Charles Schwab may be known as a brokerage giant, but it also offers one of the most unique checking accounts on the market today. If you’re someone who travels often, hates paying fees, or simply wants a solid, no-nonsense banking option, Charles Schwab Checking Account could be just what you need.

In this detailed review, we’ll explore everything from fees and features to who this account is best for. We’ll also share expert tips and comparisons to help you decide whether this is the right checking account for you.

What is Schwab Investor Checking?

The Schwab Investor Checking account is a free online checking account designed specifically for clients who have a Charles Schwab brokerage account. It’s offered through Charles Schwab Bank, which is a member of the FDIC, meaning your deposits are insured up to legal limits.

This account is known for being easy to use, with no monthly fees, no minimum balance, and no hidden charges. It comes with a Schwab Bank Visa Platinum debit card, which is widely accepted and includes unlimited ATM fee reimbursements, even for withdrawals made outside the U.S.

To open a Charles Schwab checking account, you’ll also need to open or link a Schwab One brokerage account. But don’t worry, there are no minimum deposits, trading requirements, or extra fees for that. In fact, you can open both accounts at the same time in a few minutes online. This setup gives you the flexibility to manage both your everyday spending and long-term investments in one place.

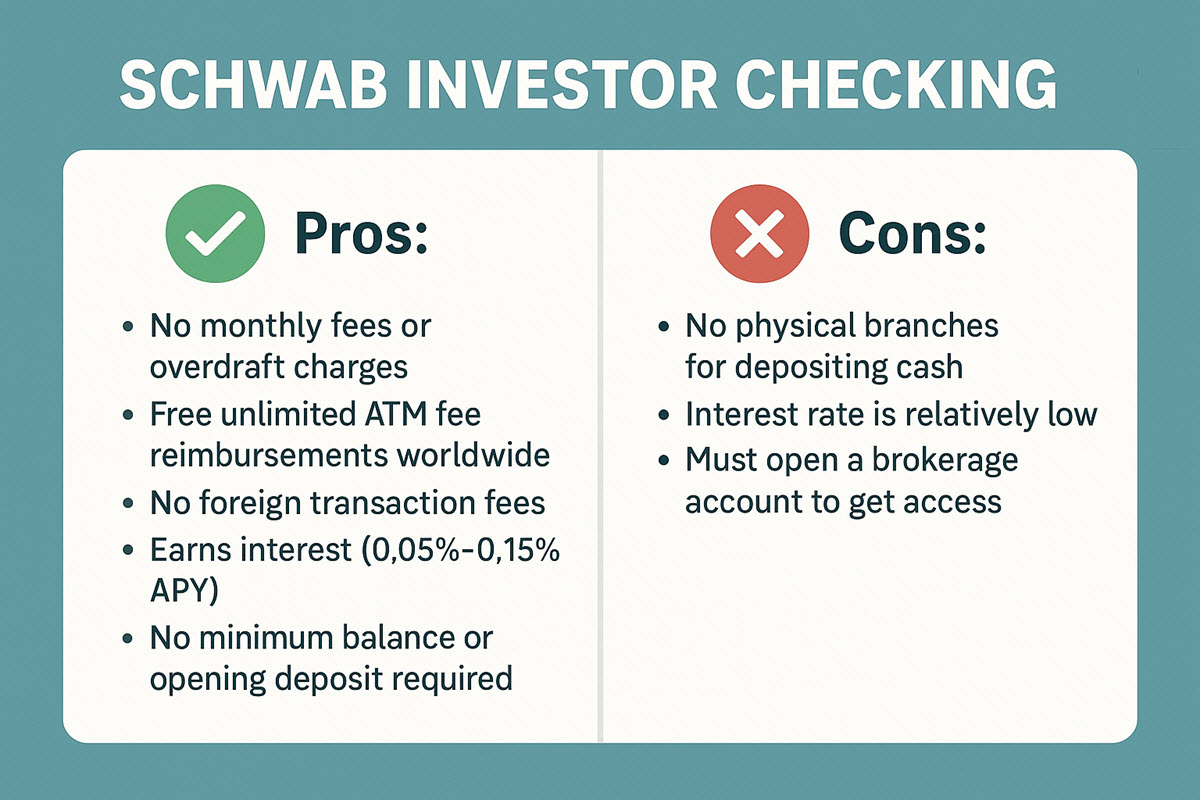

Pros:

- No monthly fees or overdraft charges

- Free unlimited ATM fee reimbursements worldwide

- No foreign transaction fees

- Earns interest (0.05%–0.15% APY)

- No minimum balance or opening deposit required

- Comes with a free Schwab One brokerage account

Cons:

- No physical branches for depositing cash

- Interest rate is relatively low

- Must open a brokerage account to get access

Charles Schwab Checking Account Features & Benefits

The Charles Schwab checking account comes packed with features that make it easy to manage your money, whether you’re banking at home or traveling the world.

No Monthly Fees, Minimums, or Overdraft Penalties

There are no maintenance fees. None. And unlike many banks, they don’t require you to keep a certain amount in the account. You don’t need a single dollar to get started. No minimum deposit. No required daily balance. This makes it accessible to anyone.

If you accidentally overdraw your account, Schwab won’t hit you with a fee. Instead, they’ll automatically transfer money from your linked Schwab brokerage or savings account to cover the difference, completely free of charge.

ATM Fee Reimbursements Worldwide

This is a game-changer. Schwab automatically refunds all ATM fees, no matter where you are in the world. Whether you’re at your local ATM or withdrawing cash abroad, any fees charged by the machine’s owner are reimbursed automatically at the end of each statement cycle.

Plus, there are no foreign transaction fees when using your Schwab debit card internationally. This is rare among checking accounts and perfect for frequent travelers.

Interest-Earning Checking

Unlike most checking accounts, the Charles Schwab checking account actually pays you interest. The APY (Annual Percentage Yield) is variable, typically ranging from 0.05% to 0.15%, depending on market conditions. While the Charles Schwab checking account interest rate is modest, it’s a nice bonus, especially when many other banks offer zero interest on checking.

Free Checks and Bill Pay

Schwab offers unlimited free standard checks, deposit slips, and prepaid return envelopes. You also get access to free online Bill Pay, so you can easily manage rent, utilities, and other recurring payments from one place without paying extra fees.

Strong Digital and Mobile Tools

The Schwab mobile app and online banking platform let you deposit checks remotely, transfer money, set travel alerts, or even freeze your debit card instantly if it gets lost.

Moreover, when you open the Charles Schwab checking account, you’re also opening a Schwab One brokerage account. Transfers between the two are also lightning-fast, usually completing within seconds during business hours. If you invest with Schwab or plan to, this integration is convenient and efficient.

Charles Schwab Checking Account’s Fee Structure

Here’s a detailed view of what won’t cost you a thing, versus what might when using a Charles Schwab checking account:

| Fee Type | Charge |

|---|---|

| Monthly maintenance | ❌ |

| Minimum balance | ❌ |

| Overdraft | ❌ |

| ATM withdrawals (anywhere) | ❌ (reimbursed) |

| Foreign transactions | ❌ |

| Standard checks/deposit slips | ❌ |

| Bill Pay | ❌ |

| Debit card replacements | ❌ |

| Mobile check deposit | ❌ |

| Stop payments | ❌ |

| Incoming domestic wires | ❌ |

| Outgoing domestic wires | $25 |

| Expedited services (e.g. rush cards) | Fee applies |

| Outgoing international wires | ❌ (not offered) |

To sum up, virtually everything is free, you just need to be cautious with wire transfers and optional extras.

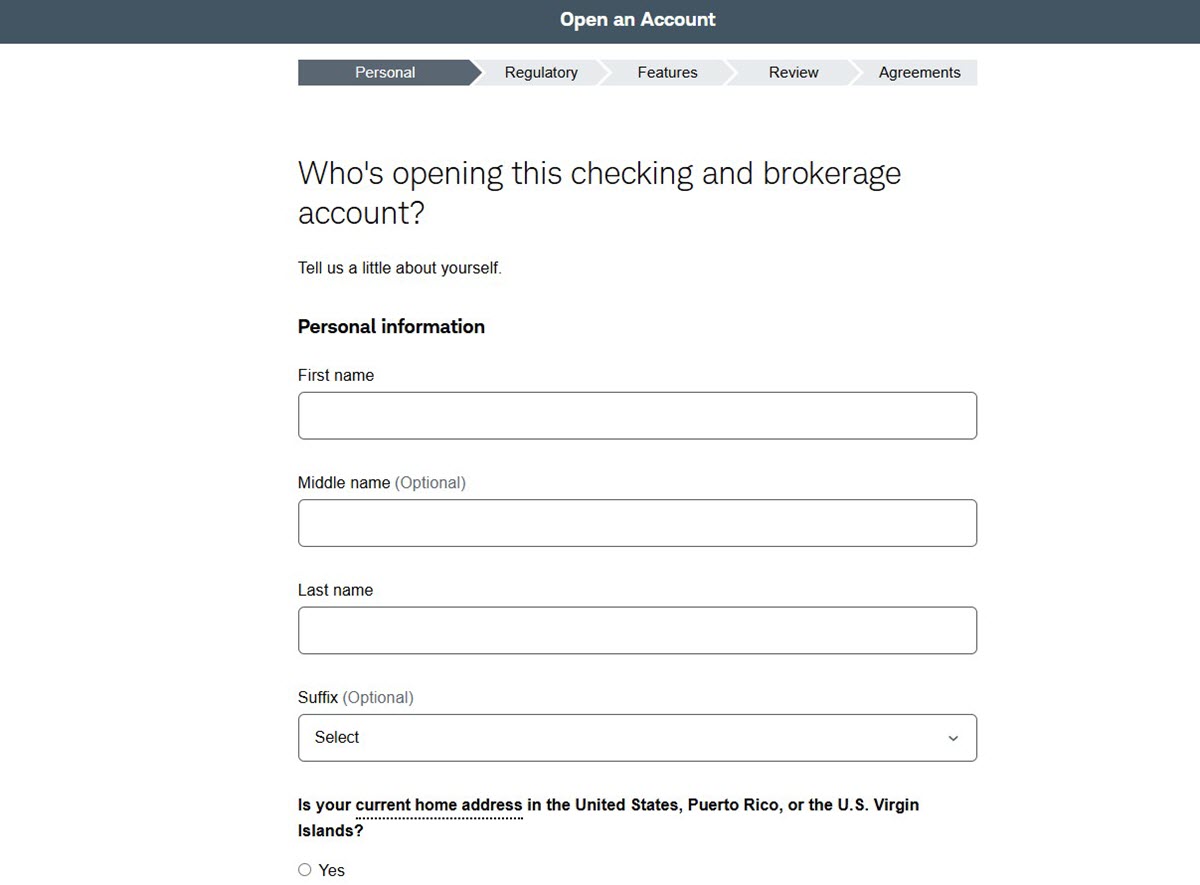

How to Open a Charles Schwab Checking Account

Opening a Schwab checking account is easier than you might think, even if you’re new to online banking. Here’s how to do it, from start to finish:

Step 1: Visit the Schwab Website

Head over to schwab.com and look for the Schwab Bank Investor Checking Account. Click on “Open an Account” to get started.

Step 2: Complete the Application Form

You’ll be prompted to fill out a joint application for both the checking account and a Schwab One brokerage account. This is because the checking account is linked to your brokerage for seamless fund transfers.

There’s no minimum deposit requirement, and you’re not required to maintain any specific balance. You can open the Charles Schwab checking account even with $0.

However, before you begin, make sure you have the following on hand:

- Valid U.S. residential address (No P.O. boxes allowed)

- Social Security Number (SSN)

- Government-issued photo ID (Driver’s license, State ID, or Passport)

- Employment information (occupation and employer details)

- U.S. citizenship or legal residency (non-residents are not eligible)

- Email address and phone number

Note: You must be 18 years or older to open an individual account.

Step 3: Fund Your Charles Schwab Checking Account

Once your application is approved, you can add money using any of these methods:

- ACH bank transfer from an external bank account

- Mobile check deposit through the Schwab app

- Wire transfer

- Mailing a physical check to Schwab’s processing center

Note: Schwab doesn’t support direct cash deposits, so if you have cash, you’ll need to deposit it into another bank and then transfer it.

Step 4: Get Your Debit Card

After your account is approved and funded, Schwab will mail your Visa debit card. The Charles Schwab checking account debit card usually arrives within 5 to 7 business days, and you can activate it online or by phone.

Your funds are FDIC-insured up to $250,000 per depositor. You can also link external bank accounts for easy transfers, set up direct deposit, mobile check deposit, or use Bill Pay features online. Now, you can start withdrawing at any ATM, anywhere.

Charles Schwab Checking Account: Customer Service & Bonuses

When you open a Schwab Investor Checking account, you’re not just getting a fee-free checking solution, you’re also backed by strong support and attractive promotions.

Reliable, 24/7 Customer Support

Charles Schwab is known for exceptional customer service. You can reach support 24/7 by phone, with live help available even on weekends.

- The Charles Schwab Bank Investor Checking Account customer service phone number is: 1-888-403-9000 (U.S.)

- If you’re calling from outside the U.S., you can reach Schwab at: +1-877-686-1937 (international)

Their service consistently ranks at the top, earning J.D. Power’s U.S. Direct Banking Satisfaction Study for checking accounts seven years in a row (2019–2025), and also earning top marks for savings in 2025. Reviews from users highlight Schwab’s professionalism, helpfulness, and strong mobile app experience.

Attractive Bonus Offers

- Up to $1,000 Cash Bonus: Open and fund a new Schwab checking account with $100,000 or more by August 25, 2025, and hold it through October 25, 2025, to earn a $1,000 bonus.

- Referral Rewards: You can earn $100 to $1,000 by referring friends who open and fund a Schwab One brokerage account.

- Starter Kit Bonus: New investors may receive a $50 bonus invested in fractional shares of top S&P 500 companies.

How Charles Schwab Checking Account Compares to Others

When choosing the right checking account, it helps to see how Charles Schwab checking account stacks up against other popular options on the market:

| Feature | Schwab Investor Checking | Capital One 360 Checking | Ally Bank Interest Checking |

|---|---|---|---|

| ATM fee reimbursement | ✅ Unlimited worldwide | ❌ $0‑$20/month cap | ❌ No reimbursement |

| Foreign transaction fee | ❌ None | ✅ Usually 3% fee | ❌ None |

| Monthly fees | ❌ None | ❌ None | ❌ None |

| Interest earned | ✅ 0.05%–0.15% APY | ✅ Small APY | ✅ Small APY |

| Cash deposit availability | ❌ None | ✅ Partner ATMs, no fee | ✅ Limited cash deposits |

| Overdraft fees | ❌ None | ✅ May charge | ✅ May charge |

| Brokerage integration | ✅ Built-in | ❌ No | ❌ No |

In summary, we can see that Schwab Investor Checking is unparalleled for travelers and fee avoidance. Capital One or Ally are better for cash deposits or keeping investing separate.

Charles Schwab checking account is ideal for:

- Frequent travelers or expats: no ATM or foreign fees.

- Fee-sensitive consumers: everything is fee-free.

- Investors or brokerage users: seamless linking to invest.

- Online-first customers: rely on digital tools and apps.

And not ideal if you:

- Regularly deposit cash.

- Want top-tier savings rates.

- Prefer physical bank branches.

Expert Tips to Make the Most of Your Schwab Account

Want to unlock the full potential of your Schwab checking account? Here are some easy tips to help you bank smarter:

- Use Any ATM Anywhere: Charles Schwab checking account refunds all ATM fees worldwide, no questions asked. Whether you’re traveling across the U.S. or exploring another country, use the closest ATM without worrying about surcharges.

- Pair with a High-Yield Savings Account: While Schwab pays interest on your checking balance, it’s still lower than what online savings accounts offer. For better returns, consider moving extra cash into a high-yield savings account and only keep spending money in checking.

- Automate Your Transfers: Set up automatic transfers between your checking and brokerage accounts. This makes it easy to fund investments or move money when needed, without logging in every time.

- Use Mobile Deposit for Checks: If you receive checks, Schwab’s mobile app lets you snap a photo and deposit instantly. It’s convenient and saves you a trip to the bank.

- Keep an Eye on ATM Refunds: Schwab processes ATM fee reimbursements within a few days. It’s automatic, but still a good idea to check your statement and confirm the refunds are coming through, especially when traveling internationally.

Charles Schwab Checking Account FAQs

How often are ATM fees reimbursed?

- At the end of each monthly statement cycle, they track and refund all fees automatically.

Can I deposit cash?

- No, Schwab Bank does not support cash deposits. Some users use workarounds like paying off a credit card with cash at other bank ATMs.

Does Charles Schwab checking account earn interest?

- Yes. As of 2025, the Charles Schwab Investor Checking account earns between 0.05% and 0.15% APY. While it’s not a high-yield rate, it’s better than most traditional checking accounts, which offer no interest at all.

Is Charles Schwab checking account good for international travel?

- Absolutely. Schwab’s checking account is widely praised by travelers because it offers no foreign transaction fees and unlimited global ATM reimbursements. It’s one of the best options for international banking flexibility.

Is Charles Schwab checking account safe?

- Absolutely. It’s FDIC-insured up to $250,000, and Schwab is a trusted financial institution.

Charles Schwab checking account is a modern, traveler-friendly checking account with nearly unmatched fee avoidance and solid investment linkage. It shines for those focused on convenience, global access, and seamless investing tools. Just remember, if you deal with cash often, you’ll need a workaround or a separate bank for cash deposits.