Fifth Third Bank mortgage rates are drawing attention from homebuyers looking for flexible loan options and competitive terms in 2025. Whether you’re a first-time buyer or a seasoned homeowner, understanding how their rates and programs work is key to making a smart financial decision.

In this comprehensive review, we’ll walk you through everything you need to know about Fifth Third mortgage rates, from available loan types and eligibility requirements to special discounts, so you can decide if this bank is the right fit for your homeownership journey.

Overview of Fifth Third Bank Mortgage Rates

Fifth Third Bank is a well-established regional bank headquartered in Cincinnati, Ohio. With over 1,000 branches across 11 states and more than $200 billion in assets, it ranks among the top 20 banks in the United States. While it operates primarily in the Midwest and Southeast, it offers a wide range of financial services, including checking accounts, credit cards, business banking, and of course, home loans.

A Trusted Mortgage Lender

Fifth Third Bank has built a solid reputation for supporting both first-time homebuyers and seasoned borrowers. Whether you’re looking to buy your first home, refinance an existing mortgage, or upgrade to a larger space, the bank provides multiple lending solutions backed by real people and accessible support.

They also offer several affordable lending programs for lower-income buyers, medical professionals, and veterans, making homeownership more accessible for those who need flexibility or assistance.

Fifth Third Bank Mortgage Rates: What Makes Them Stand Out?

Unlike some big-name lenders that post generic sample rates, Fifth Third Bank mortgage rates are customized based on your individual profile.

What sets Fifth Third apart:

- Down payment assistance up to $3,600

- Physician loans with zero down payment

- VA loans with no PMI and no closing costs

- Online rate quote tool for instant estimates

- Rate Drop Protection, which waives lender fees if you refinance within 24 months

If you’re looking for competitive rates, personalized service, and extra savings through discounts and assistance programs, Fifth Third Bank is a lender worth considering, especially if you’re located within their service area.

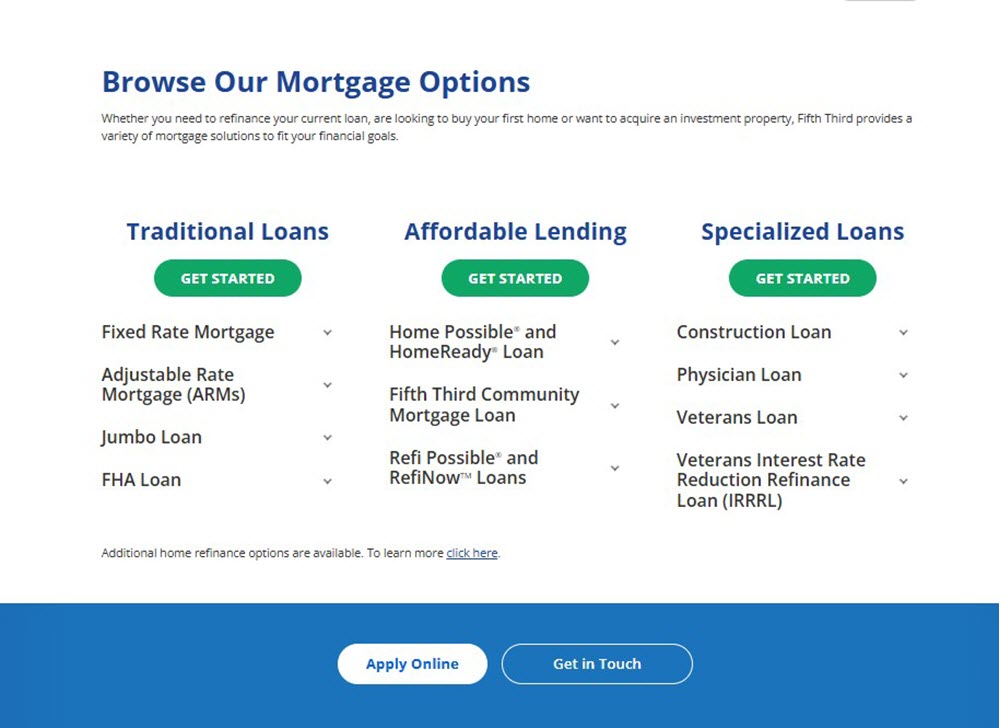

Types of Fifth Third Bank Mortgage Products

Fifth Third offers a full suite of mortgage options with different Fifth Third Bank mortgage rates to fit different borrower needs:

Conventional Loans (Fixed & Adjustable Rate Mortgages)

These are traditional home loans not backed by the government, suitable for most buyers with decent credit.

- Fixed-Rate Mortgages: Your monthly payment stays the same for the life of the loan. Terms range from 10 to 30 years.

- Adjustable-Rate Mortgages (ARMs): You start with a fixed interest rate for a set period, like 5, 7, 10, or 15 years, then the rate adjusts based on market conditions.

- Down payments start as low as 3%.

- You’ll need a minimum credit score of 620.

These loans are great if you want predictability (fixed rate) or plan to move or refinance in a few years (ARM).

FHA Loans

The purpose of these government-insured loans is to assist those with low credit scores or little money.

- Accepts credit scores starting at 600.

- Requires just 3.5% down.

- Good for first-time buyers or those recovering from past credit issues.

VA Loans

Reserved for veterans, active-duty military members, and eligible surviving spouses.

- No down payment required.

- No closing costs.

- No private mortgage insurance (PMI).

- A great low-cost option for those who’ve served in the military.

Physician and Dentist Loans

Specialized mortgage program for medical professionals who may still be paying off student loans.

- Finance up to $1 million with no down payment and no PMI.

- Borrow up to $2 million with a small down payment.

- Accepts employment contracts as proof of future income, making it easier for new doctors to qualify.

Construction Loans

Planning to build your dream home? Fifth Third offers flexible construction loans to finance the entire process:

- Covers both construction costs and lot purchase

- Convenient one-time closing

- Ideal for buyers building a custom home from the ground up

Affordable Loan Programs

Fifth Third Bank goes beyond traditional loan offerings by providing several affordable lending solutions designed for buyers with limited income or savings. These programs feature more flexible credit and income requirements than standard loans, allow debt-to-income ratios of up to 43%–45%, and include down payment assistance, making homeownership more attainable for working families and first-time buyers.

Home Possible & HomeReady Loans

- Designed for low- to moderate-income borrowers

- Flexible down payment sources

- Reduced mortgage insurance premiums

Fifth Third Community Mortgage Loan

- Aimed at increasing access to homeownership

- Offers up to $3,600 in down payment or closing cost assistance

- Ideal if you don’t have much cash saved up

Refi Possible and RefiNow Loans

- Created for borrowers with high debt-to-income (DTI) ratios

- These refinance programs offer easier approval and potentially better Fifth Third Bank mortgage refinance rates.

- Includes incentives to help you qualify even with limited income

These options are excellent for first-time buyers, renters looking to transition into ownership, or homeowners wanting to refinance with fewer obstacles.

Jumbo Loans

If you’re buying a high-value home, Fifth Third offers Jumbo Mortgages with both fixed and adjustable-rate options.

- Loan amounts range from $762,201 up to $3,000,000

- Available in both fixed and ARM formats

- Ideal for luxury properties or homes in high-cost areas

Especially, Fifth Third’s standout feature is its Rate Drop Protector. If the Fifth Third Bank mortgage rates drop within 6 to 24 months after closing your mortgage, you can refinance, and Fifth Third will cover up to $1,295 in closing costs. This provides peace of mind in a fluctuating rate environment.

Analysis of Current Fifth Third Bank Mortgage Rates

Compared to national lenders, Fifth Third Bank mortgage rates are slightly higher on average. For example, while top national lenders offer 30-year fixed rates in the 6.4% to 6.6% range, Fifth Third often hovers slightly above that, depending on your credit score, loan size, and location.

This doesn’t mean they’re overpriced. Many borrowers see value in the bank’s programs, flexibility, and refinancing protection. Especially if you expect rates to drop in the near future, Rate Drop Protector can help you avoid thousands in repeat closing costs.

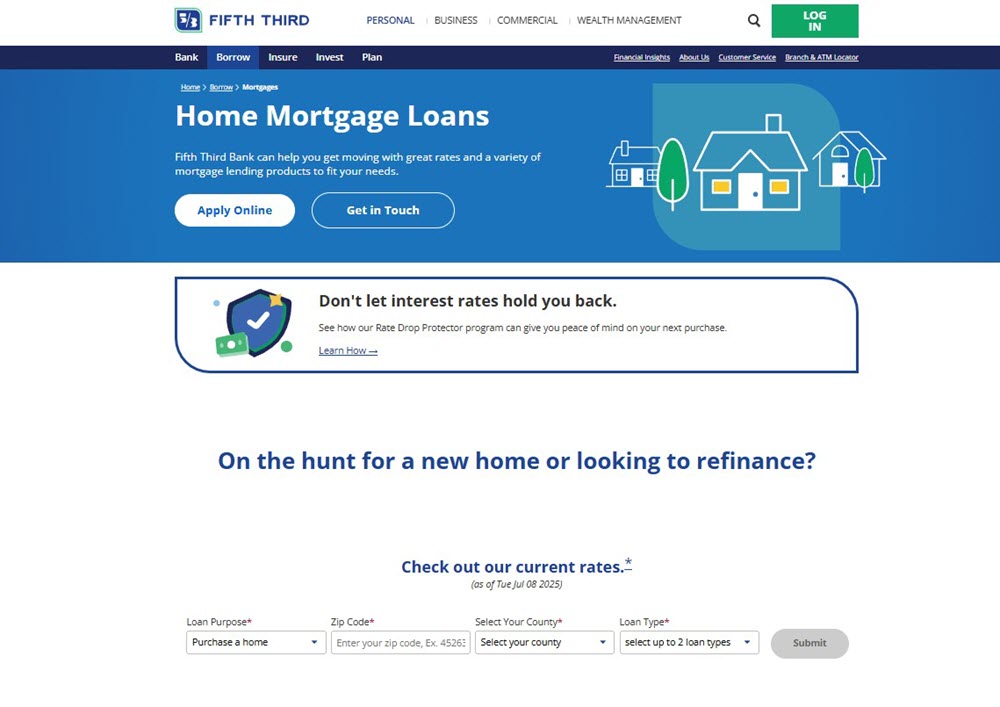

How to Know Your Fifth Third Bank Mortgage Rates

Unlike some lenders that post standard rates on their websites, Fifth Third Bank mortgage rates are customized based on your unique financial profile and location. That means you won’t see a one-size-fits-all rate table online. Instead, the bank uses a personalized rate tool that gives you an estimate within seconds.

To get your rate, you’ll need to enter:

- Your ZIP code

- Select your county

- The purpose of the loan (purchase, refinance, etc.)

- The loan type you’re interested in

What Affects Fifth Third Bank Mortgage Rates

The Fifth Third Bank mortgage rates are not set in stone. The precise rate you are offered will depend on a number of factors, including:

| Factor | Impact on Fifth Third Bank Mortgage Rates |

|---|---|

| Credit Score | Higher scores can earn lower rates. Poor credit may increase your rate or limit your options. |

| Loan Amount | Large or small loans may have different rates depending on risk and eligibility. |

| Loan Type | FHA, VA, or jumbo loans may offer different rates than conventional ones. |

| Down Payment | The more you put down, the lower your interest rate may be. |

| Property Type | Fifth Third Bank mortgage rates can vary between single-family homes, condos, or multi-family units. |

| Loan Term | 15-year loans generally have lower rates than 30-year loans. |

| Market Conditions | Fifth Third Bank mortgage interest rates fluctuate based on inflation, Federal Reserve policy, and the bond market. |

Down Payment Assistance and Bonus Programs

One of the standout features of Fifth Third Bank’s mortgage offerings is the support it provides to homebuyers who may be struggling with upfront costs. The bank has several helpful programs that reduce or eliminate down payment burdens, making it easier for families and first-time buyers to become homeowners.

- Community Mortgage Loan: This program provides up to $3,600 in non-repayable down payment assistance. That means you don’t have to pay it back. It’s designed for people who live in low- to moderate-income neighborhoods, giving them a stronger chance at qualifying for a mortgage and purchasing a home with fewer financial barriers.

- Fifth Third Down Payment Assistance Program: Another great option offers up to $3,295 to help cover your down payment. What’s even better? You can combine this program with other forms of assistance, such as state or local grants, to further reduce your out-of-pocket costs. This flexibility can be a game-changer for purchasers who need that extra financial boost to get started.

- AutoPay Interest Rate Discount: When you enroll in automatic payments for your mortgage, Fifth Third rewards you with a 0.25% discount on your interest rate. It’s a simple way to save money over time, just by setting up automatic monthly payments from your account.

These programs show that Fifth Third Bank is serious about helping borrowers not just get approved, but also save money and stay financially stable throughout their homeownership journey.

Costs and Fees Breakdown

While Fifth Third Bank mortgage rates get most of the attention, fees can quietly add up. Here’s what you can expect when applying for a mortgage through Fifth Third:

- Origination fees: May differ depending on the type of loan and the state.

- Appraisal: Typically between $400 and $600.

- Underwriting & processing fees: Standard industry rates.

- Discount points: Optional, for those who want to lower their Fifth Third Bank mortgage rate.

- Closing costs: Usually range from 2% to 5% of the loan amount.

| Fee Type | What It Covers | Estimated Cost |

|---|---|---|

| Application Fee | Starts your mortgage loan process. May be refunded at closing. | Varies, credited back if the loan closes |

| Origination Fee | Charged for processing and creating your loan. | Varies, around 0.25% of the loan amount |

| Underwriting Fee | Pays for evaluating your loan documents and risk. | Included in origination |

| Processing Fee | Covers administrative work during the loan process. | Included in origination |

| Appraisal Fee | Pays a professional to assess your home’s value. | $400 – $600 |

| Title Fees | Covers title search and insurance to protect against ownership issues. | $500 – $1,000 |

| Credit Report Fee | Cost to pull and review your credit history. | $30 – $50 |

| Recording Fee | Charged by your local government to record your mortgage documents. | $50 – $150 |

| Escrow/Prepaid Costs | Upfront payments for property taxes and homeowners insurance. | Varies (often $1,000+) |

| Closing Costs (Total) | Total fees due at closing, including all above. | Around 2% – 5% of loan |

| Refinance Closing Fee | If using Fifth Third’s Easy Refi program. | Flat $299 |

| Optional Discount Points | Pay upfront to lower your interest rate. | 1 point = 1% of loan amount |

However, with the Rate Drop Protector, they’ll waive up to $1,295 in closing fees when you refinance through them within the set time window. That can make a big difference if you’re trying to time your mortgage with interest rate trends.

They also offer certain discounts and fee waivers to eligible borrowers, especially through special programs like the Community Mortgage mentioned above.

Fifth Third Mortgage Requirements and Pre-Approval

Fifth Third primarily serves 11 core states, including Ohio, Michigan, Indiana, Kentucky, Florida, and Tennessee. However, its mortgage services are available in 48 states through correspondent lenders. That means you might still qualify even if you don’t live near a branch.

Eligibility varies by loan type, but general requirements include:

- Credit Score: 620+ for conventional loans, as low as 600 for FHA and VA.

- Down Payment: 3% for conventional; 3.5% for FHA; 0% for VA or doctor loans.

- Income: Stable, with documents to verify.

- Debt-to-Income Ratio (DTI): Preferably under 45%, though exceptions may apply.

- Home Use: Primary residences are easiest to finance; second homes and investment properties might face stricter rules.

The Community Mortgage and Physician Loan programs offer flexibility, especially for buyers without a traditional W-2 income or with high student loan debt. If you’re applying for a Community Mortgage, you may qualify with alternative documentation and lower income levels.

Before you start house hunting, it’s a smart idea to get preapproved for a mortgage. Preapproval gives you a clear picture of what you can afford.

Here’s how to get preapproved with Fifth Third Bank:

- Contact a mortgage specialist online or by phone

- Submit key income documents like W-2s, pay stubs, and bank statements

- The specialist will review your financial profile and provide a preapproval letter

- You can then use this letter when making offers on homes

Preapproval not only strengthens your offer in a competitive market but also saves time by narrowing down your home search to properties within your budget.

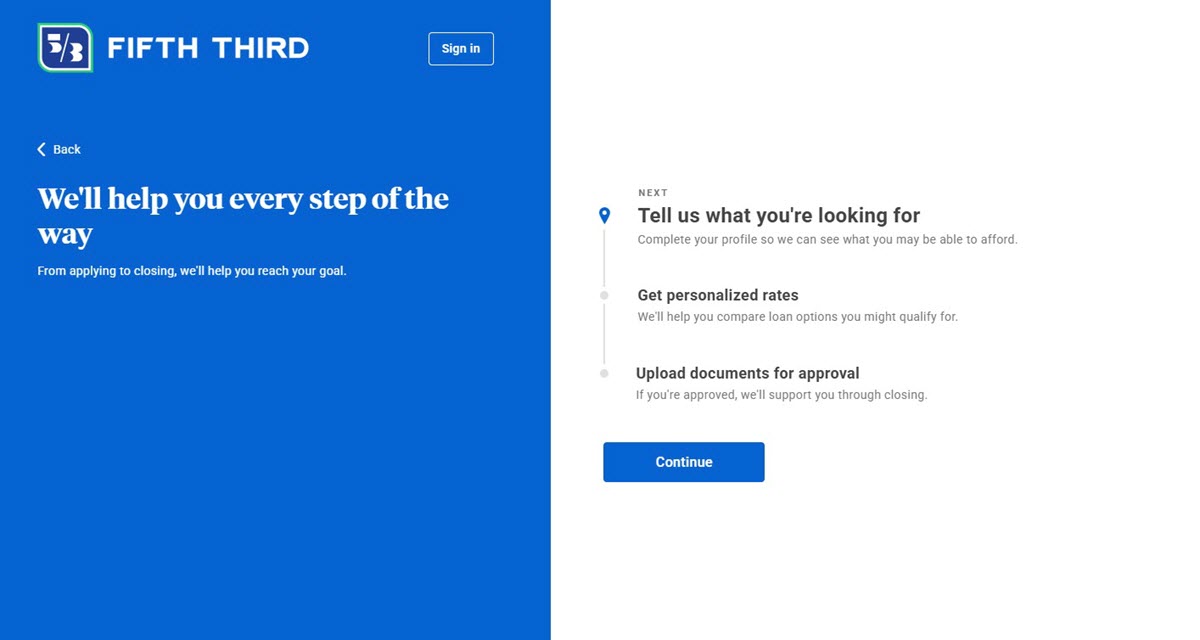

Easy and Flexible Application Process

Applying for a mortgage with Fifth Third Bank is convenient, and you can choose the method that works best for you, either online or by speaking with a mortgage expert directly.

Online Application

If you’re comfortable using the internet, you can start and complete your mortgage application from home.

- Visit homelending.53.com

- Select the type of loan you want (e.g., conventional, FHA, VA)

- Create an account using your email

- Fill out your personal and financial details

- Upload the necessary documents (such as income verification and ID)

- View your personalized mortgage rates based on the information you provide

- Submit the full application online for review

The online process is fast, straightforward, and user-friendly, even if this is your first time applying for a home loan.

Speak With a Mortgage Specialist

If you prefer human interaction or have more questions, Fifth Third makes it easy to get expert help:

- Fill out a simple online form with your name, contact info, loan amount, and property location

- A loan officer will call you by 10 a.m. the next business day to review your options

- Or, you can skip the form and call them directly at 866-351-5353 to speak with someone right away

This flexibility allows you to move at your own pace and get the support you need, whether you’re just exploring or ready to buy.

Who Should Consider a Mortgage from Fifth Third Bank?

Fifth Third Bank mortgages are a great fit for specific types of homebuyers. If you match any of the following situations, this lender could be a smart choice for you:

- You live in one of the 11 states they serve. Fifth Third is a regional bank, so their mortgage products are only available in certain areas. If you’re located in a supported state, you’ll have full access to their loans and assistance programs.

- You need help covering your down payment. If saving up for a large down payment is holding you back from buying a home, Fifth Third offers several financial assistance options that could make homeownership more affordable.

- You’re a doctor or dentist with student loans. Medical professionals often have high earning potential but also carry significant debt. Fifth Third understands this and offers special mortgage programs designed just for physicians and dentists, even those early in their careers.

- You have a moderate income but manage your money well. Fifth Third has programs for low- to moderate-income borrowers. If you have a steady job, pay your bills on time, and maintain a reasonable amount of debt, you could qualify even without a high salary.

- You prefer working with someone face-to-face. If you like asking questions, getting guidance, or reviewing documents in person, Fifth Third has hundreds of branches with mortgage experts available to help. It’s a solid choice if you’re not comfortable going through the process entirely online.

Tips Before You Apply To Minimize Fifth Third Bank Mortgage Rates

Getting the best mortgage rate can save you thousands of dollars over the life of your loan. Before you apply for a mortgage with Fifth Third Bank, here are some smart steps you can take to reduce your Fifth Third Bank mortgage rate and lower your monthly payments.

- Get pre-approved early: Before you even start house hunting, it’s a good idea to get pre-approved for a mortgage. It shows that you are a serious buyer and helps you determine how much you can spend. It can also lock in an initial interest rate for a short time.

- Ask about special offers: Fifth Third has promotions that many people don’t know about, like the Rate Drop Protector, which could save you money if Fifth Third Bank mortgage rates go down and you refinance. Always ask the loan officer what deals are available.

- Compare lenders: Don’t just go with the first offer. Reach out to at least three different lenders, including Fifth Third, and ask for rate quotes. Even a small difference, like 0.25% in interest, can save you thousands of dollars over the life of the loan.

- Check and improve your credit score: Your credit score plays a big role in the interest rate you’ll get. Before applying, check your score for free and look for ways to improve it, like paying down credit card debt or fixing any errors.

- Increase your down payment: Putting more money down shows lenders you’re financially stable. It also reduces your loan-to-value (LTV) ratio, which can qualify you for better mortgage rates at Fifth Third Bank.

FAQs About Fifth Third Bank Mortgage Rates

Does Fifth Third Bank have competitive mortgage rates?

- Yes, Fifth Third Bank offers competitive mortgage rates, especially if you qualify for discounts like AutoPay or physician loan programs. However, rates vary by credit score, location, and loan type, so it’s best to get a personalized quote.

Does Fifth Third Bank have fixed-rate mortgages?

- Yes. They offer both fixed- and adjustable-rate options.

Is there a penalty for paying off a Fifth Third mortgage early?

- No. Fifth Third does not charge prepayment penalties on standard mortgages.

How can I lower my mortgage rate with Fifth Third Bank?

- You can lower your rate by enrolling in AutoPay (0.25% discount), buying discount points, improving your credit score, or choosing a shorter loan term like a 15-year fixed mortgage.

Can I combine down payment assistance programs?

- Yes. Fifth Third allows you to combine its two assistance programs for a total of up to $5,300.

Does Fifth Third Bank offer rate locks?

- Yes, Fifth Third offers rate lock options that let you secure a rate during the mortgage process. Be sure to confirm the terms and potential fees with your loan officer.

Mortgage rates will always fluctuate. But finding a lender that offers the right combination of support, flexibility, and value is key. Fifth Third Bank mortgage rates are competitive, especially when paired with the bank’s down payment assistance, flexible loan options, and rate discounts. Take your time, compare options, and talk to a loan officer before making any decisions.