When choosing a checking account, you’re choosing a service that affects how you pay bills, manage income, and even how soon you get your paycheck. Therefore, choosing the right Huntington checking account can make everyday banking easier and more rewarding.

In this review, we’ll help you understand the key differences, so you can pick the account that works best for your lifestyle.

Huntington Checking Account Overview

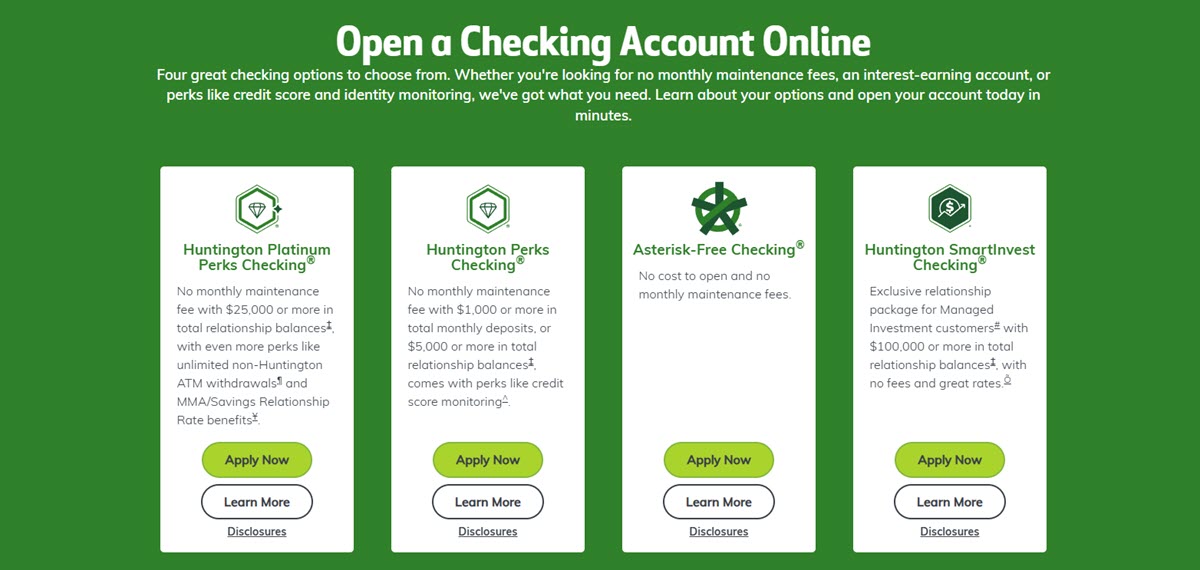

Before diving deep, let’s take a step back and look at the big picture. Huntington Bank offers four main types of checking accounts, each tailored to different financial needs and lifestyles.

- Asterisk-Free Checking is the most basic option. It’s a no-fee account with essential banking features, ideal for everyday use.

- Perks Checking adds more value with interest earnings and identity protection, while still keeping fees manageable.

- Platinum Perks Checking is a higher-tier account that unlocks premium benefits like unlimited ATM reimbursements, free checks, and extra financial perks.

- SmartInvest Checking is the most advanced option. It’s designed for customers who not only bank with Huntington but also invest significant funds through them.

Each account brings something different to the table. Whether you’re just starting out, looking to grow your money, or managing a high balance with investment goals, there’s a Huntington checking account for you.

Types of Huntington Checking Accounts

Next, here’s a closer look at what each account provides:

Asterisk-Free Checking

This is Huntington’s most popular basic checking account. It’s perfect for people who want simple banking with no monthly fees or hidden charges. There’s no minimum balance required, making it great for students, young professionals, or anyone looking for a hassle-free banking experience.

Key Features:

- No monthly maintenance fee

- Free online and mobile banking

- Free debit card

- Bill Pay and Zelle transfers

- Access to thousands of Huntington ATMs

- Overdraft protection with 24-Hour Grace

- Eligible for Standby Cash

This Huntington checking account gives you all the essentials without worrying about keeping a certain balance or paying service fees. While it doesn’t earn interest, it’s ideal if you just need a reliable way to manage your money.

Huntington Perks Checking

The Huntington Perks Checking account adds more benefits on top of the basics. It’s made for customers who want to earn interest and take advantage of extra banking tools and financial protections.

Key Features:

- Earn interest on your daily balance

- Monthly fee of $10 (can be waived with qualifying activity)

- Identity monitoring and credit score access

- Bill Pay, Zelle, and mobile deposits

- Overdraft protection with 24-Hour Grace

- Standby Cash available

- Discounts on Huntington personal loans

This account is a good fit for everyday users who want to keep things simple but also want some perks, like earning interest and monitoring their credit.

Huntington Platinum Perks Checking

This premium Huntington checking account is built for customers who keep higher balances or have multiple financial relationships with Huntington. It comes with all the perks of Perks Checking, plus a lot more.

Key Features:

- Tiered interest rates (higher balances earn more)

- Monthly fee of $25 (waivable if you meet balance or relationship requirements)

- Unlimited refunds on non-Huntington ATM fees

- No fees for cashier’s checks, money orders, or overdraft transfers

- Free paper checks

- Additional rate discounts for Huntington home equity and mortgage loans

- Access to premium customer service

If you already have savings or investment accounts with Huntington, or if you tend to keep a large balance, this account offers great value. You’ll enjoy top-tier banking services and bigger rewards.

SmartInvest Checking

Huntington’s SmartInvest Checking is crafted for clients who want more than a checking account, they want a full-service financial relationship with their bank.

This account works best for individuals who have at least $100,000 in managed investments with Huntington. It’s a part of your wealth-building toolkit.

Key Features:

- No Huntington checking monthly fee if you maintain the $100K investment threshold

- Higher interest rates on your checking and savings balances

- Unlimited ATM fee refunds, no matter where you go

- Premium identity protection, including concierge-level services

- Access to the SmartInvest Money Market account, which offers advantageous Huntington checking account interest rates.

What makes SmartInvest unique is its seamless blend of checking and investing. You can handle everyday spending and long-term portfolio growth all under one roof.

However, there’s one thing to keep in mind: If your managed investment balance drops below $100,000, your account will automatically switch over to Platinum Perks Checking, which comes with different rules and fees.

This account is ideal for high-net-worth individuals who want convenience, premium support, and full control over both their cash and investments.

Compare Huntington Checking Accounts Side-by-Side

With four different checking options, it’s helpful to see how they stack up against each other. The table below breaks down the key features so you can compare at a glance:

| Feature | Asterisk-Free | Perks Checking | Platinum Perks | SmartInvest |

|---|---|---|---|---|

| Monthly Fee | $0 | $10 (waivable) | $25 (waivable) | $0* (with conditions) |

| Earns Interest | ❌ | ✅ (Low) | ✅ (Higher) | ✅ (Highest) |

| Identity Theft Protection | ❌ | ✅ | ✅ | ✅ |

| ATM Fee Reimbursement | ❌ | ❌ | ✅ Unlimited | ✅ Unlimited |

| Free Checks | ❌ | ❌ | ✅ | ✅ |

| Overdraft Tools | ✅ | ✅ | ✅ | ✅ |

| Bonus Eligible | ❌ | ✅ $400 | ✅ $600 | ❌ |

| Investment Integration |

❌ | ❌ | ❌ | ✅ |

*SmartInvest Checking requires $100,000 in managed investments. If the balance falls, the account is degraded to Platinum Perks.

Each of Huntington’s checking accounts comes with secure access to the bank’s mobile app and online banking tools. Features like mobile deposits, spending insights, bill pay, and budgeting tools are included no matter which account you choose. And with Huntington’s overdraft tools like 24-Hour Grace and Standby Cash, you have a better chance of recovering from unexpected expenses without being penalized right away.

Whether you’re just starting out with your first bank account or managing a complex portfolio, Huntington offers options that scale with your financial life. Choosing the right one depends on your priorities.

Huntington Checking Account Fees & Requirements

Before opening a checking account, it’s smart to understand the fees and conditions that come with it. Huntington makes most of its account terms clear and simple, but each option comes with its own structure.

Common Fee Breakdown by Huntington Checking Account Type:

| Fee Type | Asterisk-Free | Perks Checking | Platinum Perks | SmartInvest Checking |

|---|---|---|---|---|

| Monthly Maintenance | $0 | $10 (can be waived) | $25 (can be waived) | $0 with conditions |

| Waive Fee with Balance | Not Needed | $5,000 | $25,000 | $100K Managed Assets |

| Overdraft Fee | $15 per item (≤ 3/day) | Same | Same | Same |

| Non-Huntington ATM | $3 per withdrawal | $3 per withdrawal | Refunded – unlimited | Refunded – unlimited |

| Paper Statement | $2 | $2 | Free | Free |

- Overdraft Fees: Capped daily to protect your wallet if you overdraw multiple times in a day.

- ATM Fees: Huntington won’t charge you at their ATMs, but using another bank’s ATM may cost extra, unless you have a Platinum account.

- Paper Statement Fee: To avoid this, switch to eStatements through online banking.

How to Waive Monthly Huntington Checking Account Fees:

If you’re eyeing the Perks or Platinum Perks Checking accounts but want to avoid the

Huntington checking monthly fees, here are a few ways to do it:

- Maintain a daily balance: For Perks Checking, keeping a certain balance (usually around $1,000) may waive the fee.

- Set up direct deposit: Having your paycheck or government benefits directly deposited into the account can qualify.

- Link other Huntington products: Holding a mortgage, auto loan, or investment account with Huntington may help you avoid monthly charges on premium accounts.

Be sure to double-check the current fee schedule on Huntington’s website, as banks often revise their rates and rules once a year.

Huntington Checking Account Bonus

If you’re opening a new checking account, Huntington Bank has a great way to welcome you, with cash bonuses. Depending on the account you choose and how much you deposit, you could earn up to $600 just for meeting a few easy requirements.

Current Bonus Offers (2025):

| Account Type | Bonus Amount | How to Qualify |

|---|---|---|

| Perks Checking℠ | $400 | Open a new account and receive at least $500 in direct deposits within 90 days. |

| Platinum Perks Checking℠ | $600 | Open a new account and deposit $25,000 in new funds within 90 days. |

To get the bonus, you also need to keep the account open for at least 90 days. After that, the money is usually deposited into your Huntington checking account automatically.

- The $400 bonus is a good fit if you get regular direct deposits, like a paycheck or Social Security.

- The $600 bonus works better if you have savings or other funds you can move into the account for a few months.

Steps to Get Your Bonus:

- Open a new eligible checking account by the deadline.

- Meet the deposit requirements and keep your account in good standing within 90 days.

- For Perks Checking, set up direct deposit of $500+ within 90 days.

- For Platinum Perks, deposit $25,000+ in new money within 90 days.

- Receive the bonus within 14 days after meeting conditions.

Get your cash bonus deposited into your account, typically within two weeks after you qualify. One small tip is that you can set up payroll direct deposit early and make sure the funds count as qualifying ACH deposits.

These offers are only available in states where Huntington operates. So, before you apply for a Huntington checking account, make sure you live in a region served by Huntington Bank, such as Ohio, Michigan, Indiana, or nearby states.

How to Open a Huntington Checking Account

Opening a Huntington checking account is easy and fast. You can apply either online or by visiting a nearby branch, depending on your preference and eligibility.

Online Application Steps

The online application takes about 10 minutes if you have your documents ready. Here’s how the process works:

- Gather the Basics: Before you begin, make sure you have:

- A valid photo ID

- Your Social Security Number

- A way to make your first deposit (bank transfer, mobile deposit, etc.)

- Choose the Right Account: Select the Huntington checking account that best suits your requirements. The bank offers options like Asterisk-Free, Perks, Platinum Perks, and SmartInvest Checking. Each one has different features and benefits.

- Fill Out the Online Form: Go to Huntington’s website and click “Open an Account.” You’ll be asked to enter your name, address, date of birth, SSN, and other personal information.

- Confirm Your Identity: You may need to upload a photo or scanned copy of your ID. Huntington might ask a few security questions to confirm it’s really you.

- Fund the Account: Add money to your new account. You can do this with a mobile deposit, external bank transfer, or debit card. Most checking accounts don’t require a minimum opening deposit.

- Review and Submit: Make sure all the information is correct, then hit submit. You’ll get a confirmation right away and can start using your account once everything is approved.

- Set Up Online Access: Create a username and password for online banking. You can also download the Huntington mobile app to manage your money from anywhere.

The online application usually takes around 5 to 10 minutes, and most people can finish it in one sitting.

In-Branch Application

If you’d rather talk to someone face-to-face, you can also open a Huntington checking account at a nearby Huntington branch. Just bring:

- A government-issued photo ID

- Your Social Security Number

- An opening deposit (cash, check, or transfer)

A banker will walk you through the process, help you choose the right account, and make sure everything is set up correctly.

Huntington Overdraft Solutions

One of the things that sets Huntington Bank apart is how it handles overdrafts. Instead of immediately charging customers high fees when an account is overdrawn, Huntington offers helpful tools to give you time and flexibility. These features are designed to reduce financial stress and help you stay in control of your money.

- 24-Hour Grace: This is one of Huntington’s most well-known features. If you accidentally spend more than what’s in your account, Huntington gives you until the next business day to fix it. That means if you make a deposit or transfer enough money into your Huntington checking account before the deadline, you can avoid the overdraft fee altogether.

- Standby Cash: Standby Cash is a unique short-term loan feature that’s available to eligible customers. Without a credit check, you can obtain up to $500 right away. There’s no interest if you repay it on time within the agreed terms, usually over three monthly payments. If you’re late on repayment, only a small fixed fee applies.

- Early Pay: When you set up direct deposit, you can receive your paycheck up to two days early using this function. There’s no extra cost, and it happens automatically when your employer sends the payment file in advance.

Together, these three tools show that Huntington is focused on offering practical, customer-friendly overdraft support. These features can help you stay afloat, avoid fees, and handle short-term financial bumps without added pressure.

Digital Banking Experience & Physical Access

Managing your money with Huntington is simple and smooth, thanks to its powerful online banking platforms and wide physical accessibility:

Huntington Mobile App & Online Banking

Whether you’re checking your balance, paying a bill, or tracking spending with your Huntington checking account, the experience is designed to be easy, even if you’re not tech-savvy.

Key Features:

- Mobile Check Deposit: Snap a picture of a check and deposit it anytime, anywhere.

- Instant Balance Preview: Quickly view your balance without logging in fully.

- Spending Insights: Get automatic tracking of your spending habits to help you budget smarter.

- Customizable Alerts: Set up text or email alerts for low balances, deposits, and transactions.

- Zelle Transfers: Instantaneously send or receive money with your loved ones.

The Huntington app is consistently highly rated in both the Apple App Store and Google Play Store. Users praise its clean design, speed, and ease of use, making it a reliable option for people who want to stay on top of their finances on the go.

Branch & ATM Access

Even in a digital world, it’s comforting to know that help is nearby. Huntington operates more than 1,000 full-service branches and 1,800 ATMs across the Midwest, including in states like:

- Ohio

- Michigan

- Pennsylvania

- Indiana

- Illinois

- Kentucky

- West Virginia

- Wisconsin

If you live in or near these regions, you’ll likely have convenient access to in-person banking and open a Huntington checking account. And even if you’re outside Huntington’s core service areas, you can still do almost everything through the mobile app or online.

For Platinum Perks Checking and higher-tier customers, Huntington offers unlimited ATM fee reimbursements, meaning you can use non-Huntington ATMs across the U.S. without worrying about extra fees. This makes it even easier to access your money wherever you are.

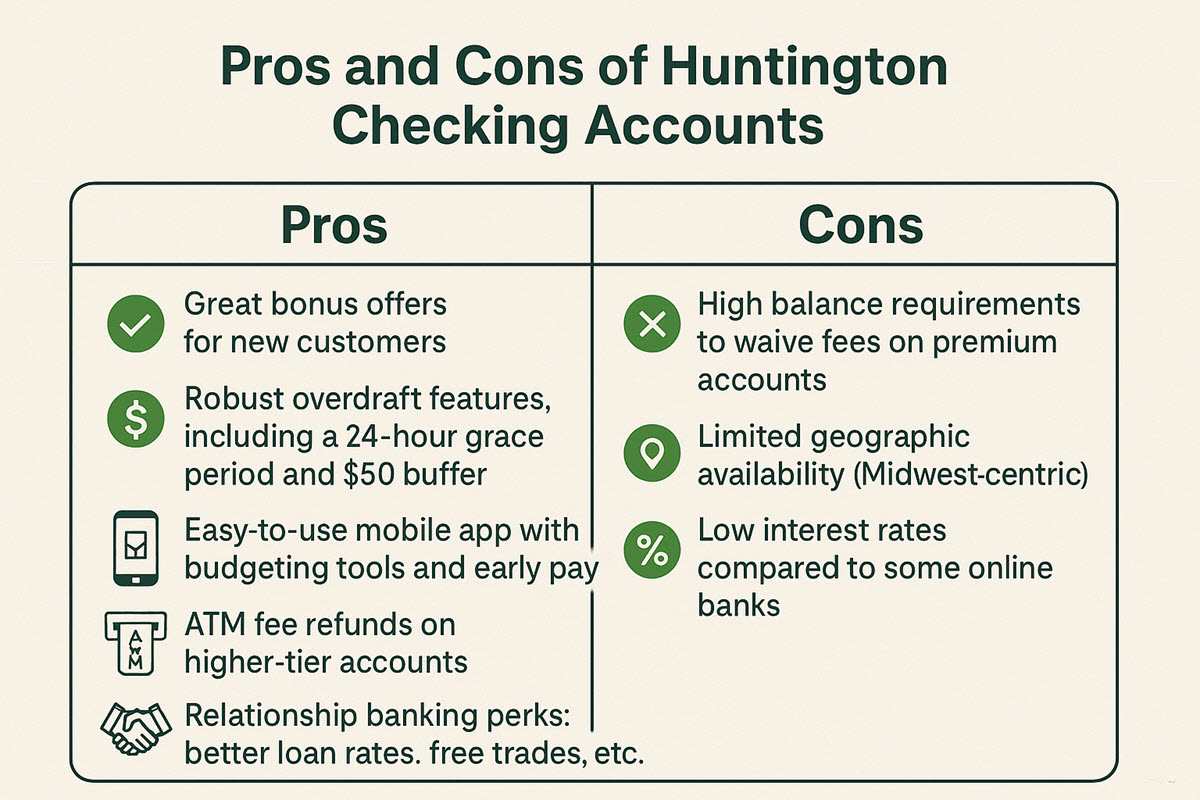

Pros and Cons of Huntington Checking Accounts

Like any bank, Huntington’s checking options come with both advantages and trade-offs. Here’s an honest look at what works well and what doesn’t.

Pros of Huntington checking accounts:

- Great bonus offers for new customers.

- Robust overdraft features, including a 24-hour grace period and $50 buffer.

- Easy-to-use mobile app with budgeting tools and early pay.

- ATM fee refunds on higher-tier accounts.

- Relationship banking perks: better loan rates, free trades, etc.

Cons of Huntington checking accounts:

- High balance requirements to waive fees on premium accounts.

- Limited geographic availability (Midwest-centric).

- Low interest rates compared to some online banks.

If you’re someone who values strong customer service, flexible overdraft protection, and easy-to-use digital tools, Huntington Bank checking accounts are worth considering, especially if you live in the Midwest or already bank with Huntington.

FAQs about Huntington Checking Accounts

What is the Huntington checking account minimum balance?

- Asterisk-Free Checking has no minimum balance requirement. Other accounts may require a daily balance to waive monthly fees.

Does Huntington charge overdraft fees?

- Yes, but they offer tools like 24-Hour Grace and Standby Cash to help you avoid them.

Can I open a Huntington account online?

- Yes. Most personal checking accounts can be opened online in minutes.

Can I get multiple Huntington bonuses?

- No. You’re only eligible once every 6 months, and only if you haven’t had a Huntington checking account in the past 180 days.

What is the Huntington checking routing number?

- Huntington Bank’s standard routing number is 044000024. However, it’s best to confirm by checking the bottom of your checks or logging into your online account.

How to close a Huntington checking account?

- You can close your Huntington checking account by visiting a local branch or calling customer service. Make sure to withdraw all funds and stop any automatic payments before closing.

Huntington checking account options offer something for everyone, from basic banking to relationship rewards. The Asterisk-Free account is a great no-fee option, while the Perks and Platinum accounts reward loyal customers with more features. Huntington’s digital tools and overdraft solutions add strong value. If you live in the Midwest or already bank with Huntington, these checking accounts are definitely worth considering.