Choosing the right business checking account matters. Fees, services, and convenience all count. A Citizens Bank business account aims to support that balance, offering tools designed for smarter financial management.

With a strong regional footprint and a customer-first mindset, Citizens Bank delivers a streamlined banking experience tailored to small businesses. In this review, we’ll walk you through everything you need to know about Citizens Bank business accounts, from account types and fees to tools, perks, and who it’s best for.

Overview of Citizens Bank

Before choosing a business account, it’s important to know who you’re banking with. It’s a well-established financial institution with deep regional roots and a growing national presence.

About the Citizens Bank

Founded in 1828, Citizens Bank is one of the oldest and most respected banks in the U.S. Headquartered in Providence, Rhode Island, it operates over 1,000 branches and 3,000 ATMs. Most of its locations are concentrated in the Northeast and Mid-Atlantic regions, making it a popular choice for small businesses in these areas.

Citizens Bank is also an FDIC-insured financial institution, which means your deposits are protected up to the federal limit. It is publicly traded and ranked among the top 20 largest commercial banks in the country by assets. Over the years, it has built a reputation for strong customer service, local decision-making, and digital tools that make banking easier for individuals and businesses alike.

Whether you’re opening your first business checking account or switching from another bank, Citizens offers a stable and secure platform with both in-person service and online convenience.

Business Banking Philosophy

Citizens Bank takes a simplified approach to business banking. Its flagship checking account, Clearly Better Business Checking, was designed for everyday entrepreneurs who want low fees, easy access, and modern tools without the confusion of account tiers.

The bank also offers helpful in-person service and dedicated support for business owners looking to scale.

Types of Citizens Bank Business Accounts

Citizens Bank offers a range of business banking options designed to meet the diverse needs of entrepreneurs, from startups to established companies:

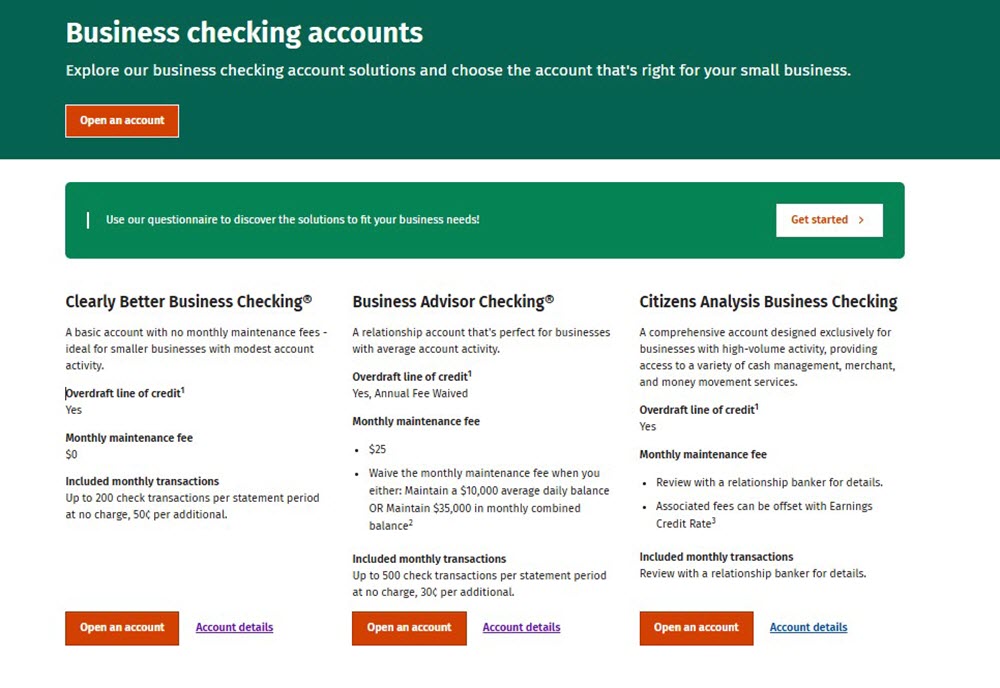

Citizens Bank Business Checking Accounts

Citizens Bank offers three main types of business checking accounts, each designed to meet different business needs. Whether you’re just starting out or managing a high volume of transactions, there’s likely a Citizens Bank business account that fits your operation.

Clearly Better Business Checking

This is the most basic and affordable option, ideal for startups and smaller businesses with lower transaction volumes.

- Monthly fee: $0. No maintenance fees, no minimum balance requirements.

- Free transactions: Includes up to 200 check items per statement cycle, whether you’re depositing or withdrawing.

- Excess item fee: $0.50 per transaction over the 200-limit.

- Overdraft options: You can link a savings account or apply for a business overdraft line of credit. Plus, there’s a courtesy overdraft pass for charges under $5.

- Digital banking: Comes with online and mobile banking, including mobile check deposit. For an extra $9.99/month, you can also use Autobooks to send invoices, accept payments, and manage receivables.

This Citizens Bank business account is perfect for businesses looking for a no-frills, low-cost solution with enough free transactions to cover everyday banking needs.

Business Advisor Checking

This account is designed for growing businesses that need more flexibility and a higher number of transactions per month.

- Monthly fee: $25, but you can avoid this fee by keeping at least $10,000 in average daily balance, or $35,000 in combined balances across all eligible Citizens Bank business accounts.

- Free transactions: Up to 500 items per statement cycle, giving you room to grow.

- Excess item fee: Just $0.30 per additional item beyond the 500 limit.

- Overdraft protection: Same options as above, linked savings, credit line, and overdraft coverage.

- Extra perks: Get a $100 discount on your first order of business checks, plus access to advanced online tools and cash flow management features.

This Citizens Bank business account works well for businesses with higher monthly activity that still want to avoid high fees and benefit from advanced banking tools.

Citizens Analysis Business Checking

This is the most customizable and powerful option, built for businesses with high transaction volume or more complex banking needs.

- Monthly fee: Varies. The cost depends on your account activity and is determined through consultation with a banker.

- Ideal for: Companies that manage a large number of daily transactions or require advanced cash-management features.

Key services include:

- ACH payments

- Wire transfers

- Remote deposit capture

- Merchant services and credit card processing

- Treasury and liquidity management tools

With this account, you’ll work closely with a Citizens Bank representative to build a tailored solution for your operations. While this Citizens Bank business account isn’t listed with a flat monthly fee, it often uses earnings credits to offset service charges, making it more efficient for large businesses that maintain higher balances.

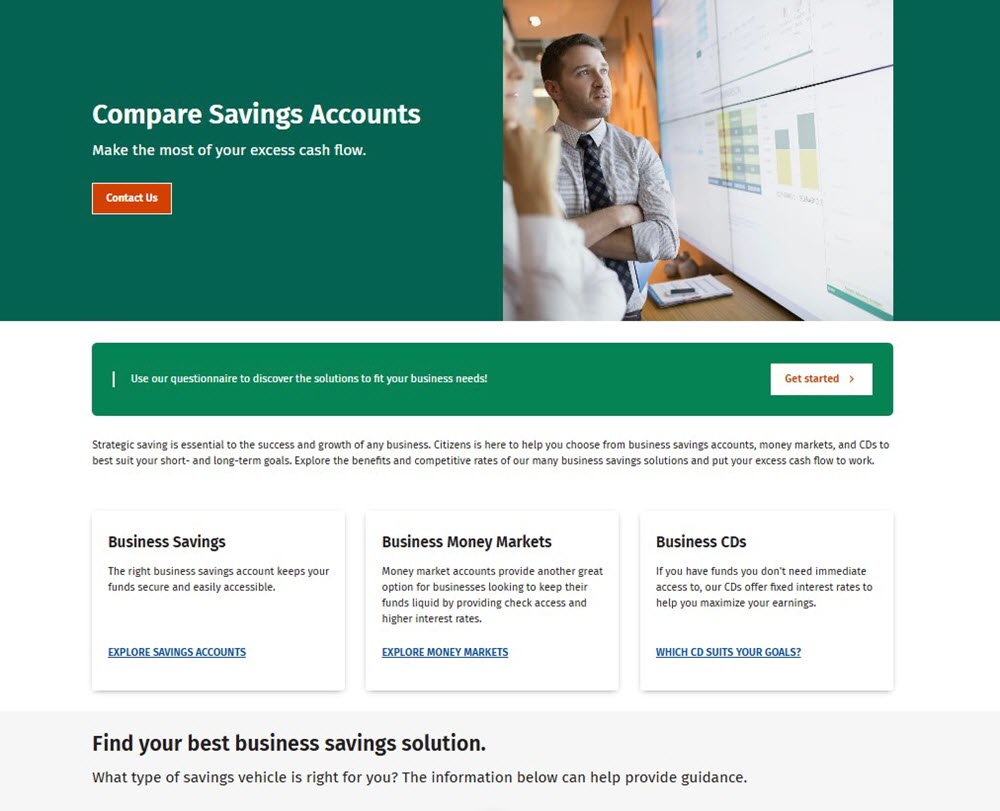

Other Citizens Bank Business Accounts and Products

Beyond checking accounts, Citizens Bank provides a full suite of business financial tools to help companies grow and manage their money efficiently.

- Business CDs and Savings Accounts: If you want to set aside extra funds, you can open a Business Savings Account or Certificate of Deposit (CD), perfect for building a cash reserve or earning interest on money you don’t need right away.

- Merchant Services: For businesses that accept payments in-store or online, Merchant Services make it easy to process credit cards, set up POS systems, and manage transactions. This is especially helpful for retail shops, restaurants, and service-based companies that deal with customer payments daily.

- Treasury Services: If your company handles larger sums of money or needs advanced cash flow tools, Treasury Services offers solutions for managing receivables, payables, and liquidity. These services are great for medium to large businesses looking to streamline operations.

- Citizens Bank Business Credit Card: Citizens Bank also offers Business Credit Cards, some with cashback rewards or low interest rates, ideal for making purchases and managing expenses.

- Lines of Credit & Loans: If you need access to extra funds, Lines of Credit and Citizens Bank business loans are available to help you cover equipment costs, purchase inventory, or handle unexpected expenses.

Together, these Citizens Bank business accounts and products help you build a financial system that grows with your business and supports your long-term success.

Key Features and Tools for Citizens Business Banking

Citizens Bank equips business owners with a variety of digital tools and features designed to simplify day-to-day financial management:

Digital Banking and Mobile App

Citizens Bank offers a solid online and mobile experience for business users. The mobile app is rated 4.6 stars on the App Store and 4.4 stars on Google Play.

Features include:

- Mobile check deposit

- Fund transfers and bill pay

- Transaction alerts and account monitoring

- Ability to manage multiple users (if your business has staff)

- While not as flashy as some fintechs, it’s stable, secure, and easy to use.

Business Hub

Citizens’ Business Hub is an online portal with tools for:

- Managing receivables and payables

- Setting up recurring payments

- Accessing statements and reports

- Linking QuickBooks or accounting software

It’s especially helpful for owners managing finances without a full-time bookkeeper.

Fraud Protection and Security

Citizens Bank provides:

- Dual authorization for ACH and wires

- Positive Pay (to catch fraudulent checks)

- Encrypted connections and secure login protocols

- Multi-user access control

These features make it a safe choice for handling sensitive transactions.

Citizens Bank Business Account Fees

Before opening a Citizens Bank business account, it’s important to understand the fees and transaction limits. Citizens Bank keeps things refreshingly straightforward.

Citizens Bank Business Account Fees

While Citizens Bank offers flexible business checking options, each account comes with its own fee structure, transaction limits, and service charges. Here’s a clear breakdown to help you compare:

| Fee / Feature | Clearly Better | Business Advisor | Analysis Checking |

|---|---|---|---|

| Monthly Maintenance Fee | $0 | $25 (waivable if $10,000 avg. balance or $35,000 combined) | Custom, based on usage (negotiated) |

| Free Transactions / Items | 200 per statement cycle | 500 per statement cycle | Negotiated based on business needs |

| Fee per Additional Item | $0.50 | $0.30 | Not Applicable (custom agreement) |

| Overdraft / Returned Item Fee (Paid/Returned) | $35 per item (capped at 8/day or $280) | Same: $35 per item (waived for overdrafts ≤ $10) | Same structure; advanced overdraft tools |

| Overdraft Grace Threshold | ≤ $5 — no fee | ≤ $10 — no fee | Similar courtesy policy applies |

| ATM Fees (Non-Citizens ATMs) | $3 per withdrawal, balance inquiry, transfer | Same for all accounts | Same fee applies |

| Wire Transfer Fees | Incoming/Outgoing charged (see guide) | Charged separately (domestic & international) | Included or offset via earnings credit tools (varies) |

| Other Fees | Miscellaneous fees apply (e.g., stop-payment, research, collections) | Same | Enhanced fee offsets via custom services |

Using Citizens Bank ATMs is also free of charge, and there are thousands of them across the bank’s service regions.

However, here are a few extra fees to be aware of:

- $0.30 – $0.50 per transaction over the free monthly limit

- Out-of-network ATMs typically cost $3.

- Wire transfer fees typically range from $15 to $30, depending on whether it’s domestic or international and whether it’s incoming or outgoing

- Overdraft fees may apply if your account goes negative, though optional overdraft protection is available to help you avoid these charges

Overall, these fees are reasonable and competitive, especially compared to other traditional banks that often charge monthly fees or require high minimum balances.

Other Business Accounts’ Fees and Rates

While checking accounts are the core of Citizens Bank business banking, Citizens also provides add-on deposit products. These Citizens Bank business accounts can help businesses manage surplus funds, though their interest rates are modest.

Business Savings Account

- Monthly fee: $4.99

- Waiver: No fee if you keep a $500 minimum daily balance

- Interest rate (APY): Around 0.01%, which is quite low

- Best for: Holding small emergency reserves or temporary surplus funds

- FDIC insured: Yes

This account is simple and easy to open alongside your business checking. However, due to the low APY, it’s not ideal for growing funds long-term.

Business Certificates of Deposit (CDs)

- Terms: 3 to 18 months

- Interest rates: Generally 0.03% to 0.10% APY, depending on term length

- Early withdrawal penalty: Applies if funds are taken out before the maturity date

- Best for: Businesses that can lock up cash for a fixed period

CDs offer a bit more yield than savings accounts, but not by much. If your business can commit funds for a fixed period without needing access, they’re a safe, low-risk option.

Business Money Market Account

- Monthly fee: $9.99

- Waiver: Fee waived if you keep a $2,500 minimum daily balance

- Interest rate: Slightly better than savings, but still low compared to market leaders

- Liquidity: Allows limited check writing and transfers

- Best for: Businesses that want a bit more flexibility while still earning some interest

Money market accounts from Citizens give you more access than CDs and slightly better earnings than a basic savings account. Still, rates remain low, so they work better as cash buffers than growth vehicles.

ATM Access and Fees

Citizens Bank gives you unlimited access to its own network of ATMs, which are widely available in the Northeast, Midwest, and other regions the bank serves. Transactions at these ATMs, like withdrawals, balance checks, and transfers, are completely free.

If you use an out-of-network ATM, third-party fees might apply. However, some Citizens Bank business account tiers may offer ATM fee rebates or additional perks, so it’s worth asking your local branch representative about your options.

Pros and Cons of Citizens Bank Business Accounts

When deciding where to open your business checking account, it’s important to weigh both the advantages and the limitations. Citizens Bank offers several strong features that appeal to small and mid-sized businesses, but it also comes with a few drawbacks to consider.

Pros of Citizens Bank Business Accounts

- No-Fee Basic Checking: The Clearly Better account has no monthly fees or minimum balance, perfect for small businesses.

- High Free Transaction Limits: Get 200 free items/month with Clearly Better and 500 items with Business Advisor, more than many competitors.

- Strong Regional Access: With 1,000+ branches and 3,000+ ATMs, it’s easy to bank in person within Citizens’ service areas.

- Useful Digital Tools: Includes online/mobile banking, invoicing, and Autobooks integration for just $9.99/month.

- Overdraft Flexibility: Offers linked savings, credit lines, and fee waivers for small overdrafts.

Cons of Citizens Bank Business Accounts

- Limited Geographic Reach: Only available in 14 states + D.C., which may not suit national businesses.

- Costly Overdrafts: The standard fee is $35 per item, plus potential daily charges if the account stays negative.

- Not ideal for large corporations: Lacks complex cash management tools for enterprises

Comparison with Other Business Bank Accounts

Let’s take a closer look at how Citizens Bank stacks up against two major competitors: Chase and Bank of America. It’s helpful to compare your options side by side.

Citizens Bank Clearly Better Business Checking vs. Chase Business Complete Checking

| Feature | Citizens Bank | Chase |

|---|---|---|

| Monthly Fee | $0 | $15 (can be waived) |

| Free Transactions | 200/month | 20/month |

| Branch Locations | Regional (Northeast/Midwest) | Nationwide |

| Digital Tools | Good | Excellent |

Citizens Bank business account clearly shines when it comes to cost. There’s no monthly maintenance fee (with the Clearly Better Business Checking), and you get a generous 200 free transactions per month, ideal for small and mid-sized businesses that do regular banking.

Chase, on the other hand, offers fewer free transactions and charges a monthly fee unless you meet certain requirements. However, Chase wins on digital tools and branch access, thanks to its nationwide footprint and robust mobile app features.

Citizens Bank vs. Bank of America Business

| Feature | Citizens Bank | Bank of America |

|---|---|---|

| Monthly Fee | $0–$25 (waivable) | $16–$29 (waivable) |

| Cash Deposit Limit | $5,000–$20,000/month | $7,500–$20,000/month |

| App Ratings | 4.6 / 4.4 | 4.8 / 4.6 |

Bank of America is a great choice for businesses that handle a lot of cash. Its higher deposit limits make it easier to manage large amounts of incoming payments without running into extra fees. Its mobile app also earns slightly higher ratings, reflecting a smooth user experience.

However, those benefits come at a price. BoA’s monthly fees can add up quickly unless you maintain high balances or meet specific activity thresholds.

Citizens Bank, by contrast, is much more budget-friendly. It’s a great pick for those who want to keep things simple and affordable.

Who Should Use Citizens Bank Business Accounts?

Not every business needs the same kind of banking, so here’s a look at who might benefit most from opening a business account with Citizens Bank.

Best for:

- Small to mid-sized businesses located in the Northeast or Mid‑Atlantic.

- Businesses want in-person service + digital tools.

- Businesses with moderate transaction needs (under 200–500/month).

Not ideal for:

- Businesses outside its service area or needing nationwide ATM access.

- Businesses want high interest returns on idle balances.

- High‐volume operations, unless choosing the customized “Analysis” account.

How to Open a Citizens Business Account

Opening a Citizens Bank business account is a quick and straightforward process. Whether you prefer to apply online from the comfort of your office or visit a nearby branch for in-person help, the bank makes it easy to get started.

Application Process for Citizens Bank Business Account

You can begin by selecting the Clearly Better Business Checking account, the bank’s most popular option for small businesses.

Here’s how the process works:

- Choose your account: Head to the Citizens Bank website or speak with a banker in person to confirm the account type that fits your business needs.

- Complete the application form: The online application usually takes about 15 to 20 minutes to complete. You’ll be asked for basic information about yourself and your business, such as your name, business name, address, and contact details.

- Fund your account: To open the account, you’ll need to make an initial deposit of at least $100. This can be done by transferring money from another account or bringing a check or cash to a branch.

- Submit your documents: You’ll be asked to upload or bring a few key documents (see the list below). If you’re applying in person, a banker can walk you through each requirement.

Citizens Bank also provides the help of small business specialists who can guide you through every step, explain any paperwork, and help link your account to digital banking tools.

Documents Needed

To open a Citizens Bank business account, you’ll need to provide some standard documentation. These documents help verify your identity and your company’s legal structure.

Here’s what you may need:

- A government-issued photo ID (such as a driver’s license or passport)

- Employer Identification Number (EIN) or Social Security Number (SSN) if you’re a sole proprietor

- Business formation documents, such as articles of incorporation, partnership agreement, or business registration certificate

- A business license (if required in your state or industry)

Citizens Bank business account requirements can vary slightly depending on your business type and location, so it’s a good idea to call ahead or visit the Citizens Bank website to confirm what applies to you.

FAQs About Citizens Bank Business Accounts

How many free transactions are allowed per month?

- You get 200 free transactions per statement cycle.

Can I open a Citizens Bank business account online?

- Yes. Citizens Bank allows online applications for most business checking accounts.

What do I need to open a Citizens business account?

- You’ll need a government ID, your EIN or SSN, and business registration documents.

Is Citizens Bank good for small businesses and startups?

- Absolutely. Its no-fee structure and ease of use make it ideal for freelancers, LLCs, and small business owners.

Citizens Bank delivers a smart business checking solution for regional businesses. Its fees are fair, the features are practical, and it balances digital access with personal service. Just be sure it fits your location and cash‑flow needs. If you’re a small business in its footprint seeking reliable checking with no hidden fees, the Citizens Bank business account is worth a serious look.