In today’s fast-paced financial world, choosing the right bank for your personal needs is more important than ever. And one name that’s been gaining attention recently is First Citizens Bank personal banking.

In this comprehensive review, we dive deep into First Citizens Bank’s personal banking offerings to help you decide if it’s the right fit for your financial journey.

Introduction to First Citizens Personal Banking

If you’re looking for a personal banking partner that balances tradition with modern convenience, First Citizens Bank might be the right choice. First of all, let’s take a closer look at who First Citizens Bank is and what it offers.

Who Is First Citizens Bank?

First Citizens Bank has been around for over 125 years. Founded in 1898 and headquartered in Raleigh, North Carolina, it has grown from a small community bank into a major player with over 500 branches across the United States. In 2022, the bank made headlines by merging with CIT Bank, expanding its national presence and capabilities.

Despite its size, First Citizens has maintained a reputation for personal service and a community-first approach. It’s still family-controlled, which gives it stability and a long-term vision that many customers appreciate.

An Overview of First Citizens Personal Banking Products

First Citizens offers a wide array of personal banking products that cater to a broad range of customer needs. Specifically, here’s a snapshot of what First Citizens Bank personal banking provides:

- Checking Accounts

- Savings Accounts

- Money Market Accounts

- Certificates of Deposit (CDs)

- Personal Loans

- Retirement Accounts

- Investment Services

- Insurance Products

- Credit Cards

Now, let’s dive into each of these in more detail.

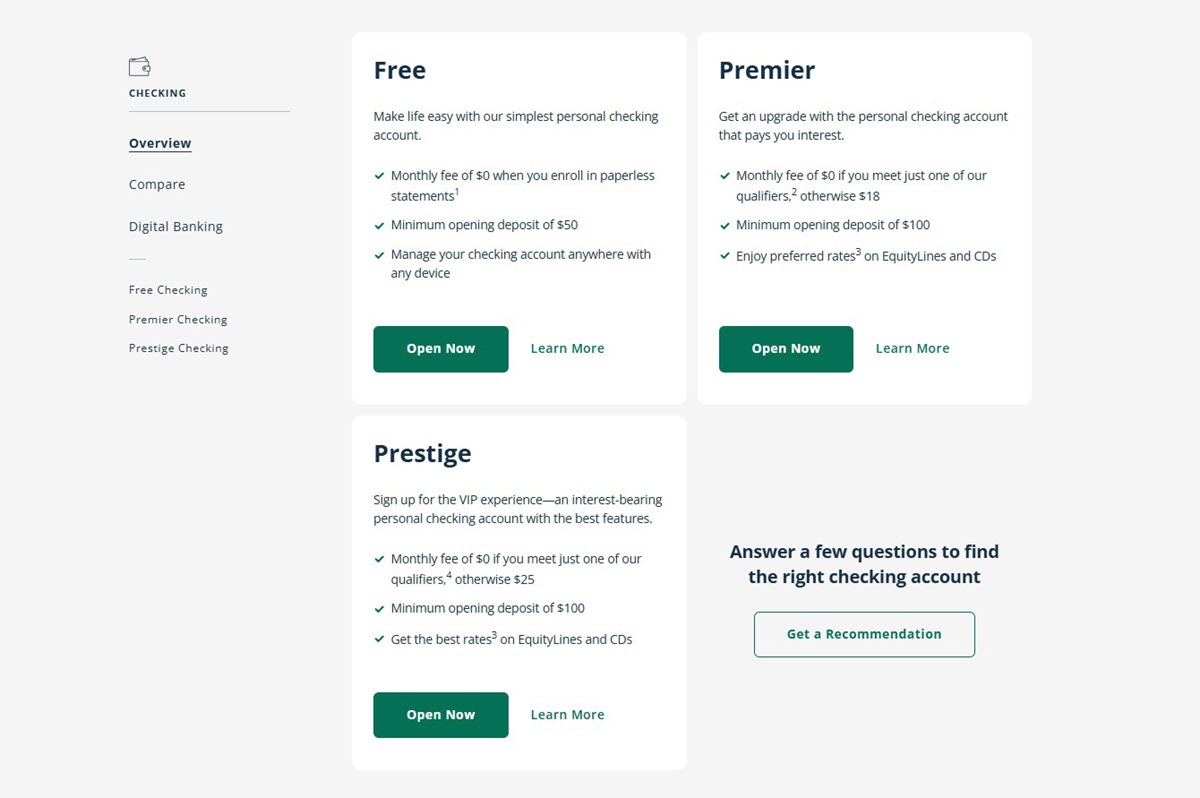

First Citizens Checking Accounts Overview

First Citizens Bank Personal Banking offers three main types of checking accounts designed to meet different needs and lifestyles: Free Checking, Premier Checking, and Prestige Checking. Each account comes with its own features, fees, and benefits, giving you the flexibility to choose what fits your financial habits best.

Let’s take a closer look at what each account has to offer:

Free Checking

This is the most basic and affordable checking option. In general, it’s great for anyone who wants to avoid monthly fees and keep things simple.

- Monthly fee: $0 when you sign up for paperless statements. If you prefer paper statements, there may be a small monthly charge.

- Minimum opening deposit: $50

- Interest: This account does not earn interest.

- Overdraft protection: Optional. You can link a savings account or another account to cover any overdrafts, but there’s a $10 fee per transfer.

- ATM access: You can use First Citizens ATMs for free. But if you withdraw from an ATM outside their network, you’ll be charged $2.50 per transaction (not including what the ATM owner may charge).

Why people like it:

- It’s free when you go digital. No need to worry about meeting a minimum balance.

- You can open and manage it easily online or in person at a branch.

Things to consider:

- It doesn’t earn any interest, so it’s not ideal if you keep a high balance.

- Out-of-network ATM fees can add up if you travel a lot or live far from First Citizens branches.

Premier Checking

The Premier Checking account is a step up. It’s built for customers who want a few more benefits and don’t mind maintaining a slightly higher balance.

- Monthly fee: $18, waived if you maintain a certain balance or set up direct deposit (usually $5,000+ in combined balances or regular deposits).

- Minimum opening deposit: $100

- Interest: Yes, this account earns interest on your balance, though the rate is modest.

- ATM access: Free ATM withdrawals at both First Citizens and other ATMs.

- Extras: You also get higher ATM withdrawal limits and other banking perks compared to the Free Checking account.

It’s a good fit for:

- People who keep larger balances and want a checking account that gives something back.

- Customers who want more flexibility with ATMs and access to interest.

Prestige Checking

Prestige Checking is the premium option for First Citizens personal banking customers. It includes the most features but also has the highest requirements.

- Monthly fee: $25, waived if you meet specific criteria, such as maintaining a high combined balance (usually $25,000 or more) or qualifying for relationship banking.

- Minimum opening deposit: $100

- Interest: Yes, you earn interest on your account balance.

- ATM access: Unlimited free ATM withdrawals worldwide, including from non‑First Citizens ATMs.

- Overdraft benefits: Prestige account holders pay no overdraft fees when overdraft protection is in place.

- Additional perks: You may get preferred rates on loans, discounts on services, and dedicated support depending on your location.

This account is best for:

- People who have higher banking balances and want VIP-style perks.

- Frequent travelers or business owners who need nationwide and global ATM access.

Lastly, to help you compare the key features at a glance, here’s a quick summary of the three checking account options offered by First Citizens Bank.

| Account Type | Monthly Fee | Minimum Deposit | Interest | ATM Fees | Key Perks |

|---|---|---|---|---|---|

| Free | $0 with e-statements | $50 | No | $2.50 for out-of-network | Simple, low-cost, overdraft available |

| Premier | $0–$18* | $100 | Yes | Free ATM withdrawals | Earns interest, higher limits |

| Prestige | $0–$25* | $100 | Yes | Unlimited free worldwide | No overdraft fees, premium benefits |

* Monthly fees are waived if you meet certain requirements, such as minimum balances or direct deposits.

First Citizens Personal Savings, Money Markets & CDs

In addition to checking accounts, First Citizens Bank Personal Banking also offers several ways to save and grow your money. But they are more focused on safety and convenience than high returns:

Online Savings Account

This account is a great place to start if you’re looking for a safe and simple way to save.

- Monthly fee: None. You won’t be charged a monthly maintenance fee, which helps you keep more of your savings.

- Minimum opening deposit: $50

- Interest rate (APY): Low, typically between 0.03% and 0.10%, depending on the balance and market conditions.

- Overdraft protection: You can link your savings account to a First Citizens checking account. If your checking balance runs low, money will be pulled from savings to cover the difference (a $10 fee may apply per transfer).

- Withdrawal limits: You get two free withdrawals per month. If you go over that, there’s a $3 fee for each additional withdrawal.

This savings account is best for people who want to build an emergency fund, save for a short-term goal, or have a backup for overdraft protection.

On the other hand, the APY is quite low, so your money won’t grow fast. But it’s a low-risk, low-cost place to store your savings.

Money Market Accounts

Money market accounts give you a bit more earning potential and flexibility than a standard savings account.

- Monthly fee: $10, but it’s waived if you keep at least $1,000 in the account.

- Minimum opening deposit: Usually $100 or more.

- APY: Around 0.05%, which is only slightly higher than the online savings account.

- Access: You can transfer funds online, but check-writing and debit card access are not included, which makes it less flexible than some other banks’ money market options.

This First Citizens personal banking account type is perfect for people who want a safe savings option with a slightly better return and don’t need to touch the money often. On the downside, you’ll need to maintain a $1,000 balance to avoid fees, and the lack of check-writing means it’s more like a savings account than a hybrid.

Certificates of Deposit (CDs)

CDs are good for long-term savers who won’t need access to their money for a while and want a fixed return.

- Terms available: From 1 month to 5 years, depending on how long you want to lock in your funds.

- Minimum deposit: $500

- APY: Very low, typically around 0.01% for most standard CDs. Some promotional CDs may offer slightly higher rates.

- Early withdrawal penalties: Apply if you take money out before the CD matures. The penalty varies based on the CD term.

Other CD types:

- IRA CDs: Ideal for retirement savings with tax benefits.

- Bump-Up CDs: These allow you to increase your rate once during the term if market rates rise (only available on select terms).

CDs are designed for people with extra cash they won’t need soon and want a guaranteed return, even if it’s small.

But remember, the interest rates are very low compared to online-only banks or credit unions. And once you put the money in, you’ll have to wait until the term ends (or pay a penalty to withdraw early).

More Personal Banking Products from First Citizens Bank

Beyond the main products, such as checking and savings, First Citizens Bank offers a wide range of personal financial products. Let’s explore each one.

Credit Cards

No two people spend money the same way, and First Citizens Bank understands that. That’s why they offer a variety of Visa credit cards to fit different lifestyles and financial goals.

You can choose from:

| Card Name | Best For | Annual Fee | Top Feature |

|---|---|---|---|

| Cash Rewards | Simple cash back | $0 | 1.5% unlimited cash back |

| Rewards Credit Card | Gas, groceries, streaming | $0 | Up to 3X points in everyday categories |

| Secured Cash Back | Building/rebuilding credit | $0 | Cash back + free FICO Score |

| Smart Option | Balance transfers, low APR | $0 | 0% intro APR for 12 months |

| Travel Rewards | Travel + dining rewards | $95 (1st yr free) | 3X points on travel + $100 travel credit |

All First Citizens personal credit cards come with security features like fraud monitoring, Visa Zero Liability for unauthorized charges, and compatibility with mobile wallets such as Apple Pay and Google Pay. Whether you’re focused on saving, earning rewards, or improving credit, there’s a card designed to help.

Personal Loans

First Citizens Bank offers unsecured personal loans with flexible terms and competitive fixed rates.

- Loan amounts: Typically range from $1,000 to $50,000

- Terms: From 12 to 84 months

- Fixed interest rates: So you know exactly what your payments will be

- No collateral required: No need to put up your car or home

- Prepayment penalty: No

- Main products:

- Auto Loans

- Home Equity Lines and Loans

- Home Improvement Loans

- Other Specialized Lending

- Use cases: Consolidate debt, pay medical bills, fund major purchases, or cover unexpected expenses

You can apply online or in a branch. Approval decisions are relatively quick, and funds may be disbursed within a few business days. There are no prepayment penalties for First Citizens personal loans, which is ideal for borrowers who want flexibility.

Moreover, a small tip for you is that you can use the online First Citizens personal loan calculator to estimate your monthly payments before applying.

Retirement Solutions

First Citizens Personal Banking offers Individual Retirement Accounts (IRAs) to help you plan for the future.

- Traditional IRA:

- Contributions may be tax-deductible (depending on income)

- Earnings grow tax-deferred until withdrawal

- Roth IRA:

- Contributions are made with after-tax dollars

- Qualified withdrawals are tax-free

You can open an IRA through:

- A CD-based IRA with fixed returns

- A self-directed investment IRA (in partnership with First Citizens Investor Services)

Their team can help assess which option suits your income, age, and retirement goals. These solutions are food for people looking to roll over a 401(k) or start saving on their own.

Investment Services

Through First Citizens Investor Services, the bank offers access to personalized investment advice and brokerage services.

First Citizens personal investment services include:

- Mutual funds

- Stocks and bonds

- Managed portfolios

- Annuities

- College savings plans (like 529s)

- Retirement planning and wealth management

Each client can work with a dedicated financial advisor. These professionals are licensed and trained to assess your risk tolerance and long-term goals.

You can track your investments through a secure online dashboard. This allows full transparency into your portfolio’s performance.

Note: First Citizens personal investment products are not FDIC-insured and may carry market risk. Always consult with a licensed advisor.

Insurance Products

Last but not least, First Citizens partners with First Citizens Insurance Services to provide personal protection solutions.

Here are some of the options available:

- Accident Insurance: Covers medical costs and income loss due to unexpected injuries from accidents. It can help pay for emergency care, hospital stays, or recovery expenses that health insurance may not fully cover.

- Life Insurance: Helps protect your loved ones financially if something happens to you. It can be used to pay for funeral costs, living expenses, or even outstanding debts.

- Pet Insurance: Designed for pet owners who want to ensure their furry companions get the care they need. It helps cover vet visits, treatments, surgeries, and medications.

- Property Insurance: Provides protection for your home and belongings against risks like fire, theft, or natural disasters. Whether you own or rent, this coverage gives you peace of mind.

- Umbrella Insurance Policy: Offers extra liability coverage beyond your standard auto or home insurance. It’s there to protect you from large claims or lawsuits that could threaten your financial security.

- Vehicle Insurance: Covers your car, truck, or SUV in case of accidents, theft, or damage. It includes liability coverage and can be customized with options like collision and comprehensive protection.

These policies can be bundled with your banking or loan products to streamline billing and possibly reduce premiums.

First Citizens Personal Banking Customer Services

While many banks today rely heavily on automation, First Citizens still values personal connection. That’s one of their strongest points, giving customers the ability to reach out and talk to a real person when needed.

Here’s how you can get help:

- First Citizens Personal Banking phone support: 888-323-4732. Available with extended weekday hours, so you can call even after a busy workday. Automated system available 24/7.

- Live chat: Get answers in real time directly through their website or app.

- In-branch support: Visit your local branch if you prefer face-to-face conversations. First Citizens has a strong branch and ATM presence, especially in the Southeast and Mid-Atlantic regions of the U.S., with over 500 full-service branches available in 23 states and more than 590 ATMs.

- Secure messages: Use the in-app messaging feature for account-specific questions.

Most customers of First Citizens personal banking services appreciate the friendly and professional service, especially at branches. However, some online users have mentioned that response times for digital support (like chat or messages) can sometimes be a bit slow during peak hours.

Keeping your money and information safe is a top priority for First Citizens Bank. The bank uses strong, industry-standard security measures to protect your accounts online and in the mobile app.

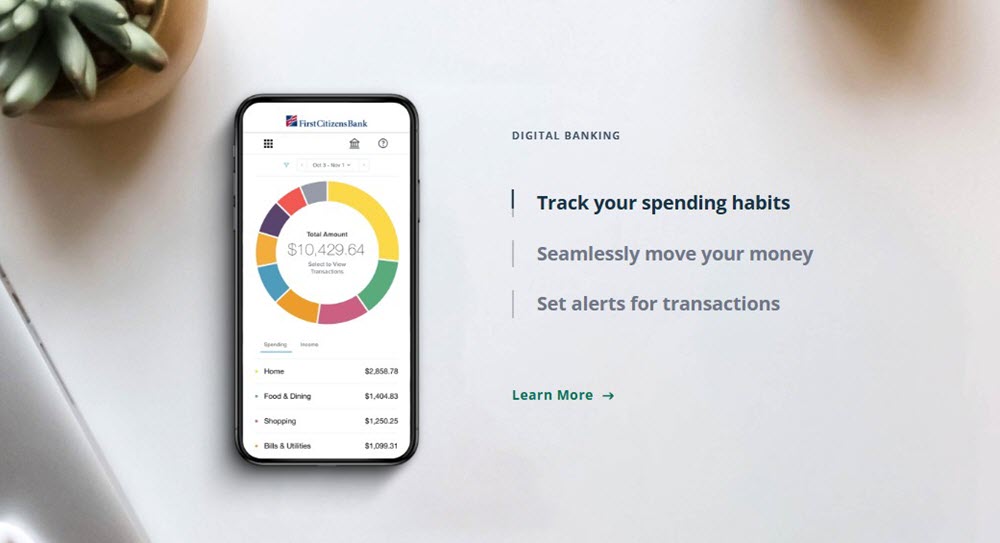

First Citizens Personal Banking: Digital Tools & Mobile App

First Citizens Bank offers a modern and user-friendly digital banking experience, designed for people who like to manage their money on the go.

You can download the First Citizens mobile app on both iOS and Android devices. Their mobile app is well-reviewed, with a strong 4.6+ rating on the Apple App Store, showing that users are generally satisfied with how it performs.

Here’s what you can do with the app:

- Log in securely using Face ID, Touch ID, or a passcode, depending on your device.

- Deposit checks anytime with mobile check deposit. Just take a picture of your check, and it goes straight into your account.

- Send and receive money with Zelle, making it easy to split a dinner bill or send funds to friends or family.

- Use digital wallets like Apple Pay, Google Pay, and Samsung Pay to make quick, contactless payments.

- Track your spending with the “Manage My Money” tool, which allows you to link external bank accounts, view all your finances in one place, and create a budget.

Their First Citizens Personal online banking (desktop version) offers a similar experience. It’s fast, clear, and designed for people who want to handle everything from checking transactions to transferring money, without needing help.

First Citizens Personal Banking Security & Privacy

Key security features include:

- TLS encryption and firewalls to protect data as it travels across networks

- Automatic lockout after multiple failed login attempts, helping prevent unauthorized access

- Secure access codes tied to your device, so only recognized devices can log in

- Real-time account alerts for key activity, such as changes in passwords, contact info, or suspicious transactions

- In-app card freeze, which allows you to lock your debit card instantly if it’s lost or stolen

These features reflect the bank’s commitment to transparency, safety, and trust.

First Citizens Personal Banking Fees & Overdraft

When it comes to banking fees, First Citizens keeps things relatively straightforward. While it’s not completely fee-free, the structure is reasonable and easy to understand.

Here are some key fees of First Citizens personal banking services to know:

- Monthly fees: Many of their checking accounts have no monthly maintenance fees, or they’re easy to waive by meeting basic requirements like maintaining a minimum balance or setting up direct deposit.

- Overdraft fee: Just $10 per transfer if you use linked overdraft protection. This is much lower than the industry average, which can be as high as $35.

- Out-of-network ATM fee: $2.50 per transaction for Free and Premier accounts. However, Prestige Checking users don’t pay any ATM fees, even when using non-First Citizens machines.

Here’s a fee summary table for First Citizens personal banking products:

| Fee Type | First Citizens Fee | When It Applies |

|---|---|---|

| Overdraft Fee | $10 per paid item (max 4/day); no fee for $5 or less | When the bank covers an overdraft on checks, ACH, ATM, or debit‑card transactions |

| NSF (Insufficient Funds) Fee | $0 | If a transaction is declined instead of being paid |

| Overdraft Transfer Fee | $10 for most checking accounts; $0 for Premier, Prestige, Executive | When funds are transferred from savings or LOC to cover an overdraft |

| Out‑of‑Network ATM Fee | $2.50 per withdrawal (Free/Premier); waived (Prestige) | For withdrawals at non‑First Citizens ATMs |

| Excess Savings Withdrawals | $3 per transaction beyond 2/month | Applies to online savings accounts when exceeding the monthly limit |

| Monthly Paper Statement Fee | $3 | Charged for mailed paper statements with check images |

| Returned‑Statement Fee | $7 | After three undeliverable or returned statements |

| Stop‑Payment (branch/phone) | $35 via branch; $23 online/phone | To cancel a check or scheduled debit |

| Telephone Transfer (assisted) | $3.50 per transfer | For staff‑initiated account transfers |

| Domestic Wire Incoming | $16 | For incoming wire transfers |

| Domestic Wire Outgoing | $30 | For sending money via wire domestically |

| Wire Advice (email notification) | $2.50 | Optional email confirmation of wire transfers |

How to Open a First Citizens Personal Account

Opening a bank account with First Citizens Bank is a quick and straightforward process. But first, you should have all documents ready to make account opening quick and easy:

First Citizens Personal Account Requirements

What you’ll need to bring (or upload):

- A government-issued ID (like a driver’s license or passport)

- Your Social Security Number (SSN) for identity verification

- A proof of address (like a utility bill or lease agreement)

- An opening deposit, which varies depending on the type of account you’re opening (some may require as little as $50)

Whether you’re tech-savvy or prefer speaking to someone face-to-face, they give you two convenient ways to get started with First Citizens Personal Banking:

Online Opening

Want to open an account without visiting a branch? First Citizens makes it quick and simple to start banking online from home.

- Go to the official First Citizens Bank website and pick the type of account that suits your needs: Free Checking, Premier, Prestige, or a Savings/CD option.

- Click the “Open Account” button to begin the secure application form.

- Enter your basic personal details, including your full name, current address, Social Security Number (SSN) or Resident Alien number, date of birth, phone number, and email address.

- Upload a valid photo ID, such as a driver’s license or passport, to confirm your identity.

- Choose how you want to fund your account. You can link an existing bank account or use a debit/credit card to make your opening deposit.

- Once you submit the form, most accounts are opened and ready within minutes or a few hours.

- You’ll get your login credentials via email, so you can immediately start using First Citizens online and mobile banking.

In-Branch Account Opening

Prefer a face-to-face experience? You can also open your First Citizens Bank personal account in person at a nearby First Citizens branch.

- Find your nearest branch online or call ahead to schedule an appointment with a banker.

- When you arrive, be sure to bring the following:

- A valid government-issued photo ID (driver’s license or passport)

- Proof of address, like a recent utility bill or lease (dated within the last 60 days)

- Your Social Security Number or Tax ID

- An initial deposit, usually $50 for checking accounts and $50 to $500 for savings or CDs

- A bank representative will guide you through your options, help you pick the right account, and complete the paperwork with you.

- Your account will usually be active the same day, and you can set up online and mobile banking right away at the branch or from your phone.

For most people, the entire online process takes less than 15 minutes from start to finish. Once completed, you’ll get instant access to online First Citizens personal banking services and mobile tools to start managing your money right away.

FAQs About First Citizens Personal Banking

Is my money safe with First Citizens Bank?

- Yes. First Citizens is a member of the FDIC (Federal Deposit Insurance Corporation). The FDIC insures your deposits up to $250,000 per depositor, per account category, giving you peace of mind.

Can I track my spending and set savings goals with their app?

- Not at this time. The mobile and online platforms allow you to view transactions, check balances, and set up alerts. However, they don’t currently include advanced budgeting tools like expense tracking graphs or goal setting.

Does First Citizens Personal Banking offer special accounts for students or seniors?

- Yes. First Citizens understands that different life stages require different banking needs. They provide customized account options for students, seniors, and other specific groups. These often include features like lower fees, flexible terms, or tools for beginners.

Can I apply for a loan or credit card online?

- Absolutely. It’s easy to apply for First Citizens Bank personal loans, credit cards, and even mortgages through their website.

Does the bank offer help with financial planning?

- Yes. Through its First Citizens Investor Services, the bank offers access to licensed financial advisors who can help you create a custom investment or retirement plan.

First Citizens Bank doesn’t try to be the flashiest or trendiest bank. Instead, it focuses on consistency, personal service, and long-term financial solutions. For those who prefer traditional values with modern tools, First Citizens Personal Banking could be the right fit, especially if you live in an area where branches are available. And even if you don’t, their digital services are more than enough to handle your day-to-day banking needs.