Are you planning to buy a home or refinance in 2025? If you’re a Charles Schwab client or just exploring smart mortgage options, this review will walk you through everything you need to know about Charles Schwab mortgage rates, Investor Advantage Pricing, and unique loan programs.

With competitive rates and exclusive discounts, Schwab’s mortgage offerings are tailored for modern borrowers who value flexibility, transparency, and financial integration.

Who Is Charles Schwab in the Mortgage Market?

Charles Schwab is best known as a leader in investment and wealth management. But what many people don’t realize is that it also offers home loans through Charles Schwab Bank, giving clients access to competitive mortgage options.

Instead of running its own mortgage department, Schwab has teamed up with Rocket Mortgage, one of the largest and most trusted home loan providers in the U.S. This collaboration allows Schwab clients to enjoy the seamless digital tools and loan options of Rocket Mortgage, while still receiving the perks and support of Schwab’s financial ecosystem.

For Schwab clients, the mortgage experience comes with extra benefits. There are dedicated loan teams who understand the financial goals of investors, and exclusive pricing options like rate discounts for those with qualifying investment assets held at Schwab. You can also access your mortgage details through your Schwab account dashboard, keeping your investments and borrowing in one place.

In short, Charles Schwab brings its reputation for financial strength and client-focused service into the mortgage world-backed by Rocket Mortgage’s lending technology and expertise.

Current Charles Schwab Mortgage Rates (as of June 2025)

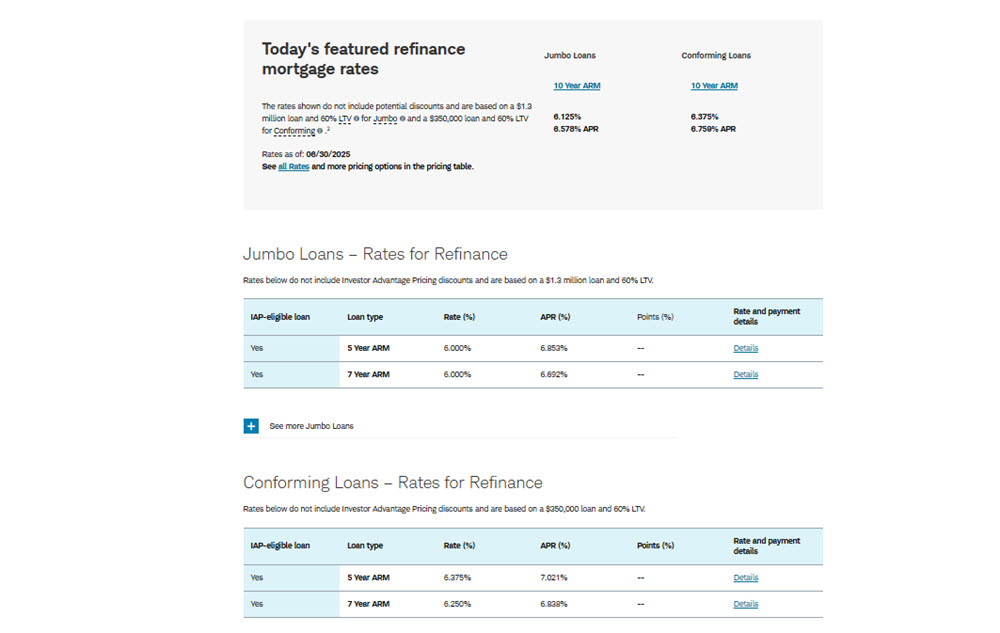

Schwab Bank, through Rocket Mortgage, offers several types of refinance options depending on the size of your loan. These Charles Schwab mortgage rates are listed before any potential investor discounts:

Charles Schwab Mortgage Rates for Jumbo Loan Refinance

(Assumes a $1.3 million loan at 60% loan-to-value)

- 5-Year ARM: 6.00% interest rate (6.85% APR)

- 7-Year ARM: 6.00% interest rate (6.69% APR)

- 10-Year ARM: 6.125% interest rate (6.58% APR)

- 15-Year Fixed: 6.375% interest rate (6.43% APR)

- 30-Year Fixed: 6.75% interest rate (6.78% APR)

Charles Schwab Mortgage Rates for Conforming Loan Refinance

(Assumes a $350,000 loan at 60% loan-to-value)

- 5-Year ARM: 6.375% interest rate (7.02% APR)

- 7-Year ARM: 6.25% interest rate (6.84% APR)

Here’s a table summarizing the current Charles Schwab mortgage refinance rates (as of June 2025), based on Schwab Bank data through Rocket Mortgage. These Charles Schwab mortgage rates shown are before applying any Investor Advantage Pricing (IAP) discounts and assume the specified loan amounts and 60% loan-to-value (LTV) ratios:

| Loan Category | Term & Type | Interest Rate | APR | Examples Assumptions |

|---|---|---|---|---|

| Jumbo Loans | 5‑Year ARM | 6.00 % | 6.853 % | $1.3M loan, 60% LTV |

| 7‑Year ARM | 6.00 % | 6.692 % | ||

| 10‑Year ARM | 6.125 % | 6.578 % | ||

| 15‑Year Fixed | 6.375 % | 6.428 % | ||

| 30‑Year Fixed | 6.750 % | 6.784 % | ||

| Conforming Loans | 5‑Year ARM | 6.375 % | 7.021 % | $350K loan, 60% LTV |

| 7‑Year ARM | 6.250 % | 6.838 % |

Notes: These are refinance rates, not for new home purchases, and do not include IAP discounts up to 1.00%.

What Do These Loan Types Mean?

Understanding the different types of home loans can help you choose the best one for your financial situation with suitable Charles Schwab mortgage rates. Here’s a breakdown in plain language:

- Conforming Loans: These are standard-sized loans that follow rules set by the Federal Housing Finance Agency (FHFA). They must stay within certain loan limits (which vary by state and county) and meet credit, income, and documentation standards. Because they’re less risky, conforming loans often have lower Charles Schwab mortgage rates than larger loans.

- Jumbo Loans: If you need to borrow more than the FHFA limit, often over $766,550 in 2025, then you’ll need a jumbo loan. These are used for buying or refinancing more expensive properties. Charles Schwab jumbo mortgage rates are usually slightly higher or come with stricter qualifications since lenders take on more risk.

- Adjustable-Rate Mortgages (ARMs): ARMs start with a fixed interest rate for a set period, typically 5, 7, or 10 years. After that, the rate adjusts every year based on the market. For example, a 5-Year ARM keeps the same rate for 5 years, then adjusts annually. These loans are great if you plan to move or refinance before the adjustment kicks in.

- Fixed-Rate Mortgages: With a fixed-rate mortgage, your interest rate never changes for the life of the loan. You can choose between 15-year or 30-year terms. Among them, the Charles Schwab 30 year mortgage rates are the highest, up to 6.625% on conforming loans and 6.750% on jumbo loans. This type offers predictable monthly payments, making it a good fit for buyers who plan to stay in their home long-term and prefer stability.

Fixed vs Adjustable Rate Mortgages: Which One Suits You?

Schwab offers a variety of mortgage structures. Choosing between a fixed-rate loan and an ARM depends on your financial goals:

- Fixed-rate loans: Your Charles Schwab mortgage rate stays the same for the life of the loan. Ideal for long-term owners who want predictability.

- Predictable monthly payments.

- Great for long-term ownership.

- Ideal when rates drop and you may refinance

- Adjustable-rate mortgages (ARMs): These offer a lower initial rate (often 5–7 years) that adjusts annually afterward. Good for short-term stays or if you plan to refinance later.

- Have low initial Charles Schwab mortgage rates.

- Good if you plan to move or refinance before rate changes.

- Risky if rates rise unexpectedly

For example:

- 5-year ARM jumbo: Starts at ~6.00% (first 5 years), then adjusts.

- 10-year ARM: May offer a slightly higher initial Charles Schwab mortgage rate, but longer stability.

The IAP discount applies during the fixed period of your ARM. After that, the rate adjusts based on market indexes.

Exclusive Rate Discounts for Schwab Clients

One of the biggest advantages of getting a Charles Schwab bank mortgage is the opportunity to lower your interest rate through special client-only programs. The bank rewards its investors by offering meaningful Charles Schwab mortgage rate discounts based on how much you hold in your Schwab accounts.

Investor Advantage Pricing (IAP)

This is Schwab’s flagship discount program for clients who keep investment assets with the firm. The more you invest, the bigger the discount you receive on your mortgage interest rate. Here’s how the IAP tiers work:

- $250,000–$499,999 in assets: 0.25% rate discount

- $500,000–$999,999: 0.50% discount

- $1,000,000+: 0.75–1.00% discount

These Charles Schwab mortgage discounts apply to adjustable-rate mortgages (ARMs), jumbo fixed-rate loans, and refinance options. FHA, VA, and HELOC loans are not eligible.

The Investor Advantage Pricing program is especially valuable for high-net-worth individuals looking to borrow larger amounts. Even a 0.25% reduction in your interest rate could mean saving thousands of dollars over the life of your loan.

To qualify, assets must be held in Schwab brokerage, retirement, or cash accounts. The more assets you move or keep with Schwab, the more you save over the life of your loan.

Mortgage Advantage Program (MAP)

Schwab’s Mortgage Advantage Program is designed for borrowers who plan to live in their new home as a primary residence.

If you’re not eligible for IAP, or if you’re buying a home in specific locations, you might benefit from Schwab’s Mortgage Advantage Program. This option is designed for clients purchasing homes in selected major metro areas, including parts of: California, Florida, Georgia, Illinois, Maryland, New Jersey, New York, Texas, Virginia, and Washington, D.C.

This program offers a 30-year fixed-rate conforming mortgage with terms that are especially helpful for first-time homebuyers or buyers with smaller down payments. Key benefits include:

- A low down payment requirement, as little as 10%

- A competitive interest rate around 6.50% (APR 6.55%)

- Access to Schwab’s digital mortgage tools and local support through Rocket Mortgage

For example, a $350,000 loan under MAP with 10% down might carry a monthly payment of around $2,212, based on current Charles Schwab mortgage rates.

However, it’s important to note that you can’t combine this program with Investor Advantage Pricing. You’ll have to choose the one that best suits your financial profile and location.

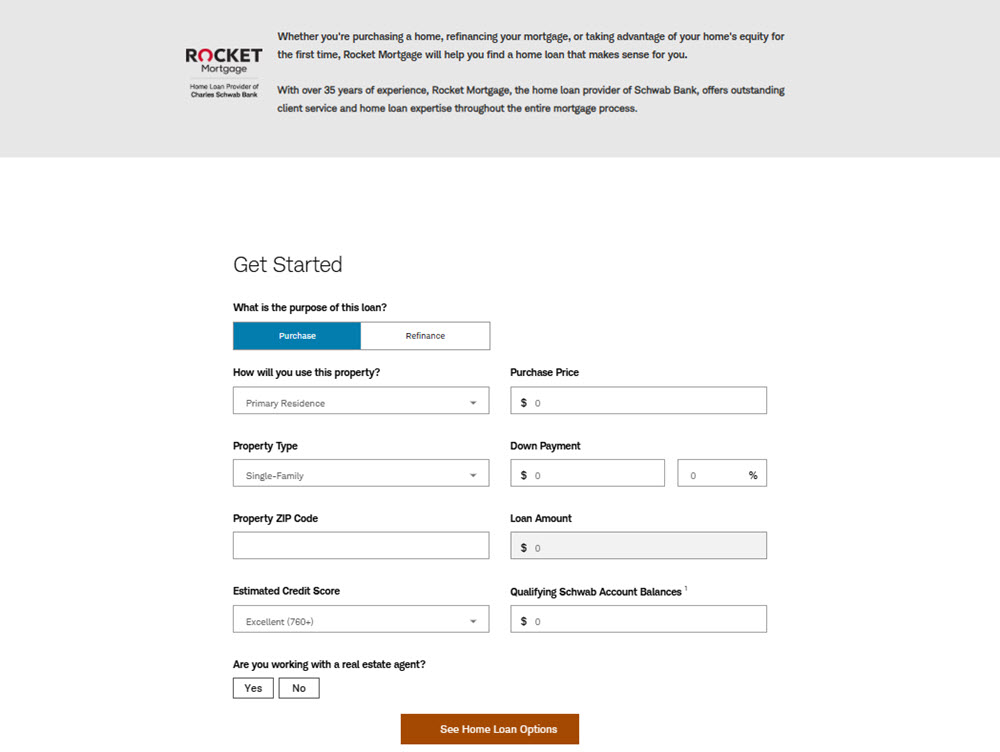

How to Estimate Your Charles Schwab Mortgage Rates

Charles Schwab mortgage rates vary for every borrower based on their personal financial situation. That’s why Schwab offers a user-friendly Mortgage Rate Calculator, powered by Rocket Mortgage, to help you get a customized estimate in minutes.

Here are the key factors the calculator uses to determine your potential rate:

- Loan Type and Term: Whether you want a fixed-rate or an ARM, and how many years you plan to borrow

- Loan-to-Value (LTV): The size of your loan compared to the value of the home

- Credit Score: Higher scores usually result in better Charles Schwab mortgage rates

- Income and Debt Levels: Your ability to repay the loan, measured by your debt-to-income ratio

By entering these details, you’ll get a realistic rate preview, including estimated monthly payments and closing costs. This tool is especially helpful for comparing how different loan types and terms affect your finances before you apply.

You can access the calculator directly through Schwab’s mortgage page, and it doesn’t require a full application or credit check to use. It’s a smart first step for anyone considering a Schwab home loan.

How to Apply for a Schwab Mortgage

Getting a mortgage through Charles Schwab is simple and mostly done online, thanks to their partnership with Rocket Mortgage. Here’s how the process works, step by step:

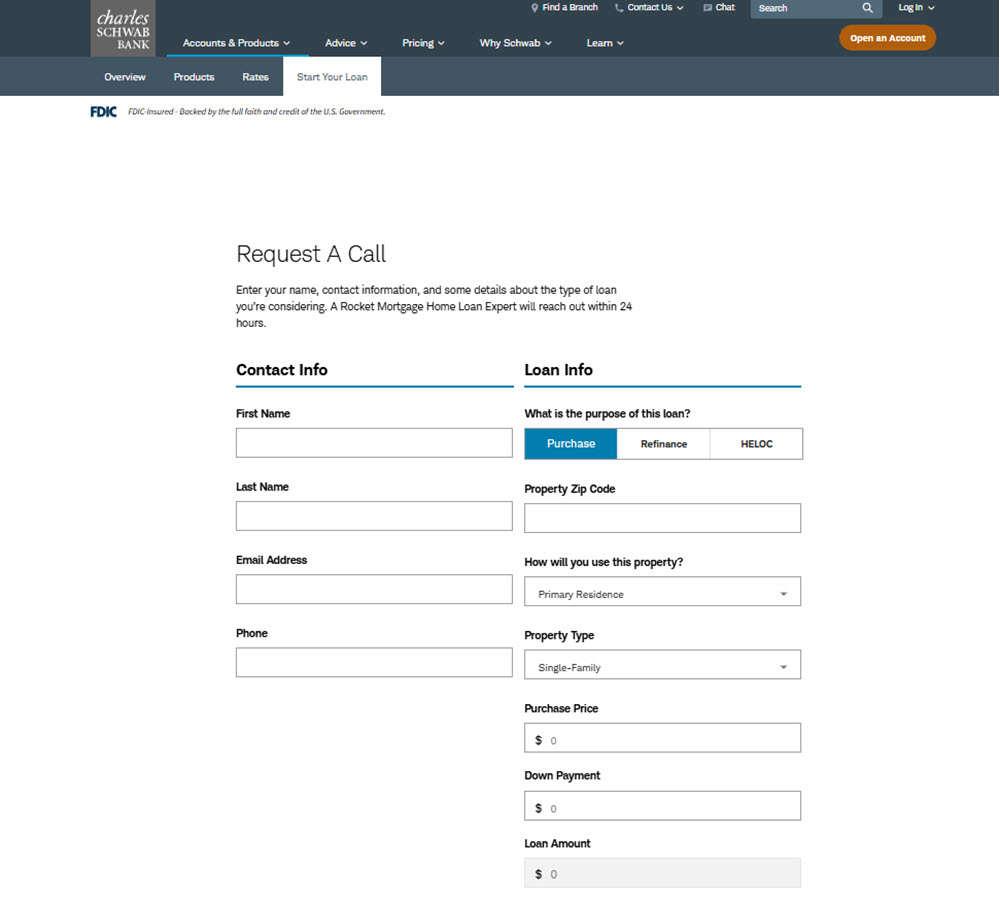

- Start with Schwab’s Website: Visit the Schwab mortgage page and click “Start Your Loan” or “Apply for a Mortgage.” This begins the streamlined process powered by Rocket Mortgage.

- Request a Call: Enter your personal information and some details about the loan you’re considering into the online form on Schwab’s official website. A Rocket seller will contact you shortly.

- Get Preapproval & a Verified Approval Letter: Next, you apply for a Verified Approval Letter (VAL). This is a powerful tool that shows sellers you’re a serious buyer. It confirms that your finances have been reviewed and you’re likely to be approved for a loan.

- Make an Offer, Then Lock Your Rate: Once a seller accepts your offer on a home, you can lock in your mortgage rate. This means your interest rate won’t go up, even if market rates rise while your loan is being finalized.

- Complete Your Application and Submit Documents: After locking your rate, you’ll need to upload your financial documents (like tax returns, pay stubs, and bank statements) through Rocket Mortgage’s secure online portal. You can sign everything electronically, saving time and hassle.

- Close the Loan with Help Along the Way: Your loan will be handled by a team that includes a Schwab-connected mortgage advisor. They’ll guide you through the final steps, answer questions, and make sure everything stays on track until your loan closes.

Throughout the entire process, you’ll get updates from both Rocket Mortgage and Schwab. You can also track your progress and view loan details inside your Schwab account dashboard.

Pros and Cons of Charles Schwab Mortgage Rates

Like any mortgage provider, Charles Schwab offers a mix of advantages and limitations, understanding both can help you decide if it’s the right fit for your home financing needs:

Pros

- Up to 1% Charles Schwab mortgage rates discount with IAP

- Strong refinance and jumbo loan options

- Trusted partner: guided by Rocket Mortgage

- Digital convenience: e‑signing, home/office closings

- Option for 10% down via MAP

Cons

- MAP is available only in select counties

- Rate lock only after accepted home offer

- No FHA, VA, or HELOC loans

- Must keep assets at Schwab for IAP discount

Is a Schwab Mortgage Right for You?

Schwab mortgage loans are best for:

- Schwab investors with $250k+ in assets

- Homebuyers in MAP-eligible areas seeking lower down payments

- Short-term homeowners exploring ARMs

- Borrowers valuing a digital-first, integrated experience

If you don’t already have Schwab accounts, you can still apply but the biggest benefits and best Charles Schwab mortgage interest rates come when you’re an active client.

Tips to Get the Best Mortgage Deal with Charles Schwab

Getting the most value from a Schwab mortgage is about knowing how to unlock the best possible Charles Schwab mortgage rates and terms. Here are some simple but effective ways to do just that:

- Grow Your Schwab Investment Balance: One of the easiest ways to lower your mortgage rate is by increasing your eligible assets at Schwab. Thanks to the Investor Advantage Pricing (IAP) program, the more you invest, the more you can save, potentially up to 1.00% off your rate.

- Check If You Qualify for Local Programs: If you’re buying in select metro areas, look into Schwab’s Mortgage Advantage Program. It offers competitive fixed Charles Schwab mortgage rates and lower down payment requirements. But remember, it’s only available in certain cities and can’t be combined with IAP.

- Always Compare Rates from Other Lenders: Schwab offers great tools, like its online calculator, to estimate your mortgage rate. Still, it’s smart to get a few quotes from other lenders to see where you stand and maybe use them as leverage.

- Getting Pre-approved with a Verified Approval Letter (VAL): It can make a big difference. In a competitive housing market, it helps your offer stand out and shows sellers that you’re financially ready to buy.

- Monitor Rates Frequently: Charles Schwab mortgage rates change every day, sometimes more than once. Keep an eye on the market, and sign up for Schwab rate alerts if needed. Even a small dip can mean big savings over time.

- Pick the Right Loan Type for Your Goals: Think about how long you plan to stay in your home. If it’s a short-term plan, an ARM might save you money up front. If you want long-term stability, a fixed-rate loan is the safer choice.

- Lock In When the Timing Is Right: If Charles Schwab loan rates fall to a level you’re comfortable with, don’t wait. Lock it in. Schwab and Rocket Mortgage allow you to secure a rate while your loan is being processed so you’re protected from sudden increases.

With the right timing, planning, and strategy, Schwab clients can turn a good mortgage into a great one.

FAQs About Charles Schwab Mortgage Rates

What are the current Charles Schwab mortgage rates in 2025?

- As of June 2025, Schwab offers rates around 6.625% for a 30-year fixed conforming loan and 6.00% for certain ARMs. Rates may vary based on loan type, credit score, location, and whether you qualify for Investor Advantage Pricing (IAP).

How does Charles Schwab’s Investor Advantage Pricing (IAP) work?

- IAP offers mortgage rate discounts ranging from 0.25% to 1.00% for clients with $250,000 or more in eligible assets at Schwab. The higher your qualifying asset level, the bigger your discount.

Can I lock in a mortgage rate with Schwab before making an offer?

- No. You can only lock your rate with Schwab after your home purchase offer has been accepted. This is a key difference from some lenders that offer rate locks during pre-approval.

Charles Schwab mortgage rates offer smart value for investors. Competitive pricing, digital ease, and exclusive perks stand out. Whether you’re buying your first home, refinancing, or relocating to a new area, Schwab’s partnership with Rocket Mortgage delivers a smooth, streamlined path to homeownership. For those already managing investments with Schwab, the value only gets better.