When you’re looking for a home loan, trust and flexibility matter. BMO home loans, offered by BMO (short for Bank of Montreal), have been serving customers since 1817. With more than 200 years of experience, it’s now the eighth-largest bank in North America.

If you’re considering BMO for a mortgage or home equity loan, here’s a deep dive into what they offer, and whether it’s the right fit for your financial journey.

What is BMO Bank?

If you’re considering a home loan with BMO, it’s worth knowing who they are and what they stand for.

A Long Legacy of Trust

BMO, short for Bank of Montreal, was founded in 1817. It’s the oldest bank in Canada and one of the most respected names in North American banking. With over 200 years of experience, BMO has built a reputation for stability and trust.

In the U.S., BMO operates under its brand after acquiring Bank of the West and retiring the “Harris” name in 2023. Today, it serves more than 13 million customers across Canada and the United States, offering a full range of financial services from checking & savings, credit cards, to loans and investment. Whether you’re opening your first bank account or buying your dream home, BMO has the tools and support to help you every step of the way.

Branch Network Across North America

BMO has a strong physical presence on both sides of the border. In Canada, the bank operates around 900 branches, making it easy for customers to visit in person. In the United States, its U.S. division – BMO Bank, N.A. – runs more than 600 branches across many states, especially in the Midwest, like Illinois and Wisconsin. This wide branch network makes it easier to get local support when applying for a mortgage or managing your home loan.

Types of BMO Home Loans

BMO offers a variety of home loan options to suit different buyers, lifestyles, and financial goals. Whether you’re a first-time buyer or an experienced homeowner, BMO’s wide selection gives you flexibility and control.

Let’s take a closer look at the key types of BMO home loans you can get:

BMO Home Loans: Mortgage Products

First, BMO offers a variety of mortgage products designed to fit different needs, from first-time buyers to experienced homeowners.

Fixed-Rate Mortgages

A fixed-rate mortgage gives you peace of mind with predictable monthly payments. Your interest rate stays the same for the entire term of your BMO home loan.

What BMO offers:

- Fixed terms from 1 to 10 years (Canada) or 10 to 30 years (U.S.)

- Ideal for buyers who plan to stay in their home long-term

- Protection against rising interest rates

- Easy budgeting

Bonus feature (Canada only):

BMO offers a 130-day rate guarantee on fixed-rate mortgages. That’s one of the longest rate locks available in Canada. If rates go up during that time, your rate stays the same. If they drop, you may still get the lower rate at closing.

Best for: Buyers who want stability and plan to stay in their home for years.

Adjustable-Rate Mortgages (ARMs)

If you’re looking for a lower initial rate, a variable or adjustable-rate mortgage (ARM) could be a smart option. These BMO home loans start with a lower interest rate, but that rate can change over time based on market conditions.

What BMO offers:

- Competitive initial rates

- Rate adjustment after a fixed period (for example, 5/1 ARM in the U.S.)

- Payment changes based on market trends

- In Canada: variable-rate options that follow the BMO prime rate

Things to keep in mind:

- Your payments may increase over time

- Good for short-term homeowners or those expecting rate drops

Best for: Buyers who plan to refinance or move within a few years.

Physician Mortgage Loans

BMO offers specialized loans for doctors and medical professionals in the U.S. These BMO home loans come with unique benefits to help physicians buy homes early in their careers, even with student loan debt.

Program highlights:

- Low or no down payment

- No private mortgage insurance (PMI)

- Flexible debt-to-income (DTI) requirements

- Designed for licensed physicians, dentists, and medical residents

This program can help medical professionals get into the housing market sooner, even with limited savings or high student loans.

Best for: Medical professionals early in their careers.

Cross-Border Mortgage Program

Are you a Canadian looking to buy property in the U.S.? BMO has a dedicated cross-border mortgage solution just for you.

Benefits:

- Easy approval process using Canadian credit history

- U.S.-based customer support

- Loans available in U.S. dollars

- Online tools to simplify the process

Whether it’s a vacation home or a retirement plan, BMO makes it easier for Canadians to invest in U.S. real estate.

Best for: Canadians purchasing property in the U.S.

Construction Loans

Building a new home or doing major renovations? BMO offers construction loans in select U.S. markets to help finance your project.

What you get:

- Financing for land + building costs

- Interest-only payments during construction

- Smooth transition to a permanent mortgage once the home is complete

- Flexible draw schedules based on project milestones

Construction BMO home loans are more complex than traditional mortgages, but BMO offers support every step of the way.

Best for: Buyers building custom homes or doing full renovations.

Jumbo Loans

Need a loan bigger than the standard limit? BMO offers jumbo mortgage loans for high-value homes.

Features:

- Higher loan amounts (above $766,550 in most U.S. markets)

- Competitive interest rates

- Available in fixed or adjustable formats

- May require a larger down payment and stronger credit score

- BMO jumbo loans are a solid option for luxury homebuyers.

Best for: Buyers purchasing high-end properties.

Low Down Payment Options

BMO supports first-time buyers and those with limited savings through special loan programs.

Options may include:

- FHA loans (U.S.) with as little as 3.5% down. BMO allows minimum scores of 580 for FHA and VA loans, lower than many other lenders.

- Flexible conventional loans with 3% down for qualified borrowers

- First-time buyer incentives and down payment assistance in some areas

Check with a mortgage specialist to see what programs you qualify for.

Best for: New buyers who need help entering the housing market.

BMO Home Loans: Home Equity Products

There are three main BMO Harris home equity loans:

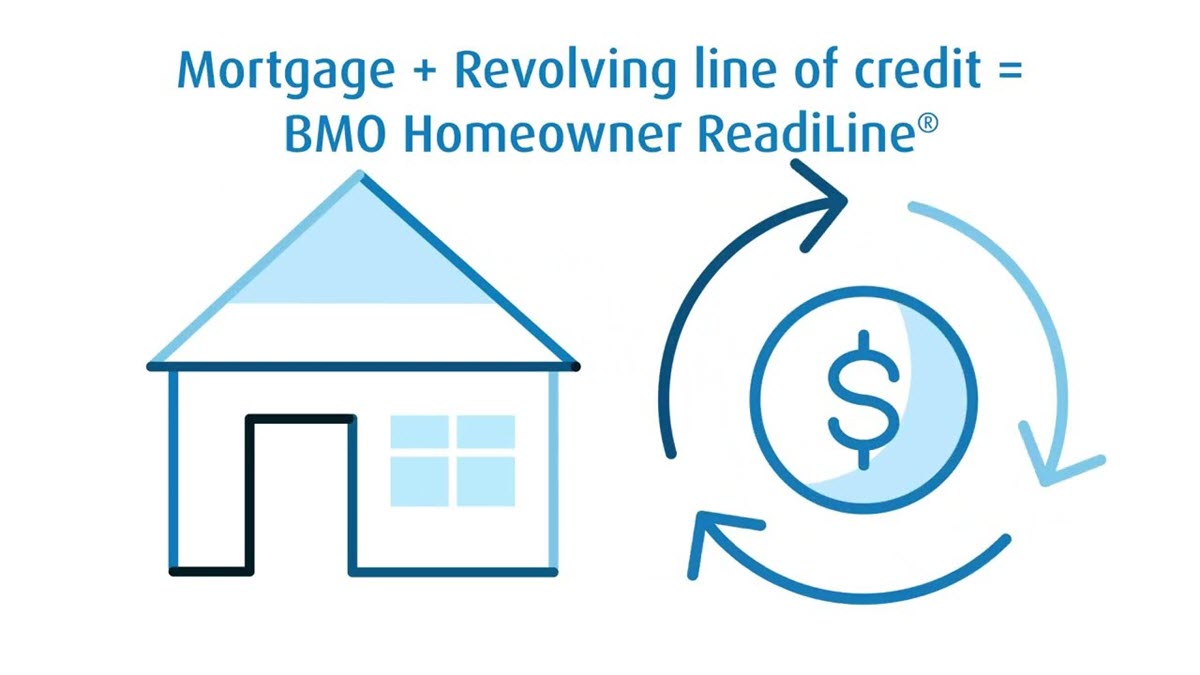

BMO ReadiLine (Canada Only)

This unique product combines a mortgage and a home equity line of credit (HELOC) into one powerful tool. It gives you flexibility to borrow against the equity in your home whenever you need it without reapplying.

Key benefits:

- Borrow up to 80% of your home’s value

- Access funds as you pay down your mortgage

- Only pay interest on what you use

- Great for renovations, investments, or emergencies

- No need to apply for a second loan

ReadiLine is available for both primary and rental properties. It’s a great option for people who want a mortgage and credit line in one convenient package.

Best for: Homeowners who want flexible access to equity without reapplying.

Home Equity Line of Credit (U.S.)

In the United States, BMO offers a HELOC that works similarly to the ReadiLine in Canada. You can borrow from your home’s equity, up to a certain limit, and only pay interest on what you use.

HELOC features:

- Borrow between $25,000 and $1,000,000

- Variable interest rate with an option to lock in fixed rates for portions

- 10-year draw period followed by a 20-year repayment period

- $75 annual fee and $75 lock fee

- No closing costs unless the account is closed within 3 year

It’s a great solution for homeowners planning major expenses like home improvements, debt consolidation, or education costs.

Best for: U.S. homeowners who want flexible borrowing power over time.

Fixed-Rate Home Equity Loan

- Loan amounts from $25,000 to $150,000

- Choose between 5-, 10-, 15-, or 20-year repayment terms

- Fixed interest rate throughout the life of the loan

Best for: Ideal for debt consolidation or large, one-time expenses.

Which Loan Is Right for You?

With so many BMO home loans available, it’s important to match the right mortgage to your financial needs. This summary breaks down which BMO loan might work best for you:

| Loan Type | Best For |

|---|---|

| Fixed-Rate Mortgage | Buyers wanting stable payments and long-term security |

| Adjustable-Rate Mortgage | Short-term homeowners or rate-conscious buyers |

| ReadiLine (Canada) | Homeowners wanting flexible credit access |

| HELOC (U.S.) | Those planning renovations or big expenses |

| Physician Loan | Medical professionals with student debt |

| Cross-Border Loan | Canadians buying U.S. property |

| Construction Loan | Custom builders and renovators |

| Jumbo Loan | Luxury homebuyers needing larger loan amounts |

| Low Down Payment Loans | First-time buyers with limited savings |

Mortgage Assistance Programs

BMO offers two helpful programs designed to make buying a home easier for first-time buyers and those in underserved communities.

Neighborhood Home Loan Product

The Neighborhood Home Loan Product allows qualified borrowers to buy a home with just a 1% down payment, making it easier to get started even if you don’t have a lot of savings.

- Requires only 1% down from borrower

- No private mortgage insurance (PMI) required

- Credit score minimum: 640

- Can be combined with additional grants and support

Welcome Home Grant Program

The Welcome Home Grant Program provides extra help in the form of a grant:

- Offers up to $13,000 or 3% of the purchase price

- Available for minority borrowers or purchases in minority census tracts

- Additional $3,000 available in certain counties for low-income borrowers

These BMO bank home loans are designed to help underserved communities and first-time buyers secure homeownership with fewer upfront costs.

How to Qualify and Apply for BMO Home Loans

Getting a mortgage from BMO is a big step, but it doesn’t have to be confusing. The process starts with knowing what you need to qualify and how to apply with confidence.

Below is a step-by-step guide to help you get started.

Know the Basic Requirements of BMO Home Loans

Before you apply, it helps to understand what BMO looks for in a mortgage applicant. While the exact requirements of BMO home loans can vary by location and loan type, most borrowers will need to meet these general criteria:

- Good credit history: A credit score of at least 620 (U.S.) or 680+ (Canada) is often required for the best rates. Some programs may accept lower scores, but you’ll pay more in interest.

- Steady income: You’ll need to prove that you have a stable job or source of income. This shows the bank that you can repay the loan.

- Reasonable debt-to-income ratio (DTI): Your monthly debts including the new mortgage should usually be no more than 43–45% of your gross monthly income.

- Down payment: For most BMO mortgages, you’ll need at least 5% down in Canada or 3% to 20% in the U.S., depending on the loan program.

- Proof of assets and ID: Be ready to share your bank statements, pay stubs, and government-issued ID.

Easy Ways to Apply for BMO Home Loans

Applying for a BMO home loan is simple and can be done in the way that suits you best:

- Online: Visit BMO’s official website to start the application at any time, from anywhere.

- By Phone: For home equity loans, call 1-844-219-6001 (U.S.) or 1-877-225-5266 (Canada). For mortgage, call 1-888-482-3781 (U.S.) or 1-866-262-1618 (Canada). Loan experts are available to guide you through the process.

- In Person: Prefer face-to-face help? Visit a branch near you to speak directly with a loan officer.

Whether you’re applying for your first mortgage or tapping into your home equity, BMO aims to make the process smooth, flexible, and accessible.

How to Apply for a BMO Home Loan

- Get Pre-Qualified or Preapproved: You can use BMO’s online tools or visit a branch. Pre-qualification is a fast, no-commitment way to check what you may qualify for. Preapproval, on the other hand, is more detailed. BMO will review your credit score, income, and financial documents to give you a solid loan offer.

- Gather Documents: You’ll likely need:

- Pay stubs or tax returns

- Bank statements

- Job verification

- Property details (if available)

- Submit Your Application: You can apply with BMO in one of three ways: Apply online, by phone, or at a BMO branch. Once submitted, BMO will assign a loan officer or advisor to guide you through the rest of the process. They may ask for more documents or clarification.

- Wait for Approval & Close: After applying, BMO will review everything and order an appraisal if needed. If everything checks out, BMO will issue a mortgage commitment letter. Then you’ll work with them to set a closing date, sign the final documents, and get the keys to your home.

BMO Home Loans: Rates & Fees

While exact rates aren’t always listed online, BMO has a reputation for competitive APRs and lower-than-average fees:

BMO Mortgage Rate Snapshot

BMO is known for offering competitive fixed-rate mortgages, especially when it comes to rate-lock terms.

| Region | Rate Type | Average / Example Rate | Notes |

|---|---|---|---|

| Canada | 5-Year Fixed | ~4.39% – 4.66% | Competitive rate (source: WOWA); actual rate may vary |

| Canada | Rate Lock | Up to 130 days | One of the longest in Canada; protects from rising rates |

| U.S. | Average Rate (2023) | 8.29% | Slightly above APOR by ~1% (source: HMDA data) |

| U.S. | Spread to APOR | +0.85% | Slightly higher than industry average (+0.78%) |

BMO Mortgage Fees & Closing Costs

But when you get a mortgage, it’s not just about the interest rate, fees matter, too. Here’s a breakdown of BMO’s typical cost structure of BMO home loans:

| Fee Type | Canada | United States |

|---|---|---|

| Origination Fee | N/A | ~$2,008 (below U.S. average ~$3,665) |

| Total Loan Costs | N/A | ~$5,092 (vs. $7,375 industry average) |

| Closing Costs | Competitive; may include prepayment flexibility | Often includes $500 discount promos |

| Prepayment Penalty | 3-month interest or IRD for fixed-rate loans | Varies by program; often no penalty on standard loans |

Disclaimer: The two summary tables above are for informational purposes only, designed to help you better understand and compare the rates and fees of BMO home loans. Before making any decisions, be sure to contact BMO Bank directly to get the most up-to-date rates and fee details.

Overall, BMO’s transparent fee structure and flexible mortgage rate options make it a strong choice for borrowers who want to save money over the life of their loan without sacrificing service or support.

FAQs About BMO Home Loans

Does BMO offer mortgages in all 50 states of the U.S.?

- Yes, you can apply for BMO loans in all 50 states and D.C.

Can I get pre-qualified online?

- No. You need to request a callback or start a full application.

Are there BMO home loans for first-time homebuyers?

- Yes, BMO’s Neighborhood Home Loan and Welcome Home Grant programs are designed for new buyers.

What is the minimum credit score for a home equity loan?

- 700+ for a fixed loan; 650+ for a HELOC.

Does BMO show current rates online?

- Only for select states. Most rate info is shared via phone or after application.

BMO home loans are a solid choice for many types of borrowers. If you’re looking for flexible terms, affordable options, and helpful support for first-time or lower-income buyers, BMO stands out. While it may lack online rate visibility, it makes up for it in low fees, grant programs, and decades of stability. Whether you’re refinancing, tapping into home equity, or buying your first property, BMO offers a range of tools to help you succeed in your homeownership journey.