Choosing the right mortgage can feel overwhelming, but it doesn’t have to be. With Huntington home loans, borrowers get a mix of flexible options, helpful guidance, and trusted service.

Whether you’re buying your first home or using your equity, Huntington offers solutions designed to fit real-life needs. In this review, we’ll explore what Huntington Bank home loans bring to the table and help you decide if it’s the right fit for your journey.

About Huntington Bank

Huntington Bank has a long history, starting all the way back in 1866. Today, it is one of the most well-known regional banks in the Midwest and has expanded its presence across multiple states. With its headquarters in Columbus, Ohio, Huntington operates over 1,000 branches and nearly 1,800 ATMs across 11 states. The bank provides a wide range of services, including Huntington checking accounts, credit cards, small business banking, and, of course, home loans.

What sets Huntington home loans apart from many national lenders is the bank’s focus on building relationships, not just processing mortgages. Whether you’re buying your first home, upgrading to a bigger space, or refinancing, Huntington offers flexible loan options and real support to guide you through the process. They also provide helpful tools and calculators to help you understand how much home you can afford before you apply.

Top Reasons to Consider Huntington for Your Home Loan:

- Competitive Huntington Home Loan rates: This bank offers interest rates that are often lower than national averages, which can save you thousands over the life of your loan.

- Local, Personalized Support: You can meet with real loan officers in your area who understand your local market and can give you honest advice.

- Wide Range of Loan Types: From standard mortgages to government-backed loans like FHA, VA, and USDA, Huntington has something for almost every type of buyer.

- Helpful Planning Tools: Free online Huntington home loan calculators help you estimate monthly payments, compare loan options, and more.

- Special Offers: Huntington offers closing cost discounts for veterans and programs that help first-time buyers reduce their down payments.

Types of Huntington Home Loans

Whether you’re looking for stability or flexibility, Huntington has a mortgage that fits your situation. Here are the main types of home loans they offer:

Fixed-Rate Mortgages

A popular option under Huntington home loans, fixed-rate mortgages lock in your interest rate and monthly payment for the life of the loan. This type of loan is a great choice if you plan to stay in your home long term.

Key Features:

- Choose from loan terms between 10 and 30 years

- Monthly payments never change, so budgeting is easy

- You may qualify for down payment assistance programs

With a fixed-rate loan, you don’t have to worry about Huntington home interest rates rising in the future. Your payment will be the same every month, which gives you peace of mind and makes long-term planning easier. It’s especially helpful if you’re buying your “forever home” and want stable payments for the long haul.

Adjustable-Rate Mortgages (ARMs)

If you want to start with lower monthly payments, an ARM could be a good option. These Huntington home loans come with a lower introductory rate for a set number of years (like 3 or 5), and then the rate adjusts every 6 months based on the market.

Key Features:

- Lower starting interest rate than fixed-rate loans

- Available in 3/1, 5/1, and other terms

- Rate adjusts periodically after the initial term

ARMs are great for people who don’t plan to stay in their home long term. If you’re planning to move or refinance in a few years, you could save money with the lower introductory rate. Plus, Huntington’s ARMs come with rate caps, so you won’t face extreme payment increases all at once.

Government-Backed Loans (FHA, VA, USDA)

Huntington also offers loans backed by government programs. These Huntington home loans make it easier for many people to buy a home, especially if they have limited savings or credit challenges.

FHA Loans

- Down payments as low as 3.5%

- Easier qualification for buyers with lower credit scores

- Backed by the Federal Housing Administration

FHA loans are ideal for first-time homebuyers or anyone who needs flexible credit requirements.

VA Loans

- No down payment required

- Reduced closing costs, Huntington may cover up to $5,500

- Veterans, active-duty military personnel, and their family members are eligible.

Huntington offers special support for veterans, helping them save on upfront costs and secure affordable housing.

USDA Loans

- No down payment

- Designed for rural and suburban areas

- Must meet certain income limits to qualify

USDA loans help families buy homes in less populated areas and are a great option for buyers who qualify under the income guidelines.

These Huntington home loans are made to help buyers who might struggle to qualify for a conventional loan. So, if you’re just starting out, rebuilding your credit, or serving in the military, Huntington’s FHA, VA, and USDA loans could be your ticket to buying a home sooner than you think.

Huntington Special Mortgages

Not every homebuyer fits into a standard loan category, and that’s where Huntington’s Special Mortgages come in. These customized Huntington home loans are designed for people with unique financial situations, career paths, or home buying goals.

- Doctor Loans: If you’re a physician, you may qualify for up to 100% financing, with no down payment required. It’s a great option for doctors just starting out who may have student debt but strong future income potential.

- Construction Loans: Planning to build a home from the ground up? Huntington offers one-time close construction loans, combining both construction and permanent financing into a single closing. That means less paperwork and lower costs.

- Home Renovation Loans: These Huntington home loans let you buy or refinance a home and roll in the renovation costs. Perfect for fixer-uppers or homes that need a little TLC.

- Jumbo Loans: If you’re buying a high-priced property that goes beyond typical loan limits, a jumbo loan gives you access to larger financing with competitive rates.

- State Bond Down Payment Assistance: Huntington works with state programs to help first-time buyers and qualifying borrowers get help with their down payment or closing costs, guided by trained specialists.

These specialty loans are designed to make homeownership more accessible for people with specific needs or big goals. If your situation is a little outside the box, Huntington’s special mortgages could be the key to getting into the home you want, on your terms.

Huntington Bank Home Equity Loans

Already a homeowner? Huntington home loans also include equity-based borrowing options. This type of loan lets you tap into the value of your home and use that cash for big expenses or to pay off other high-interest debts.

A home equity loan gives you a lump sum of money up front, which you repay over time with fixed monthly payments. It’s different from a Huntington personal loan because it’s secured by your home, so you usually get a lower interest rate.

Key Benefits:

- Fixed Interest Rate: Your rate stays the same for the life of the loan, no surprises.

- Predictable Monthly Payments: Know exactly what you’ll owe each month.

- No Application Fees: You can apply without paying extra just to get started.

- Online Management: Track your loan, make payments, and view your balance online anytime.

A Huntington Bank home equity loan is ideal when you need a specific amount of money for a one-time project or major purchase, and you want to pay it back with a simple, fixed plan.

Home Equity Line of Credit (HELOC)

If you’re looking for more flexibility than a traditional loan offers, a Home Equity Line of Credit (HELOC) might be the right solution. With a HELOC, you get access to a revolving credit line, much like a credit card, but backed by the equity in your home. You’re approved for a credit limit based on your home’s value and your credit profile. You can then borrow what you need, when you need it, without reapplying each time.

Key Features:

- Only Pay for What You Use: You’re charged interest only on the amount you borrow, not the total line.

- 10-Year Draw Period: Borrow as needed for up to 10 years, followed by a 20-year repayment period.

- Option to Lock In a Fixed Rate: For added stability, you can convert parts of your balance to a fixed rate.

- No Application Fees: Just like their home equity loans, HELOCs come with no upfront fees.

- Online Access & Mobile Banking: Manage your account from anywhere with Huntington’s digital tools.

- Current Rates: APR ranges from 7.99% to 17.00% based on the line amount and your credit qualifications.

A HELOC is best for homeowners who want flexible access to funds over time, rather than taking a large lump sum all at once.

Mortgage Refinancing

Already own your home and thinking about lowering your payments or getting cash out? Refinancing your mortgage with Huntington could be the answer. Refinancing means replacing your current mortgage with a new loan, usually to get a better interest rate, reduce your monthly payment, or tap into your home’s equity.

Available Refinancing Options:

- Rate-and-Term Refinance: Replace your current loan with one that has better terms, like a lower interest rate or a different loan length. This can save you money over time or make your monthly payments more affordable.

- Cash-Out Refinance: Borrow more than what you owe on your current mortgage, and take the difference in cash. This is great for large expenses like renovations, tuition, or paying off other debts.

- First Mortgage Equity Loan: A unique option from Huntington that lets you refinance without private mortgage insurance (PMI), even if you put less than 20% down. This option often comes with lower upfront costs and fees, too.

Refinancing with Huntington home loans can help you take better control of your finances, whether that means lowering your bills, reducing your interest payments, or using your equity to fund life’s next chapter.

Interest Rates and Fees

Huntington home loans offer competitive rates, but your exact rate will depend on several factors, including your credit score, loan type, location, and the amount of your down payment. Rates can change frequently, so it’s best to speak with a loan officer or apply online to get a personalized rate quote based on your situation.

What to Know About Fees:

- No application fees for Huntington home equity loans, which can help you save money upfront.

- Home Equity Line of Credit (HELOC) comes with a small annual fee of $60 ($50 if you live in Minnesota).

- VA loans offer special closing cost assistance, where Huntington may cover up to $5,500 of eligible fees.

- First Mortgage Equity Loans do not require Private Mortgage Insurance (PMI), even if your down payment is below 20%.

Estimated Huntington Mortgage Rates & Fees:

| Loan Type | Estimated Interest Rate (APR) | Key Fees & Highlights |

|---|---|---|

| 30-Year Fixed Mortgage | Around 7.01% | Standard closing costs; good for long-term homeowners. |

| 15-Year Fixed Mortgage | Around 6.31% | Lower total interest paid over the life of the loan; higher monthly payments. |

| FHA Loan | Around 7.44% | Lower credit score allowed; low down payment; includes mortgage insurance. |

| VA Loan | Around 6.63% | No down payment required; closing cost discounts for eligible military borrowers. |

| USDA Loan | Around 7.25% | For rural and suburban homebuyers; no down payment; income limits apply. |

| Conventional Refinance | Around 6.85% | Used to get a better rate or reduce your monthly payment. |

| Cash-Out Refinance | Around 7.35% | Tap into home equity for large expenses or debt consolidation. |

| 10-Year Fixed Mortgage | Around 7.74% | Faster payoff with higher monthly payments. |

| 5-Year ARM | Around 7.95% | Lower starting rate; rate adjusts after the first 5 years. |

| Home Equity Line of Credit (HELOC) | 7.99%–17.00% | No upfront fees; $60 annual fee ($50 in Minnesota); only pay interest on what you borrow. |

| Home Equity Loan | Varies by credit and amount | Fixed interest rate; set monthly payments; no application fee. |

Disclaimer: Huntington does not publicly disclose rates for its home loans, and the Huntington Bank home loans rates above are estimates. For accurate, personalized rates, it’s best to contact the bank directly or apply online.

Huntington Mortgage Tools & Support

Buying a home is a big step, and it often comes with a lot of questions. Whether you’re a first-time buyer or thinking about refinancing, Huntington home loans come with free online tools to help you make smart, confident decisions every step of the way.

Helpful Tools You Can Use:

- Rent vs. Buy Calculator: Not sure if it’s time to stop renting? This tool compares the long-term costs and helps you decide.

- Refinance Analyzer: Thinking about refinancing your current mortgage? This tool shows if you’ll save money by switching to a new loan.

- Loan Comparison Tool: Compare different types of Huntington home loans side by side to see which fits your budget and lifestyle.

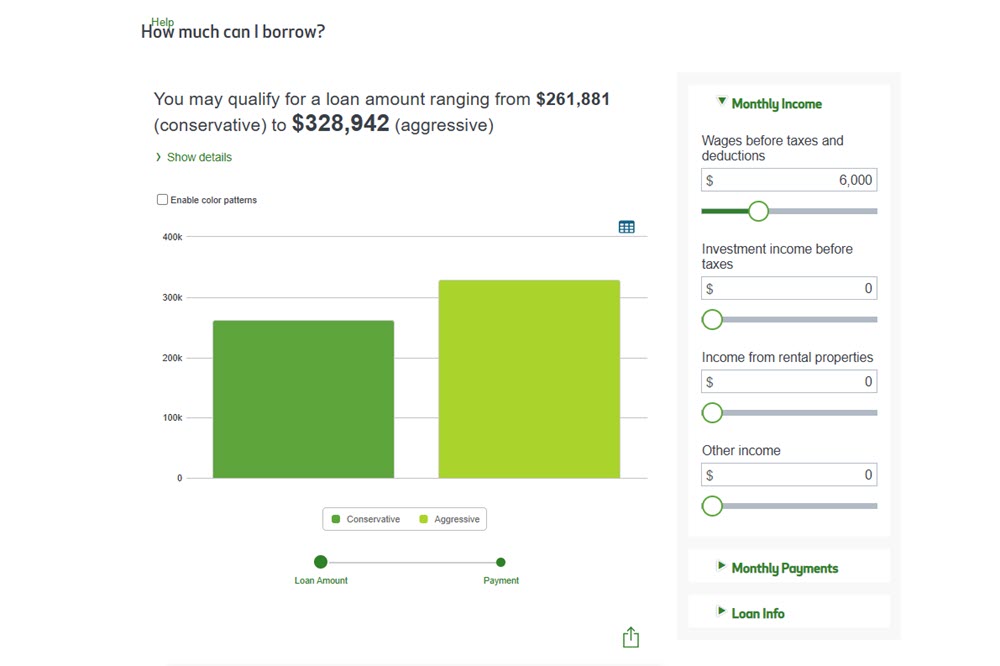

- Affordability Calculator: Find out how much home you can realistically afford based on your income and expenses.

- Down Payment Estimator: See how different down payment amounts affect your monthly payments and total loan cost.

These tools are especially useful for first-time homebuyers who may be unsure where to begin. They make it easy to plan your budget and understand what kind of loan works best for you.

Huntington Home Loan Customer Service & Accessibility

Huntington stands out for its strong focus on customer care. They provide multiple ways to get help, so you’re never on your own during the Huntington home lending process:

Ways to Get Support with Your Huntington Home Loans:

- Visit One of 1,000+ Branches: You can talk to someone face-to-face and get personal guidance.

- Call Anytime: Need help after hours? Their customer service line is open 24/7 at (800) 480-2265.

- Online Mortgage Center: Browse loan options, get quotes, and check the status of your application, all from your computer or phone.

- Free Mobile Banking: Manage your loan account, make payments, and get notifications right from your smartphone.

- Account Alerts: Stay on top of due dates and payments with customizable email and text alerts.

- Local Loan Officers: Huntington connects you with mortgage specialists in your area who understand the local market and can walk you through every step.

Whether you prefer digital tools or in-person help, Huntington gives you the flexibility to choose the support that works best for you.

Huntington Bank Home Loan Requirements

To qualify for Huntington home loans, borrowers need to meet a few basic requirements. While exact criteria can vary depending on the loan type (such as FHA, VA, or jumbo loans), here are the general guidelines most applicants should prepare for:

- Credit Score: Most Huntington home loans need a score of 620+. FHA loans may allow 580+.

- Income & Job: Steady income is required. Your total monthly debts should be less than 43% of your gross income.

- Down Payment: Varies by loan, about 3% to 5% for conventional, 3.5% for FHA, and 0% for VA/USDA if eligible.

- Documents Needed: When applying for a Huntington home loan, you’ll typically need to provide:

- Government-issued ID (e.g., driver’s license)

- Social Security number

- Recent pay stubs

- Tax returns (usually for the last 2 years)

- Bank account statements

- Proof of any other assets (like retirement savings)

- Property Rules: The property must be located within Huntington’s lending footprint, generally across 11 states. Homes must meet basic safety and livability standards (especially for FHA and VA loans). And an appraisal will be required to confirm the property’s value.

Some special loan types may need a higher score or income. Moreover, first-time buyer programs or state bond programs may require you to attend a homebuyer education course or meet income limits.

How to Apply for a Huntington Home Loan

Getting started with a Huntington home loan is simple, and you can apply in whatever way works best for you: in person, online, or over the phone. Here’s a step-by-step look at the process:

- Get Pre-Approved: This is your first step. A pre-approval letter offers you a clear picture of how much you can afford to spend and demonstrates to sellers that you are serious.

- Choose the Right Loan: With help from a Huntington loan officer or their online comparison tools, pick the mortgage option that fits your budget and goals.

- Complete Your Application: Submit basic financial documents like pay stubs, bank statements, and tax returns. You can do this online or with help from a loan officer.

- Loan Review & Appraisal: Huntington will review your credit and finances, and they’ll arrange an appraisal to confirm the value of the home you want to buy.

- Close the Loan: Once everything is approved, you’ll review the final documents and sign the paperwork. After closing, the home is officially yours!

Getting pre-approved through Huntington home loans early in the process also gives you an advantage in the market. It not only helps you understand your price range, but also makes your offers more attractive to sellers, sometimes even more attractive than higher offers from buyers who aren’t pre-approved.

Tips for Getting Approved for Huntington Home Loans

Getting approved for a mortgage takes preparation, especially if you’re a first-time buyer. Here are a few tips to boost your chances with Huntington home loans:

- Keep your credit score strong: Aim for a score of 620 or higher for most conventional loans. FHA loans may allow scores as low as 580, but better scores usually get better rates.

- Save up for a down payment: While you might only need 3.5% for an FHA loan, putting down 10–20% can help you avoid PMI and reduce your monthly payments.

- Limit new debt: Avoid taking on new loans or credit cards right before you apply. Lenders look at your debt-to-income (DTI) ratio, so lower is better.

- Request early preapproval: A pre-approval letter demonstrates to sellers your seriousness and financial stability.

- Ask about state programs: Huntington works with state housing bond programs, grants, and down payment assistance. These can help lower your out-of-pocket costs.

Talking with a Huntington loan officer can help you understand which programs and rates you qualify for and how to put your best foot forward.

FAQs about Huntington Home Loans

What is the minimum credit score for a Huntington mortgage?

- Most conventional Huntington home loans require a score of 620 or above. For FHA loans, scores as low as 580 may be accepted, but higher scores often lead to better loan terms.

Can I apply for a Huntington mortgage online?

- Yes, Huntington home loans are available online. If you prefer, you can also schedule a phone call or an in-person meeting with a loan officer.

Does Huntington offer VA loans?

- Yes. Huntington offers VA home loans and may provide up to $5,500 in closing cost assistance for eligible veterans, active-duty service members, and their families.

Is Private Mortgage Insurance (PMI) required?

- It depends. PMI is usually required if your down payment is less than 20%. However, Huntington’s First Mortgage Equity Loans do not require PMI, even with a smaller down payment.

If you’re looking for a lender that offers great customer service, flexible mortgage options, and tools to help you make smart financial decisions, Huntington home loans are worth considering. Whether you’re buying, refinancing, or using your home equity, Huntington provides a well-rounded mortgage experience backed by a strong local presence. Start your application or connect with a Huntington loan officer today.