Buying a home is one of the biggest financial decisions you’ll make. And you want a mortgage provider you can trust. Citizens Bank home loans offer a wide range of programs in 2025, combining competitive rates, helpful features, and a convenient digital application process.

In this guide, we’ll walk you through everything you need to know about Citizens Bank home loans, from loan types and interest rates to special programs, borrower experiences, and how they compare to other lenders.

Introduction to Citizens Bank Home Loans

Before diving into the details, let’s take a closer look at Citizens Bank and what makes its home loan offerings stand out in today’s mortgage market.

About Citizens Bank

Citizens Bank is part of Citizens Financial Group, Inc., a large and long-standing financial institution in the U.S. The company was founded all the way back in 1828, which means it has nearly 200 years of experience in banking.

Its headquarters is located in Providence, Rhode Island, and over time, it has grown to become one of the top regional banks in the country. Citizens Financial Group is also a publicly traded company and is included in the S&P 500 Index, which is a sign of strong financial health and stability.

Citizens combines traditional banking with advanced digital tools. Over the years, Citizens Bank home loans have expanded to serve a diverse customer base, including first-time buyers, professionals, and even real estate investors.

Overview of Citizens Bank Home Loans

Citizens Bank offers a wide range of home loan options to fit different financial situations and life stages. Whether you’re a first-time homebuyer, upgrading to a larger space, refinancing, or building a new home, there’s likely a mortgage solution that fits your needs. Their loan products include conventional loans, FHA, VA, jumbo loans, and even construction loans, giving borrowers more flexibility than many traditional lenders.

In addition to standard Citizens Bank home loans, Citizens also provides special options like the Destination Home program, designed for low- to moderate-income buyers with low down payment requirements and no private mortgage insurance (PMI). These offerings, along with tools like affordability calculators and online applications, make the homebuying process easier and more accessible for a wide range of customers.

Citizens Bank Home Loan Products

Citizens Bank offers a variety of mortgage and home equity solutions to meet the needs of different borrowers. Whether you’re a first-time homebuyer, building a new home, or looking to tap into your home’s value, Citizens Bank home loans support you along the way.

Mortgage Products Offered

Citizens Bank provides a wide selection of mortgage options to suit different buyer profiles, from first-time homeowners to experienced borrowers. These Citizens Bank home loans are designed to meet various financial goals, offering flexibility in both terms and structure.

Conventional Loans

These are traditional fixed or adjustable-rate mortgages. To qualify, borrowers usually need a credit score of 620 or higher and a minimum down payment of 3%. If the down payment is under 20%, Private Mortgage Insurance (PMI) is typically required. This type of loan is best for buyers with steady income and good credit history.

FHA Loans

Insured by the Federal Housing Administration, FHA loans help buyers who may have lower credit scores or limited savings. With a required 3.5% down payment and mortgage insurance premiums (MIP), these Citizens Bank home loans are ideal for those needing easier qualification criteria.

VA Loans

For eligible military service members and veterans, VA loans offer major advantages like 0% down payment, no PMI, and favorable interest rates. Citizens Bank is a VA-approved lender and provides expert guidance throughout the process.

Jumbo Loans

If you’re purchasing a high-value property above conventional loan limits (typically $766,550 or more in 2025), jumbo loans are available up to $1.75 million. These loans come with competitive rates and personalized underwriting for qualified buyers.

Construction Loans

Planning to build your dream home? Citizens offers construction-to-permanent loans that allow you to finance the build and seamlessly transition into a long-term mortgage once construction is complete. This one-time closing feature simplifies the financing process for new builds.

Citizens Bank Home Equity Loans

In addition to traditional home mortgages, Citizens Bank also offers a flexible Home Equity Line of Credit (HELOC) through its streamlined Citizens FastLine platform. This digital application process allows homeowners to access funds quickly, typically within just two weeks, with minimal paperwork.

With a HELOC, you get:

- A variable interest rate based on the current market.

- Access to funds through checks or online transfers.

- A draw period (usually 10 years) where you can borrow, followed by a repayment period.

Borrowers can receive a personalized rate offer in just 2–3 minutes, making it easy to tap into their home’s equity for renovations, debt consolidation, or large expenses. With competitive interest rates and the freedom to borrow as needed, Citizens Bank’s HELOC is a convenient solution for ongoing home projects or future financial plans.

Whether you’re buying, building, or borrowing against your home, Citizens Bank provides tools and support to help you move forward with confidence.

Interest Rates & Discounts of Citizens Bank Home Loans

Citizens Bank home loans offer competitive interest rates, along with small rate discounts if you use certain services.

Sample Mortgage Rates (as of July 2025)

Here are some typical Citizens Bank home loan interest rates you might see:

- 30-year fixed mortgage: About 6.625% interest, with an APR around 6.714%

- 15-year fixed mortgage: Around 5.75% interest, with an APR near 5.872%

- 7/1 adjustable-rate mortgage (ARM): Approximately 6.25%, with an APR close to 6.742%

- Construction loan (1-year ARM): Starting at around 5.875%

| Loan Type | Interest Rate | APR | Notes |

|---|---|---|---|

| 30-Year Fixed | 6.625% | 6.702–6.714% | Based on $300 K loan, includes discount (Source: citizensbank.com) |

| 15-Year Fixed | 5.750% | 5.872% | Based on $300 K loan |

| 7/1 Adjustable-Rate Mortgage (ARM) | 6.250% | 6.742–6.773% | Initial fixed for 7 years |

| Construction 1-Year ARM | 5.875% | ~6.899% | Interest-only during construction |

| Construction 3-Year ARM | 6.000% | 6.702% | |

| Construction 5-Year ARM | 6.125% | 6.877% |

These Citizens Bank mortgage rates can change based on your credit profile, loan amount, and location. It’s also important to remember that the APR (Annual Percentage Rate) includes fees and closing costs, so it’s usually a bit higher than the base interest rate.

Save More with Autopay and Paperless Setup

One of the easiest ways to save is by enrolling in automatic payments (autopay) and choosing paperless billing. Doing both gives you a 0.125% discount on your interest rate. While that may seem small, it can lead to noticeable savings over the life of a mortgage. To qualify, you’ll need a Citizens Bank checking account and set up autopay directly from that account. This applies to all eligible Citizens Bank home loans.

Flexible Rate Lock Options

Worried about rising interest rates while shopping for a home? Citizens has you covered with flexible rate lock options. You can lock in your mortgage rate for 30, 45, or 60 days, giving you peace of mind while you finalize your home purchase or refinancing. This is especially helpful in a market where rates can change quickly, helping you avoid unexpected increases.

Citizens Bank Affordable Programs

Citizens Bank goes beyond traditional loans by offering special programs for first-time buyers and lower-income households. These special Citizens Bank home loans can make buying a home easier, even if you don’t have a large down payment saved up.

Low Down Payment Choices

Citizens Bank makes homeownership more accessible by offering low down payment loans starting from 0% to 3.5%, perfect for buyers who haven’t saved up a large lump sum. For example, qualified borrowers can choose:

- 0% down with VA loans (for veterans and military service members)

- 3% down through the Destination Home program

- 3.5% down with FHA loans

These Citizens Bank home loans open the door to homeownership for those who might otherwise be priced out due to savings limitations.

Say Goodbye to PMI (in Some Cases)

Private Mortgage Insurance (PMI) is often required when you put less than 20% down on a home, and it can add up to 0.5–1% of your loan amount each year. But Citizens Bank offers something unique: some low-down-payment loans come with no PMI at all, especially the Destination Home loan. This can significantly lower your monthly payments and overall loan cost, making the mortgage more affordable in the long run.

Built-In Tools to Help You Plan

To help you get started, Citizens offers a Mortgage Affordability Calculator right on their website. It’s simple to use, just enter details like your income, monthly expenses, and estimated interest rate. The tool will quickly estimate how much home you may be able to afford. It’s a helpful starting point, especially if you’re still early in the planning phase and want a realistic look at your budget before applying.

Citizens Bank Special Home Loan Programs

In addition to traditional offerings, the bank also offers targeted Citizens Bank home loan programs designed to help underrepresented buyers.

- Your Home Rewards: Earn up to $9,500 back when buying or selling a home with a Citizens-affiliated real estate agent. You don’t need a Citizens mortgage to qualify, but the rebate is only available in states that allow commission returns.

- ONE Mortgage Program (in Massachusetts only): Designed for first-time buyers with low to moderate income, this program offers a 3% down payment, no PMI, and below-market interest rates. Some borrowers may also qualify for temporary interest subsidies.

- Destination Home Mortgage: Aimed at buyers in low- to moderate-income areas, this program offers down payments from 3% to 5%, no PMI, and no income limits in eligible zones. You may also receive community grants or rate discounts with autopsy.

- HomeReady Mortgage: A flexible loan backed by Fannie Mae, ideal for those with moderate income or less-than-perfect credit. Features include 3% down, reduced PMI, and the ability to use gift funds or seller assistance for upfront costs.

These programs enhance the affordability of Citizens Bank home loans and improve accessibility for many borrowers.

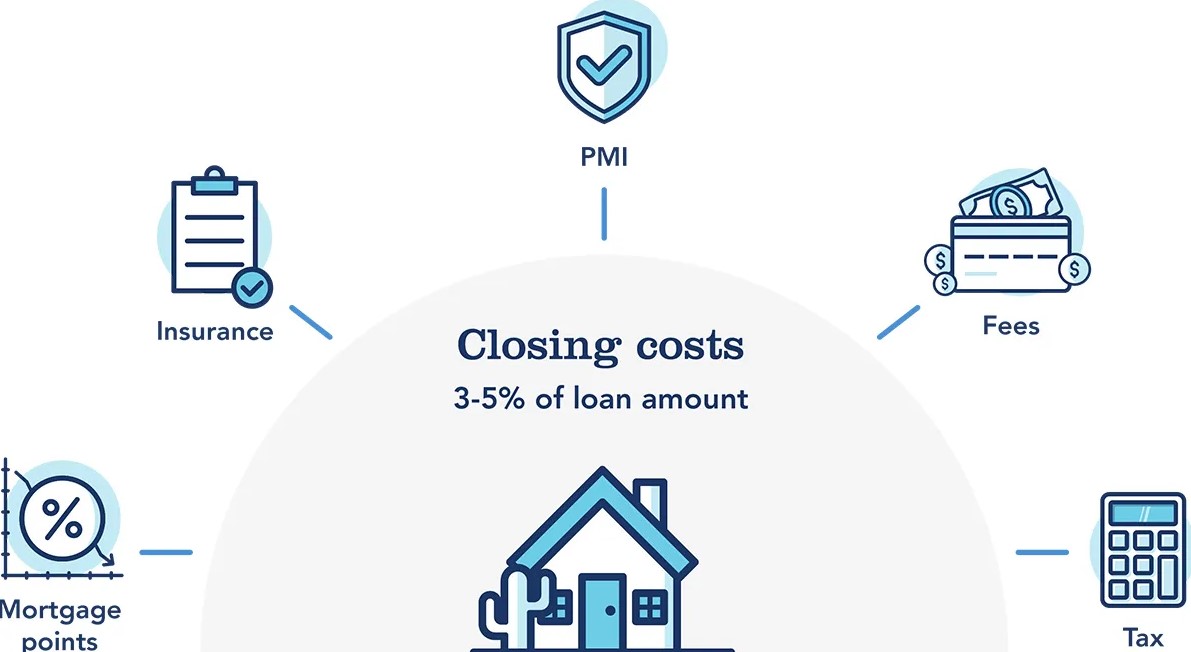

Citizens Bank Home Loans: Fees & Closing Costs

While Citizens Bank offers competitive loan products, they’re less transparent about their fees than some other lenders. For example, you won’t find detailed lender or origination fees listed on their website. This makes it especially important to ask for a Loan Estimate early in the process so you can compare the costs of Citizens Bank home loans with other lenders.

What to Expect:

- Origination Fee: Based on data from the Home Mortgage Disclosure Act (HMDA), the average Citizens Bank origination fee is about $3,646, which falls in line with the national average.

- Closing Costs: These typically range between 2% and 5% of the total loan amount, depending on where you live and the type of loan you choose. This includes fees for appraisals, title services, legal work, and more.

While interest rate is important, don’t overlook fees. A loan with a lower rate but higher fees might cost more overall. Always ask your loan officer to break down every cost so you can make an informed decision.

Citizens Bank Home Loans: Eligibility

To qualify for most Citizens Bank home loans, you’ll need:

- Credit Score: To qualify, you’ll usually need a credit score of at least 620 for most mortgage programs. If you’re applying for a home equity line of credit (HELOC), a slightly higher score, around 680 or more, may be needed.

- Debt Level: In addition, your monthly debt payments shouldn’t be too high. Citizens Bank prefers a debt-to-income (DTI) ratio of 43% or less, meaning your total debt payments each month should be less than 43% of your gross income.

- Proof of Income: Citizens will ask for documents to show that you can afford the loan. This includes recent pay stubs, W-2 forms, or tax returns if you’re self-employed. In some cases, they may also request bank statements to see your savings and spending habits.

- Down Payment Requirements: One of the benefits of Citizens Bank is its low down payment options.

- FHA loans and the Destination Home program allow as little as 3–3.5% down.

- VA loans require no down payment at all for eligible veterans.

- For certain programs like ONE Mortgage (available in Massachusetts), you may need to contribute a small portion from your own funds, usually around $1,500 or 1.5% of the home price, whichever is greater.

- Get Extra Savings with a Citizens Account: If you open a Citizens checking account and set up autopay for your mortgage, you can earn a 0.125% interest rate discount. You’ll also need to sign up for paperless statements. This simple step can help you save money over the life of your loan.

Besides, some specialized Citizens Bank home loan programs may have additional criteria, including location or income limits.

Citizens Bank Home Loan Application Process

Applying for Citizens Bank home loans involves these steps:

- Prequalification: Start by filling out a short form online. This helps you get a quick look at what types of loans and rates you may qualify for, without affecting your credit score.

- Document Gathering: Get your paperwork ready. You’ll need pay stubs, bank statements, W-2s or tax returns, a government-issued ID, and property details if you’re buying a specific home.

- Rate Lock: Once you’re ready to apply, Citizens will lock in your interest rate for 60 days. This gives you time to finalize everything without rushing.

- Underwriting: Your loan officer and the underwriting team will verify your documents, review your credit, and confirm that the loan fits your financial profile.

- Clear to Close: Once everything checks out, you’ll receive a final disclosure with all the terms of your loan. You’ll review and sign before closing day.

- Closing: You can sign closing documents either in person or electronically, depending on your location and preference.

- Funding: After closing, your loan is funded, and if you’re buying a home, the keys are yours.

Throughout the process, Citizens sends email or text alerts when action is needed, so you always know what step comes next.

Online Application Process & Turnaround Time

Citizens Bank makes the mortgage application process smooth and user-friendly, especially for those who prefer managing things online. Their home loan platform is designed to be digital-first, allowing you to apply 100% online. With just a few clicks, you can:

- Start and complete your application online or from your mobile device

- Securely upload your income and identity documents

- Track the progress of your loan in real time through a personal dashboard

If you decide to move forward, the full application and approval process typically takes about 30 to 45 days from start to finish. This timeline includes the underwriting phase, where your income, assets, and credit history are reviewed. For added peace of mind, Citizens Bank locks your mortgage rate for 60 days, giving you plenty of time to complete the paperwork without worrying about rate changes.

While most of the process is automated, Citizens doesn’t leave you on your own. You can reach out to a real loan officer at any stage via phone, live chat, or even in person at a branch. Many borrowers appreciate this blend of digital convenience and human support.

Personalized Citizens Bank Home Loans Customer Service

While Citizens offers a solid digital process, they also provide real human support when you need it. You can get in touch with a loan officer by:

- Phone for quick questions or clarifications

- Email for follow-up and document-related inquiries

- In-person meetings at selected branch locations for those who prefer face-to-face support

That said, some customers have experienced inconsistent service depending on the loan officer, region, or loan type. While many praise Citizens for being responsive and helpful, others have noted delays during peak processing times. Your experience may vary, but being proactive often leads to a smoother path.

FAQs About Citizens Bank Home Loans

What credit score do I need for a Citizens Bank mortgage?

- Most Citizens Bank home loans require a minimum credit score of 620, though FHA loans may allow slightly lower scores depending on other qualifications.

Does Citizens Bank offer home loans with low down payments?

- Yes. Citizens Bank offers programs like Destination Home and FHA loans that require as little as 3% to 3.5% down, and VA loans with 0% down for eligible veterans.

How do I apply for a mortgage with Citizens Bank?

- You can apply online using Citizens’ digital platform, through their mobile app, or by speaking directly with a loan officer at a branch or by phone.

How long does it take to close a home loan with Citizens Bank?

- The closing process typically takes 30 to 45 days, depending on your loan type, documentation, and whether you’re buying or refinancing.

What if I want to refinance later?

- Citizens offers refinance options, and the same autopay discount applies. As of July 2025, typical refinance rates for a 30-year fixed loan are around 6.75%, depending on your credit and loan amount.

With competitive programs like Destination Home and strong digital tools, Citizens Bank home loans are especially attractive to first-time buyers and those needing flexibility. From first-time buyers to experienced homeowners, Citizens offers solutions for nearly every situation. If you value convenience, custom loan options, and personalized guidance, Citizens Bank is well worth considering for your home financing journey.