completely free and available within your M&T Mobile Banking app, no need to download a separate app.

- Online Bill Pay: Forget writing checks or worrying about late fees. M&T’s Online Bill Pay lets you schedule payments for your rent, credit card, utilities, and more. You can make one-time payments or set up automatic recurring payments, so your bills are always paid on time.

- Safe Deposit Box Access: If you open a MyChoice Premium Checking account, you may qualify for a discounted or even free safe deposit box at your local M&T branch. It’s a secure place to store valuable documents like birth certificates, property deeds, or family heirlooms.

These tools are designed to give you full control of your finances, whether you’re banking from your phone, at an ATM, or inside a branch.

How to Open a M&T Bank Checking Account

Opening an M&T checking account is fast and simple, usually taking under 10 minutes. You can apply online or go to a local branch if you prefer in-person help.

M&T Bank Checking Account Requirements

You don’t need a lot of money or paperwork to open one, just a few basic details and a small deposit:

- Be at least 18 years old

- Have a valid U.S. driver’s license or non-driver ID

- Social Security number

- A U.S. mailing address

- Some basic income or employment information

- To open your account, you’ll need to deposit at least $25. This is your starting balance and is required for most M&T checking accounts.

M&T Bank Checking Account Application Process

- Start Your Application: You can choose to:

- Go to mtb.com and choose the checking account that fits your needs. Fill in your information, provide identification, and add at least $25 to your account.

- Visit any M&T branch with your ID and initial deposit. A banker will walk you through the steps and help you open your account.

- After Applying: You’ll get a confirmation email. Then, once approved, your M&T debit card will arrive by mail within 7–10 business days. Activate it by phone or at an ATM.

- Set Up Digital Access: Enroll in online and mobile banking to check your balance, pay bills, deposit checks, and send money with Zelle. M&T makes switching banks easier with their Switch Kit. This includes helpful tools and step-by-step checklists to:

- Move your direct deposits (like your paycheck or benefits)

- Transfer automatic payments for things like bills and subscriptions

- Close your old account when you’re ready

Opening an Account for Teens and Students

Teens between the ages of 13 and 17 can also open an M&T Bank checking account, specifically the MyWay Banking account. However, they must apply in person with a parent or legal guardian. Online applications are only available to customers 18 and older.

This account is a smart way to help teens start learning about money, budgeting, and responsible spending, with no risk of overdraft fees.

M&T Bank Checking Account Fees and Interest Rates

Like most banks, M&T charges certain fees depending on how you use your account. Some can be avoided with careful planning, while others depend on which type of checking account you open.

Monthly Fee and Interest Rates

Below is a quick overview of the monthly maintenance fees, interest rates, and how you can avoid them:

| Account Type | Monthly Fee | How to Waive the Fee | Interest Rate (APY) | Notes |

|---|---|---|---|---|

| EZChoice Checking | $0 | Always $0 – No requirements | Not available | Basic, no-frills account with free online/mobile banking |

| MyWay Banking | $4.95 | $0 with 1+ transaction per month (deposit, withdrawal, or debit) | Not available | Checkless account with no overdraft fees, ideal for beginners or teens |

| MyChoice Plus Checking | $14.95 ($4.95 in NJ) |

$0 with $2,500 avg. daily balance or $1,500+ in direct deposits/month | 0.01% | Includes ATM fee rebates and loan discounts |

| MyChoice Premium Checking | $24.95 | $0 with $7,500 daily balance or $25,000+ combined in eligible M&T accounts | 0.01% | Premium perks: overdraft protection, free checks, ATM fee refunds |

Note: Keep in mind that interest is compounded daily and paid monthly, and maintaining higher balances can help offset fees or unlock M&T Bank checking account bonus features.

Minimum Deposit & Balance Requirements

All M&T Bank checking accounts only require a $25 minimum deposit to open.

- EZChoice and MyWay accounts have no ongoing minimum balance requirements.

- For MyChoice Plus and Premium, you can avoid monthly fees by maintaining certain balances or setting up direct deposits.

This gives customers flexibility, whether you’re just starting out or managing larger balances.

Other Common Fees to Know

While some fees are standard across all banks, M&T’s guide helps you stay informed. Here’s a breakdown of a few you might come across with your M&T Bank checking account:

| Fee Type | Amount | Applies To |

|---|---|---|

| ATM (Non-M&T in U.S.) | $3.00 | Withdrawals and balance inquiries outside M&T network |

| ATM (International) | Greater of $5.00 or 3% of transaction | Applies to foreign ATM use |

| Overdraft Fee | $15.00 per item | Only if M&T pays overdraft, not charged to MyWay accounts |

| Overdraft Transfer Fee | $8.00 per transfer day | From linked accounts, waived for MyChoice Premium |

| Official Check Fee | $10.00 per item | Free for MyChoice Premium customers |

| Stop Payment Fee | $35.00 per item | Applies to checks and ACH transactions |

| Wire Transfer (Domestic) | $32.00 (non-M&T) / $16.00 (to M&T) | Sending within the U.S. |

| Wire Transfer (International) | $75.00 outgoing / $16.00 incoming | Higher cost for global transactions |

| Early Account Closure | $50.00 | If closed within 180 days (except MyWay) |

M&T Bank Checking Account Customer Support

Whenever you need help, M&T Bank is ready to assist. They offer several customer support options to make sure your questions get answered:

- Online Banking Help: Access a large library of FAQs, video tutorials, and live chat through the M&T website or mobile app.

- Phone Support: Speak with a real person for help with account issues, lost cards, or technical questions. Customer service hours are extended on weekdays for added convenience.

- Branch Services: Prefer face-to-face support? Visit any of M&T’s 900+ branches. Many locations are even open on Saturdays to better fit your schedule.

Whether it’s a quick question or a more complex issue, M&T’s customer service team is there to help you every step of the way.

FAQs About M&T Bank Checking Accounts

Does M&T Bank offer sign-up bonuses for checking accounts?

- Yes, M&T Bank occasionally offers limited-time sign-up bonuses for new checking customers who meet specific deposit and activity requirements. Check their website or local branches for current promotions.

What is the routing number for M&T Bank checking accounts?

- M&T Bank’s routing number is 022000046. You can also find it on the bottom left of your checks or by logging into your online banking.

Are there overdraft fees?

- MyWay Banking has no overdraft fees. Other accounts offer overdraft protection, but fees may apply unless you qualify for a waiver.

How do I avoid the monthly maintenance fee?

- Some accounts have no fee by default. Others can be waived with a minimum balance or qualifying direct deposits.

Is M&T mobile banking free?

- Yes, online and mobile banking come at no cost. Just download the M&T Mobile App and enroll.

Can I open a joint checking account with M&T Bank?

- Yes. M&T allows joint checking accounts. Both applicants must provide ID and personal information during the account setup process.

If you want a checking account that fits your lifestyle and helps you manage your money smartly, M&T offers a range of solid choices. Whether you’re a student just starting out, someone looking to avoid fees, or a seasoned saver who wants perks and interest, there’s an M&T Bank checking account option for you. With over 900 branches, strong customer support, and easy online access, managing your money has never been simpler.